Introduction

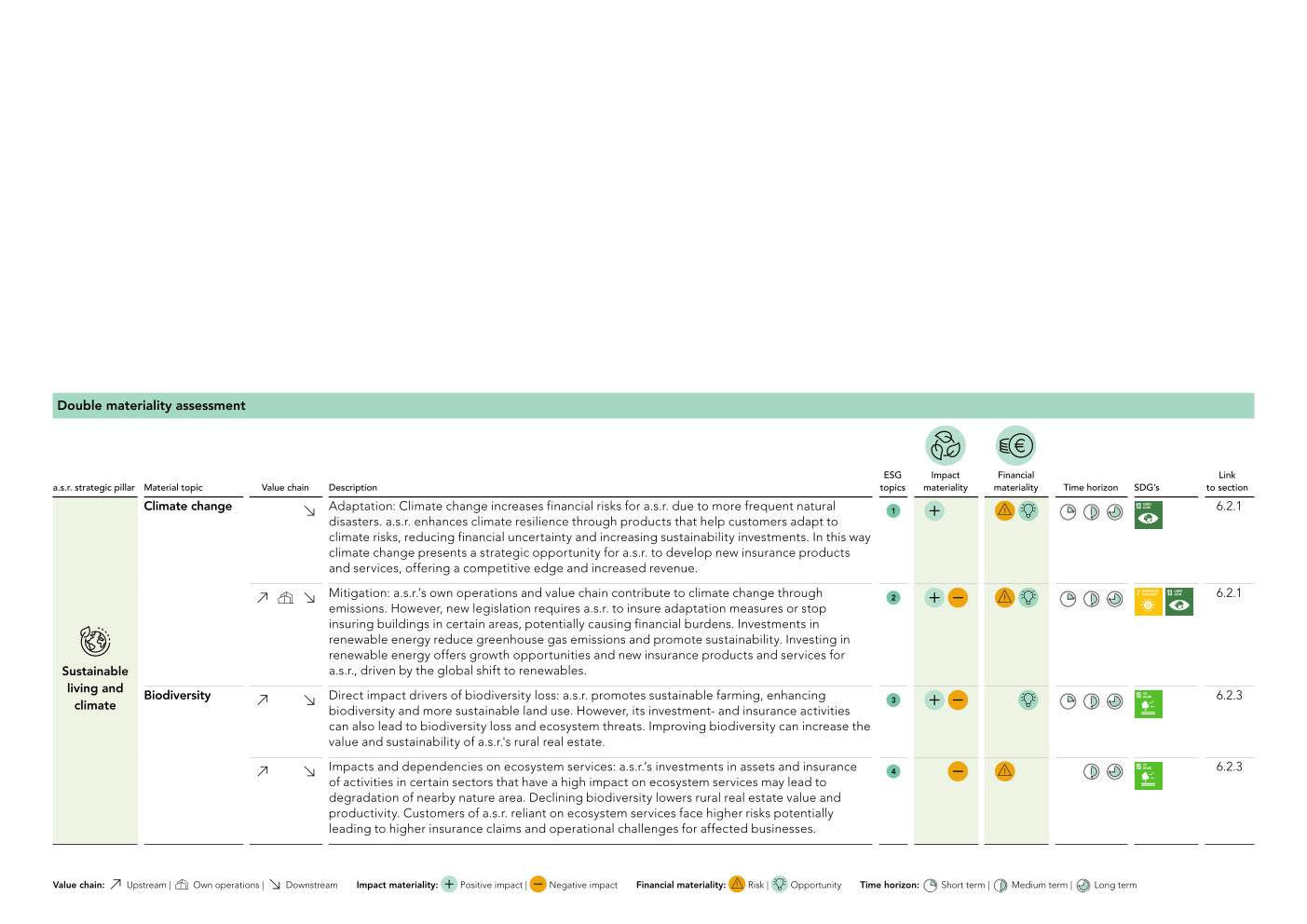

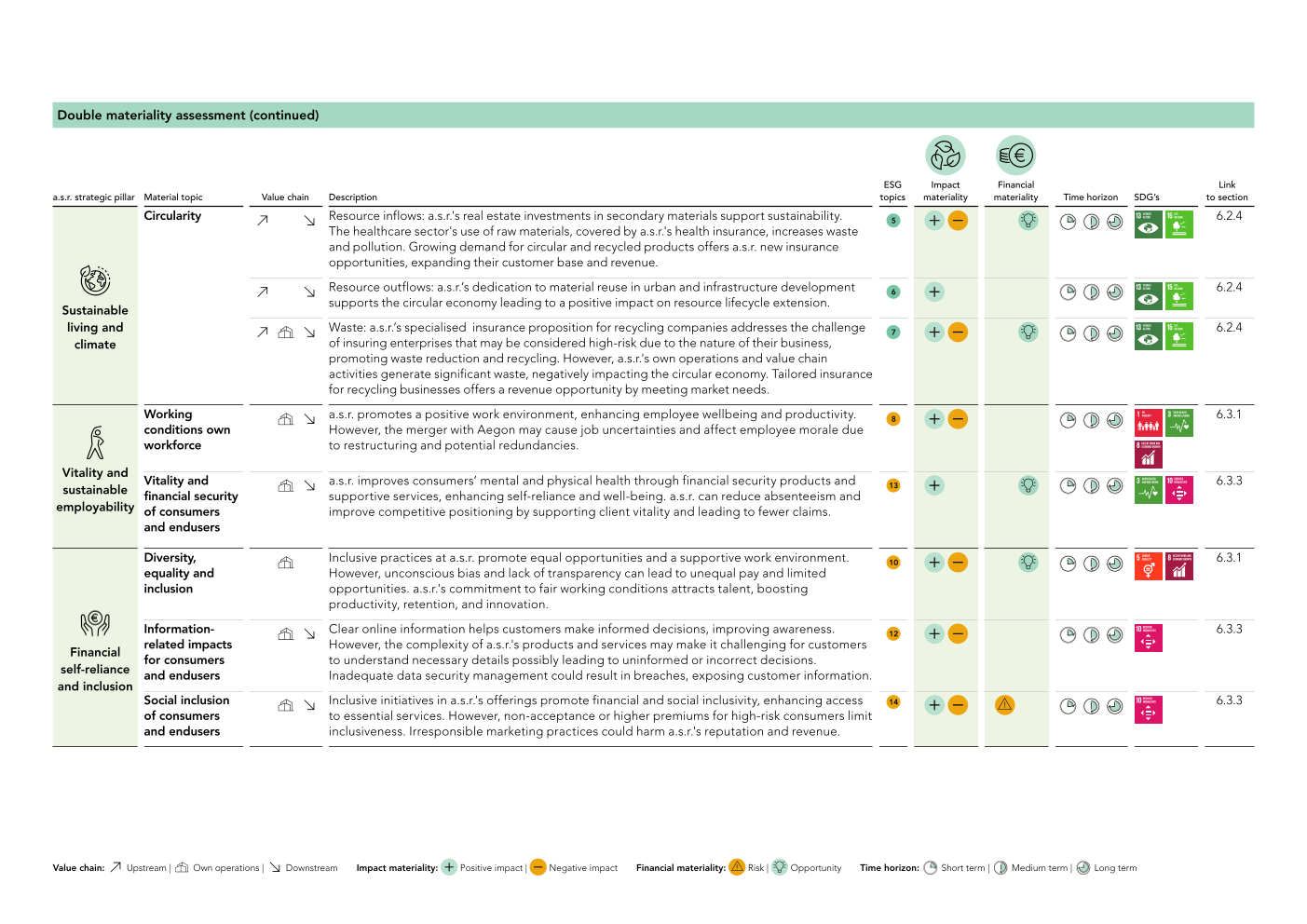

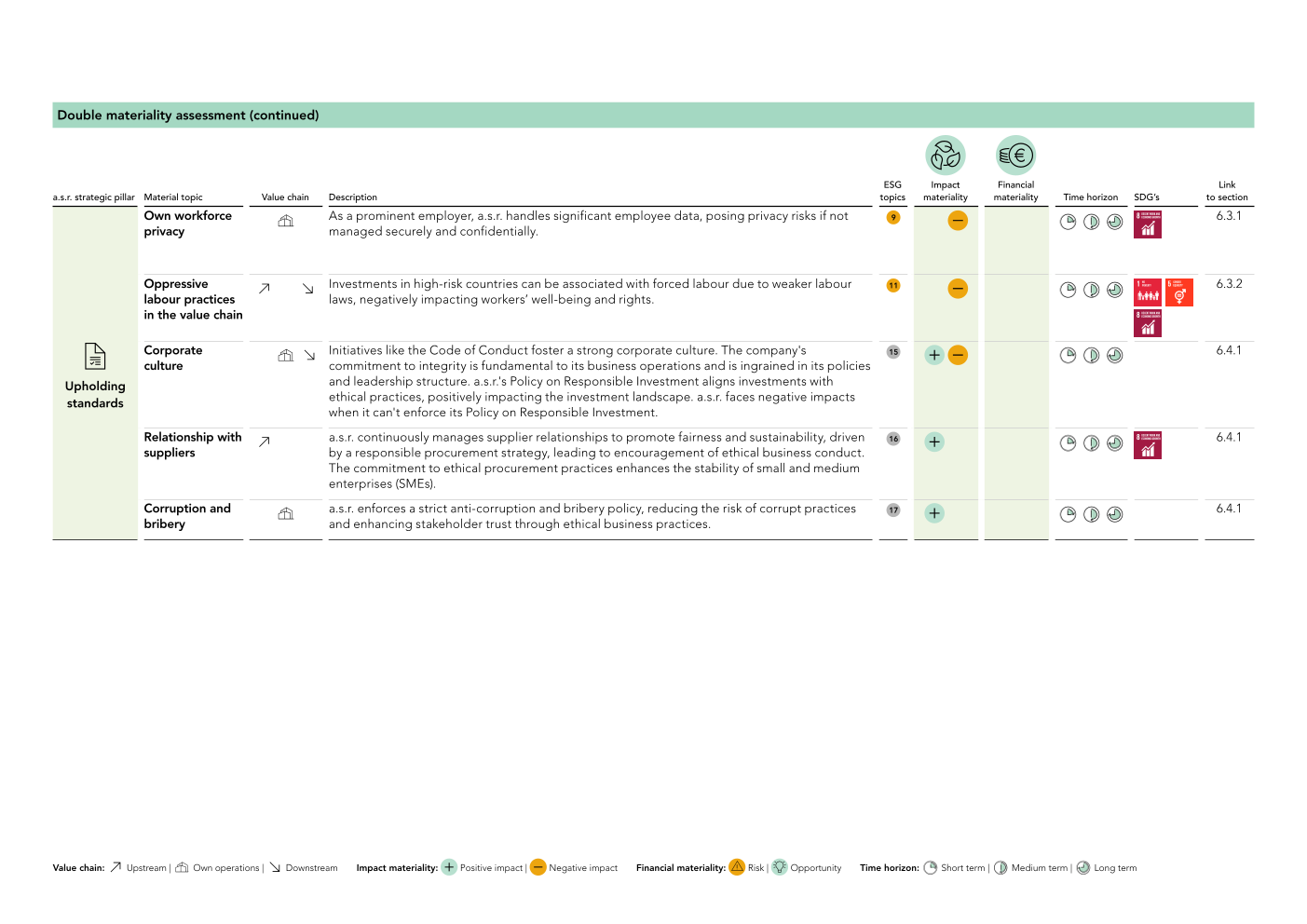

In line with the Corporate Sustainability Reporting Directive (CSRD), a.s.r. conducted a double materiality assessment in 2023 and 2024. A double materiality assessment is one of the first key steps in determining the reporting scope of the organisation of its most material sustainability matters.

Under the double materiality concept, a sustainability matter can be material from an impact point of view and/or from a risk and opportunity perspective. On the one hand, a.s.r. (potentially) has a positive and/or negative impact on people and the environment (inside-out). On the other hand, sustainability-related developments and events create (new) risks and opportunities for a.s.r. (outside-in).

Material sustainability matters

a.s.r. has identified 17 material sustainability matters (hereafter: material topics). Which are linked to the strategic sustainability pillars as shown below, also with reference to the eight SDG's that are most closely connected to the strategy. For more information on the material topics see sections 6.1.4.3 and 6.1.4.4 and for the SDG's section 2.7.

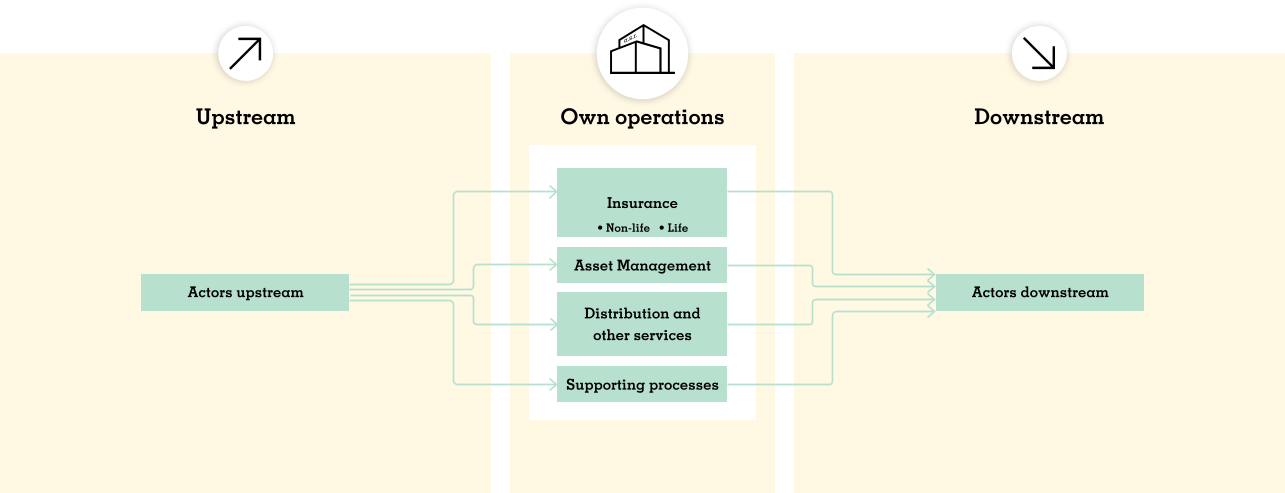

Group value chain

An important step in the double materiality assessment is mapping the value chain. The value chain outlines a.s.r.’s business operations and its associated upstream and downstream relations. The value chain is divided into three sections: upstream, own operations, and downstream. The upstream value chain of a.s.r. is characterised by the products and services purchased as well as capital provided to a.s.r. The downstream value chain of a.s.r. is characterised by financial products and services provided to customers. Finally, the own operations represent the core activities of a.s.r.

Upstream value chain

For a.s.r., the upstream part of the value chain consists of suppliers of goods, services, contractors, and capital necessary for the functioning of its business activities.

Own operations

a.s.r.'s business activities comprise several financial services that are organised into five segments. See section 2.4. a.s.r.’s workforce engaged in these activities are supported by staff functions, such as HR, IT, Facilities, Procurement, Risk and Compliance.

Downstream value chain

a.s.r.’s downstream value chain encompasses a broad range of actors, including customers, distributors, and waste management entities. Through independent intermediaries, mandated brokers, and online platforms, a.s.r. offers a variety of non-life and life insurance products and services to both businesses and private customers. a.s.r. recognises that its operations also indirectly affect and can be impacted by parties beyond direct customers and is actively managing these impacts. An example is employees of a.s.r.’s business customers whose pensions are arranged via a.s.r.

a.s.r. is an organisation with multiple product lines, each involving various internal and external stakeholders. The value chain for each product line has been mapped. These product line value chains can be categorised into four overarching value chains based on the characteristics of their activities: insurance, asset management, distribution and other services, and supporting processes. Descriptions of these value chains can be found in section 2.4. The consolidated value chain of a.s.r. as a group company, derived from these underlying value chains, is presented at the end of this section.

- 1Section 2.3 is in scope of CSRD and limited assurance (ESRS 2 SBM-1).