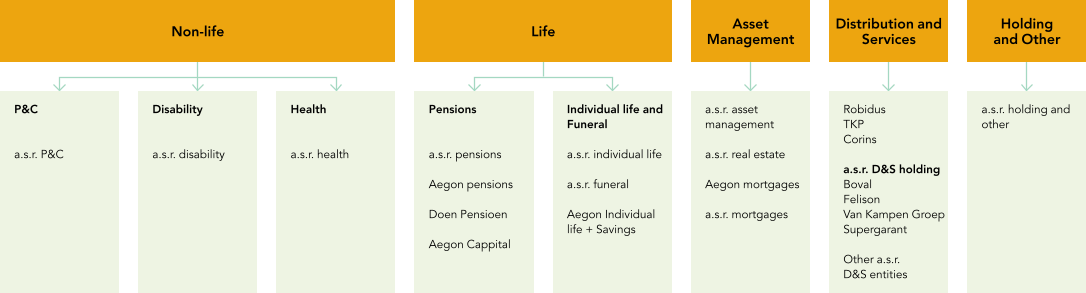

a.s.r.'s insurance segments solely operate in the Dutch market. a.s.r. has defined multiple value chains1 based on its business lines. The following paragraphs and visual representation describe the main characteristics of a.s.r.’s multiple value chains. Based on the main activities, a.s.r. consolidated value chain is split in four value chains (insurance, asset management, distribution and services, supporting processes) which are aligned with its five segments. These segments are illustrated in the figure below. The insurance value chain consists of the Non-life and Life segments.

Business relationships are not limited to direct contractual relationships. They include indirect business relationships in a.s.r.’s value chain beyond the first tier.

Tier 1 value chain actor: actors or parties that have a direct relationship with a.s.r.

Tier 2 value chain actor: actors or parties that have a direct relationship with one of a.s.r.'s Tier 1 value chain actors.

Tier 3 value chain actor: actors or parties that have a direct relationship with one of a.s.r.'s Tier 2 value chain actors.

On the following pages, four value chains are illustrated in line with the a.s.r. business segments. On these value chains the material topics as identified in the DMA (see section 2.3) are mapped to the actors in the value chains. The mapping includes the impacts, risks and opportunities identified by the relevant business lines.

For information on the strategy, products, business performance and outlook of the segments please see section 4.

- 1Section 2.4 is in scope of CSRD and limited assurance (ESRS 2 SBM-1).