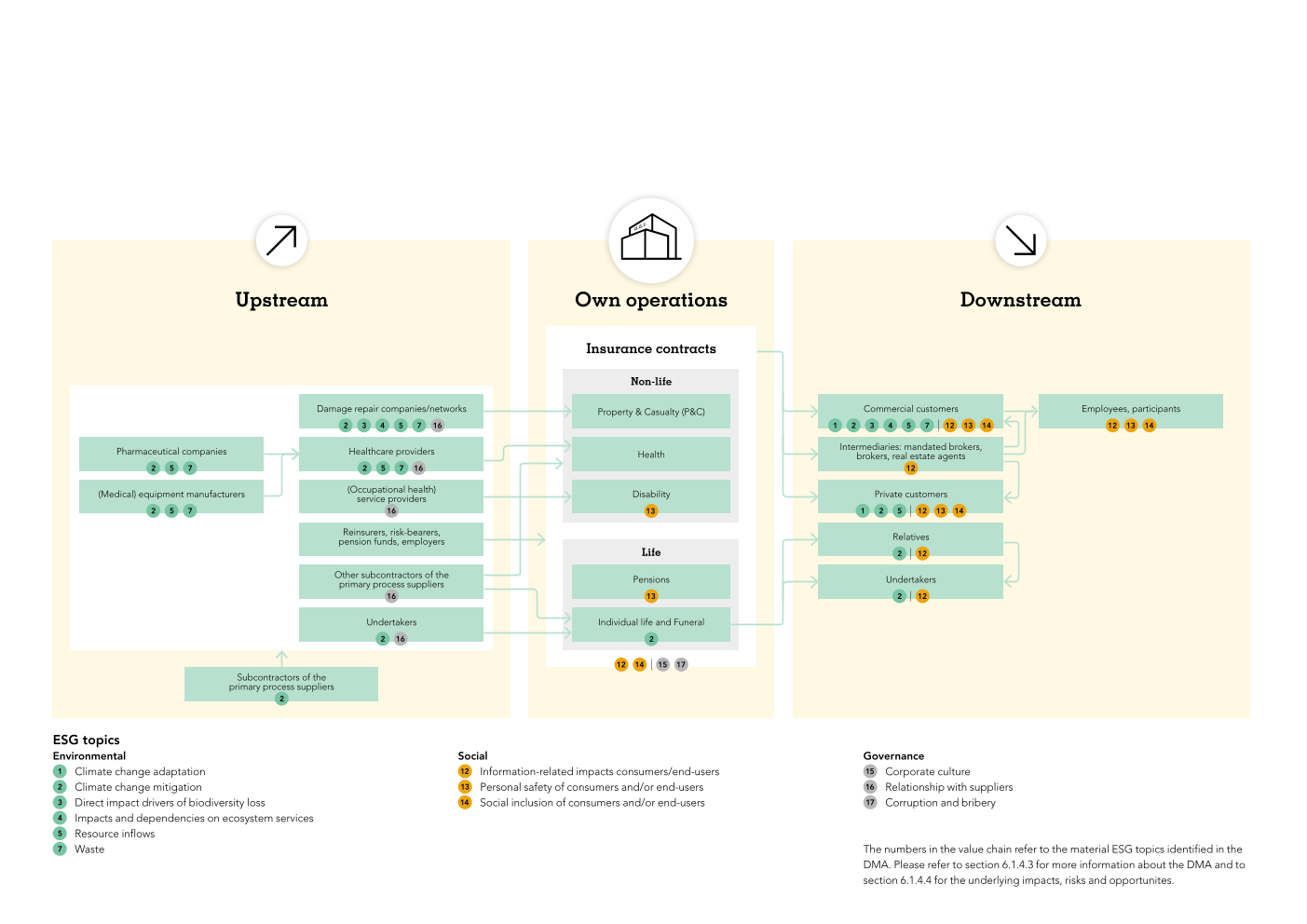

a.s.r. is an organisation with multiple product lines, with different internal and external stakeholders involved. After determining the value chains and conducting the double materiality assessment, the impacts, risks, and/or opportunities (IROs) were plotted on the specific part of the value chains where that IRO occurs. This is illustrated in the value chains below.

Insurance value chain

Non-life segment

The Non-life segment consists of non-life insurance entities and their subsidiaries. These non-life insurance entities offer non-life insurance contracts such as disability insurance, property and casualty insurance and health insurance.

P&C

a.s.r. ranks among the top three Property & Casualty (P&C) insurers in the Netherlands, with a market share of 14.7% measured by GWP1.

It offers the following products:

Motor insurance;

Fire insurance;

Other P&C insurance products, such as liability, legal aid, travel and recreation, pet, and transport insurance.

a.s.r. offers P&C products for the retail and commercial markets under the brand a.s.r. and the label 'Ik kies zelf van a.s.r.'. The a.s.r. brand focuses on the retail and commercial markets through independent advisors and mandated brokers with products such as: motor policies, fire policies and other P&C insurance products such as liability, legal aid, travel and recreation, pet insurance and transport insurance.

'Ik kies zelf van a.s.r.' offers direct online distribution to individuals and travel and recreational insurance via travel agents.

a.s.r. holds a majority interest in Soople and a minority interest in Fixxer. Soople helps its customers by taking on the full day-to-day maintenance of properties, including the initial contact with residents, planning, implementation and invoicing. Fixxer is a company set up in collaboration with Belfius Insurance and focuses on the management and further development of a digital service platform for customers' claims.

Disability

a.s.r. is the leading insurer in the disability market, offering income protection. It has an extensive range of products and services focusing on sustainable employability and on preventing and reducing absenteeism. Distribution of disability insurance products takes place mainly through insurance advisors. With the brands a.s.r. and Loyalis, a.s.r. is well positioned in the distribution channel serving self-employed individuals, SMEs, corporates and (semi-) public sectors. a.s.r. is the market leader with a market share of 39.8%.1 Through a.s.r.'s prevention and reintegration services, a.s.r. helps its customers to ensure optimal employability for themselves and their employees.

a.s.r.’s income protection insurance business offers various products divided into the following product groups:

Individual disability;

Sickness leave;

Group disability.

Health

a.s.r. offers basic health (medical) insurance under the Dutch Health Insurance Act (Nederlandse Zorgverzekeringswet) in combination with supplementary health insurance. In 2024, a.s.r. is the sixth largest provider of health insurance on the Dutch market, measured by number of customers.

The types of health cover offered in 2024 under the brand a.s.r. and the label ’Ik kies zelf van a.s.r.’ were as follows:

Basic insurance;

Supplementary health insurance.

Life segment

The Life segment consists of Pensions, Individual life and Funeral. The Life segment has a market share of 28.6%1.

Pensions

a.s.r. is a major provider of defined contribution pensions (pension DC) in the Netherlands.

a.s.r. provides different propositions for building up a pension:

The Employee pension (Werknemerspensioen), life cycle solutions for SMEs and large-cap companies (a.s.r. life);

Doenpensioen van a.s.r. (a.s.r. IORP);

Aegon Cappital (Aegon IORP).

A large number of customers is served by the two Institutions for Occupational Retirement Provisions (IORP): ASR Premiepensioeninstelling N.V. and Aegon Cappital B.V.

Individual life

Individual term life insurance is the only individual life product that a.s.r. actively sells. It guarantees payment of a stated death benefit to the insured's beneficiaries, if the insured dies during the specified term. a.s.r.’s term life products are mainly sold in combination with mortgage loans or investment accounts.

Funeral

a.s.r. is a top three funeral insurer in the Netherlands. a.s.r. sells funeral capital insurance policies, enabling customers to save and plan their own funerals.

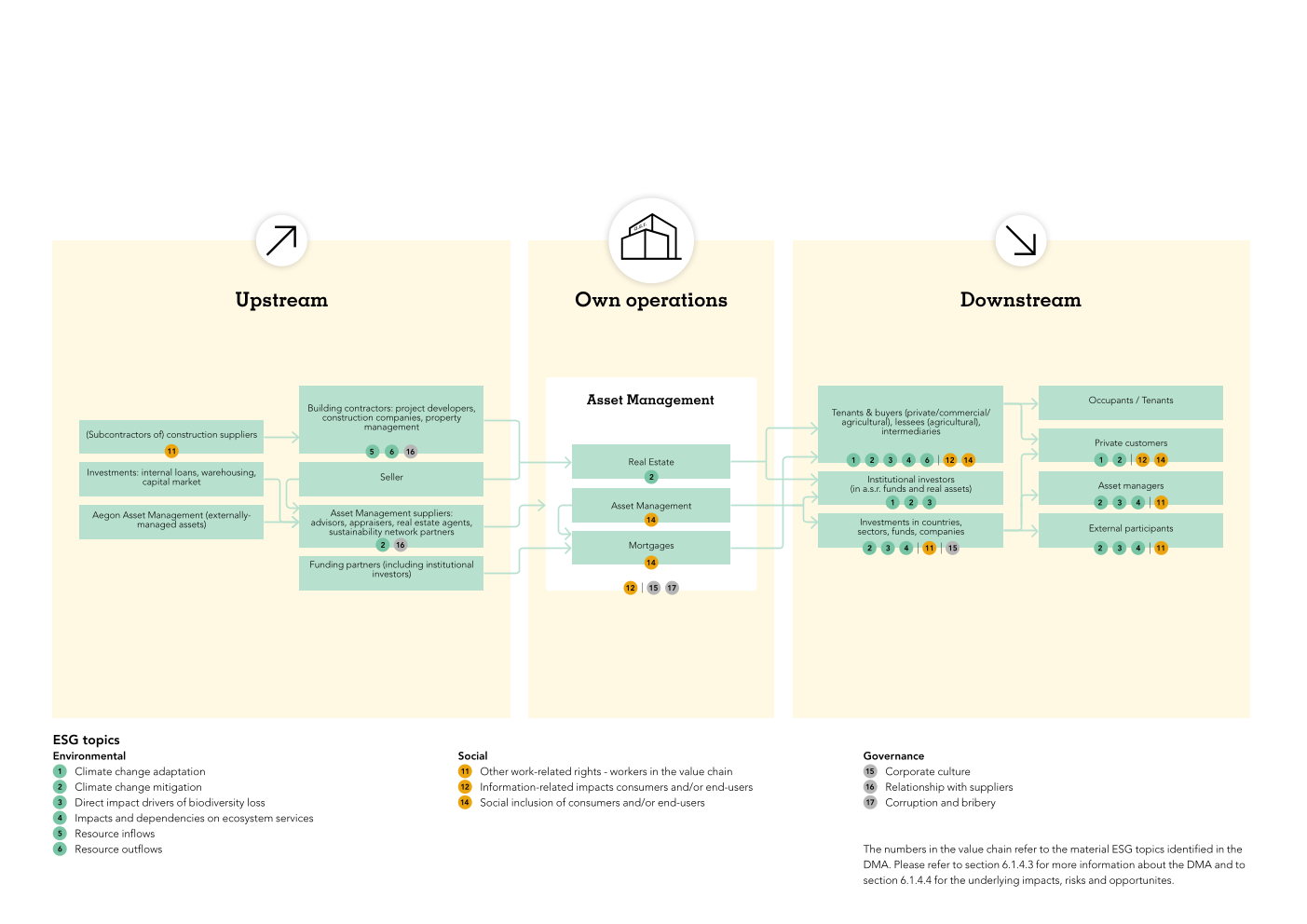

Asset Management value chain

The Asset Management segment involves all activities relating to asset management including investment property management. a.s.r. asset management conducts all of a.s.r.’s asset management activities, with the exception of direct real estate. Real estate assets are managed by a.s.r. real estate.

Asset Management

a.s.r. asset management manages assets for a.s.r.'s own account and offers asset management services for affiliated entities as well as third parties. The investment categories include corporate bonds, government bonds, equities and mortgages. In this way, a.s.r. asset management offers bespoke investment solutions with attractive returns. a.s.r. asset management invests in countries and companies that comply with a.s.r.'s social and sustainability criteria, demonstrating that sustainability and financial returns can go together.

Real Estate

a.s.r. real estate invests in real estate and infrastructure (real assets) on behalf of a.s.r. and third party institutional investors and manages real assets portfolios. a.s.r. owns a 50% interest in the joint venture Amvest Vastgoed B.V. The other 50% of Amvest Vastgoed B.V. is owned by PfZW (Pensioenfonds Zorg & Welzijn), the Dutch pension fund for the care and welfare sector.

a.s.r. real estate manages non-listed sector funds, which invest in retail and residential properties, offices, real estate on science parks and rural property in the Netherlands. a.s.r. real estate also invests in renewable energy sources such as wind farms, solar parks and estates.

a.s.r. Real Assets Investment Partners develops investment strategies, ensures their implementation and gives institutional investors control over real asset portfolios through active monitoring, reporting and engagement.

Mortgages

a.s.r. mortgages operates in the residential mortgage market. a.s.r. also offers third party investors the opportunity to invest in mortgages. With a market share of around 11%, a.s.r. mortgages is the largest Dutch mortgage lender among insurers.

a.s.r. mortgages offers its mortgage products to customers via intermediaries, under two different mortgage brands: a.s.r. and Aegon. Under the Aegon brand, standard products (annuity, linear and interest-only mortgages) are offered to a broad customer base. In addition to standard products, the a.s.r. brand offers specialised products for distinct customer groups. This includes products for first-time buyers, potential customers who want to finance sustainable home modifications, and senior citizens.

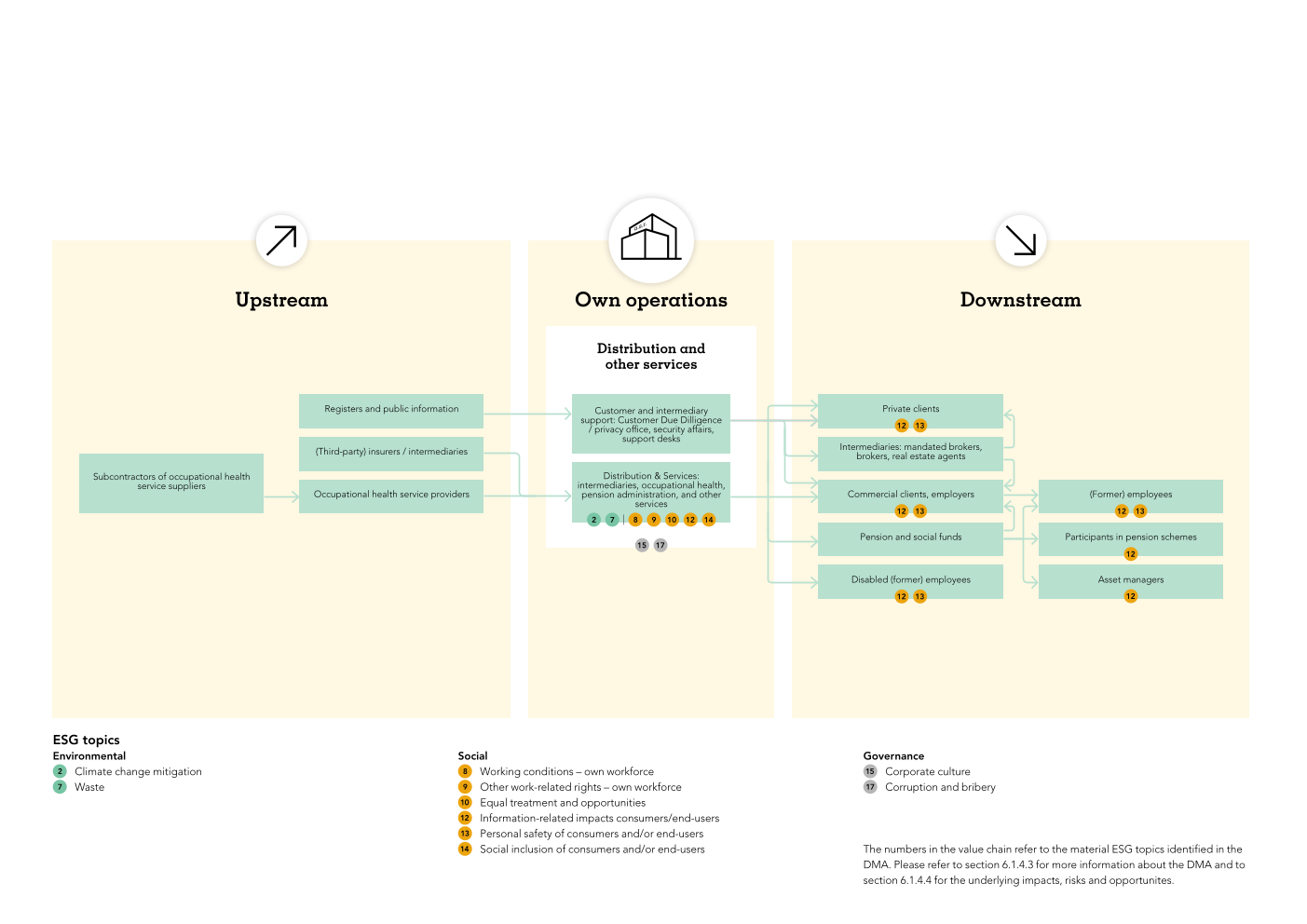

Distribution and other services value chain

The Distribution and Services (D&S) holding company is responsible for a.s.r.’s distribution and service entities. Companies under D&S are jointly responsible for developing a centralised strategy and promoting co-operation and synergy between the businesses. These companies retain their own unique identities and organisational structure. They continue to operate independently of a.s.r. but in line with the a.s.r. strategy. The participations of a.s.r. in the distribution and service market are Nedasco, Van Kampen Groep (VKG), Dutch ID (Boval, Felison), Supergarant and Poliservice. The results of Robidus are consolidated in the D&S figures, but it is a separate entity with its own strategy and it is not governed through the D&S holding company. The results of TKP are consolidated in the D&S segment. As a pension administrator, TKP operates as a separate business line under the Life segment.

See section 4.5 for more information about D&S and the underlying businesses.

Customer and intermediary support

a.s.r. customer support is primarily organised per business line and assisted by the aforementioned central support desks and a.s.r.’s intermediary support desk. Customer and Intermediary support is part of the Holding and Other segment and is assigned to the Distribution & Services value chain based on their customer and intermediary business relationships.

Services

Part of services are the Customer Due Diligence (CDD) Office, Security Affairs (Veiligheidszaken) and the Privacy Office.

The CDD Office coordinates the uniform compliance with the CDD Policy across business units and reports to the Anti-Money Laundering and Anti-Terrorist Financing Act Officer, the Money Laundering Reporting Officer (Compliance) and management.

Security Affairs (Veiligheidszaken) is responsible for various investigations into integrity among employees, contractors and intermediaries, as well as handling personnel screenings (including integrity sensitive functions).

The Privacy Office coordinates the uniform compliance with the Privacy Policy across business units and reports to the Data Protection Officer and management.

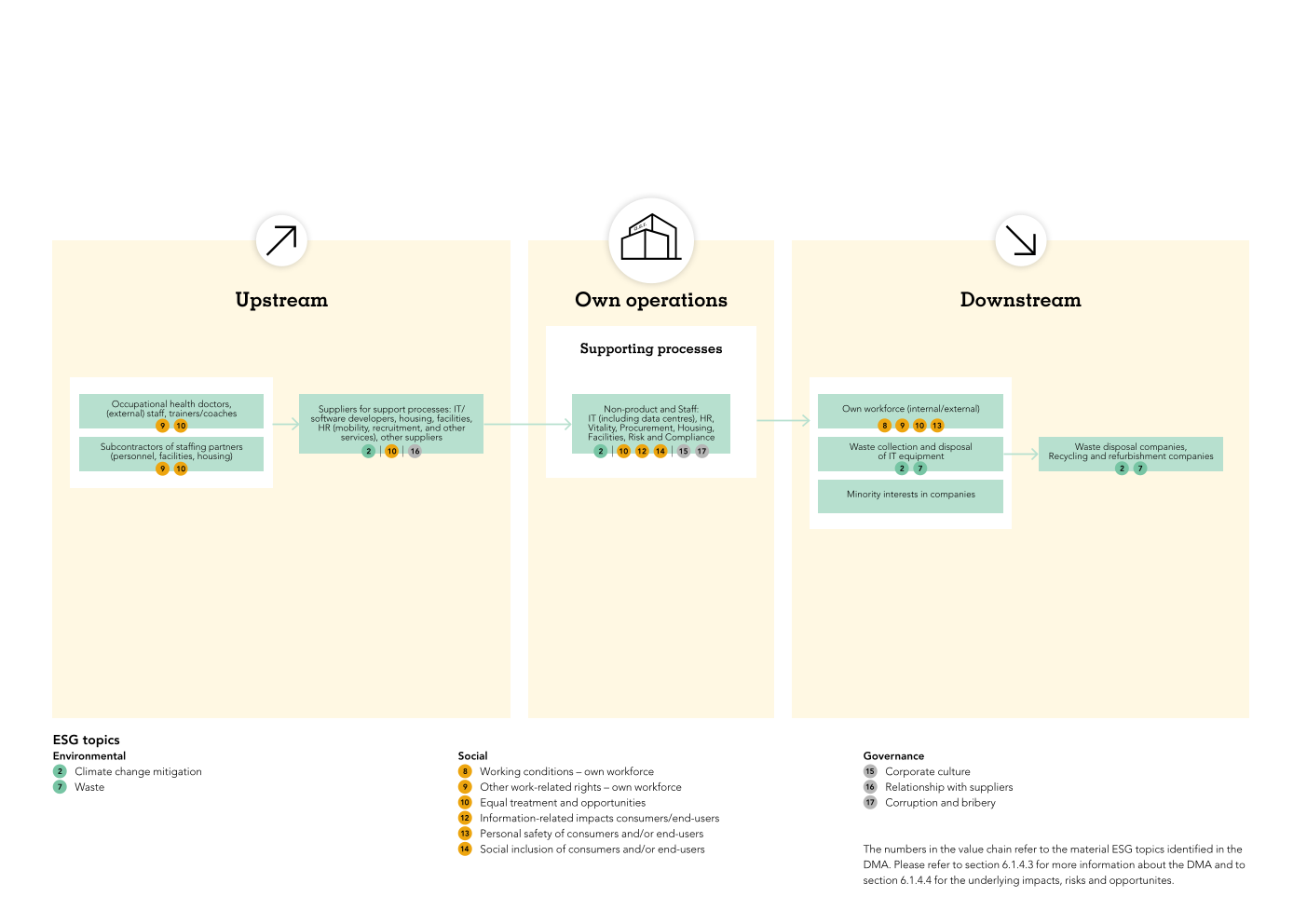

Supporting processes value chain

The Holding and Other segment (including eliminations) consists primarily of the following activities:

Holding activities of a.s.r., including group-related activities;

Other holding and intermediate holding companies, including:

ASR Vastgoed Projecten B.V., the real estate development business;

ASR Vooruit B.V., the investment firm that performs activities relating to private investments for customers;

ASR Deelnemingen N.V.

Non-product and staff value chain

The supporting processes relate mainly to the staff functions (e.g. IT, HR, Procurement, Compliance, Risk, Facility Management) that support a.s.r.'s own operations' business processes as described in the previous paragraphs. Also included is the a.s.r. Vitality programme, in which participants are encouraged to exercise more because this contributes to their physical and mental health.

Insurance value chain

Asset Management value chain

Distribution and other services value chain

Supporting processes value chain

- 1Market shares DNB 2023. Market shares 2024 are not available yet.