6.1.4.1Strategy, business model and value chain

The relation between sustainability disclosure requirements and a.s.r.'s strategy, business model, and value chain is disclosed in section 2.4.

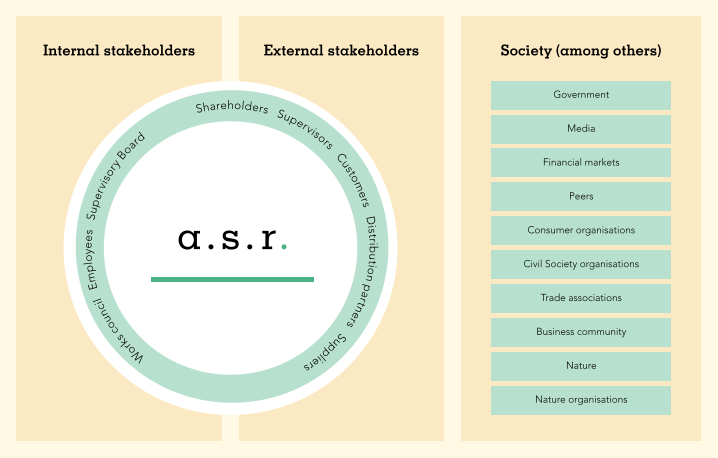

6.1.4.2Stakeholder engagement

Strategic, constructive and proactive consultations with all stakeholders are of great importance to a.s.r. With regard to stakeholders, a.s.r. is in continuous dialogue with stakeholders that influence the organisation both directly and indirectly and who are most likely to be impacted by a.s.r.'s activities. a.s.r.'s main stakeholder groups are summarised in section 8.5. Next to a.s.r.’s key stakeholders – consumers, employees, shareholders and society – this includes workers in the value chain, peers and governmental organisations. Consultation is done through roadshows, customer or employee surveys, round table sessions, dialogue sessions and participation in sector initiatives. Members of the MB also regularly engage with stakeholders.

a.s.r. also continuously monitors external trends and developments to determine which topics are most relevant to the organisation and how it can contribute positively to them. Sources used for this purpose include reports by legislative and regulatory bodies, the World Economic Forum and the World Business Council for Sustainable Development. Other sources include scientific research, peer reports and media coverage.

In addition to this continuous stakeholder interaction and trend monitoring, a stakeholder dialogue was held. This dialogue was held at a.s.r.’s office in Utrecht and was divided into two sessions: one for employees, and one for external stakeholders. Members of the MB attended both plenary and breakout sessions to hear stakeholders’ views, answer questions and take part in discussions. a.s.r. carefully selected the stakeholders for this dialogue, ensuring a good balance between all stakeholder groups. a.s.r. specifically invited stakeholders with a range of knowledge and experience on the organisation’s three strategic sustainability themes: i) Sustainable living and climate, ii) Financial self-reliance and inclusion, and iii) Vitality and sustainable employability. Participants in the stakeholder dialogue were asked to give their views on these strategic sustainability themes in three separate breakout sessions. Participants were asked three questions:

What are the most important challenges and barriers relating to the strategic sustainability theme?

On which issues does a.s.r. need to focus in order to make the biggest impact?

Which tools and partners are best suited for a.s.r.’s possibilities and ambitions?

Participants were asked to provide input on the topics most material to a.s.r.’s strategy and reporting, through a survey that stakeholders filled in after the dialogue sessions. Stakeholders were presented with a list of sustainability matters and were asked to select and rank these in order of a.s.r.’s most material impacts on people and the environment. They were also asked to rank sustainability matters representing material financial risks and opportunities for a.s.r. The outcomes of the dialogue sessions and survey results were used as input for the double materiality assessment (see section 6.1.4.3 for more information on the DMA-process). No distinction was made between the opinions of internal stakeholders and those of external stakeholders. The outcomes of the stakeholder dialogue were also used by the MB and senior management to evaluate a.s.r.’s integrated strategy, which focuses on long-term value creation for all stakeholders.

The stakeholders consulted in the stakeholder dialogue were (representatives of) customers, peers, suppliers, brokers, educational and research institutes, NGOs, media and branch organisations. A summary of the outcome of the stakeholder dialogue was shared with the MB, SB and the stakeholders that participated. The outcomes of the stakeholder survey on impact and financial materiality are included in section 8.5.

Cooperation with stakeholders

a.s.r.'s stakeholder policy, which aims to include the interests of relevant stakeholders when defining and further developing the sustainability strategy, was established in 2023. Effective consultation and engagement with a.s.r.'s stakeholders is important in this process: a.s.r. strives to serve stakeholders’ interests to the best of its ability and build lasting relationships with them. This stakeholder policy provides guidelines and principles to maintain and strengthen these relationships, including an overview of the frequency and method of engagement for different stakeholder groups. The way a.s.r. communicates with stakeholders depends on the type of stakeholder, the topic and the purpose of the communication in question. a.s.r.’s means of communication range from personal contact to organising roadshows, customer and employee surveys, and roundtable and dialogue sessions.

a.s.r. works together with peers, social organisations and government agencies to jointly develop policies on sustainability issues and to promote the thorough implementation of such policies.

a.s.r. is an active participant of initiatives such as DNB’s Platform for Sustainable Finance, the Energy Efficient Mortgages Hub Netherlands, creditors' coalition (Schuldeiserscoalitie), the Platform Living Wage Financials and the Partnership for Carbon Accounting Financials (PCAF). Furthermore, there is close collaboration with the Dutch Association of Insurers on Sustainability reporting. To spread knowledge and inspire others, a.s.r. actively presents its sustainability approach and sustainability activities at a wide range of events, such as seminars and meetings organised by parties including consultancy firms, the United Nations Environment Programme Finance Initiative, the Dutch Association of Insurers, the Dutch Fund and Asset Management Association and Zorgverzekeraars Nederland.

Key stakeholders

a.s.r.’s key stakeholder groups are customers, employees, investors and society.

Customers

a.s.r. has established the Raad van Doen. The Raad van Doen is the online customer and advisor panel for all a.s.r. brands. Through this panel, customers and intermediaries are involved in improving a.s.r.'s services. It functions as a panel for a.s.r.'s strategy, as a forum for co-creation, product development and representation of customer interests, and as a sparring partner. Product lines also use members of the Raad van Doen to conduct research on customer expectations regarding sustainability aspects for specific insurance products and services. This can be done through questionnaires or by organising a dialogue session with members. Furthermore, as part of the Product Approval and Review Process (PARP), a newly developed or revisions to an insurance product is tested before it can be introduced to the market. Existing products must also go through the PARP process periodically. Within the PARP process, several criteria are reviewed, including customer interest and social interest. In 2024, a.s.r. continued the Wat doen kan doen news bulletin. In this bulletin, customers are invited to share their experiences with a.s.r.

Employees

a.s.r. wants to establish a professional work environment that fosters autonomy and self-management for our employees, to enable employees to make choices relating to their career and enhance their sustainable employability. a.s.r. employees value good terms of employment, enjoyable work, a good work-life balance, attention to their health and well-being, and an appreciation of the contribution they make. a.s.r. encourages and supports employees in developing themselves to enhance their opportunities in the internal and external labour market. Employees also want to be recognised for who they are and to feel included and at home. a.s.r. aims to achieve a balanced workforce and be inclusive to all employees regardless of gender, age, religion, physical and mental capacity, background and sexual orientation.

Investors

Investors rely on a.s.r.'s management to devise and successfully execute the best strategy to create long-term value. a.s.r. does so with a continued focus on value over volume, maintaining a strong cost discipline and only pursuing mergers and acquisitions (M&A) that tie in well with its strategy. a.s.r. also maintains a strong balance sheet and a robust Solvency II ratio with manageable sensitivities and ample financial flexibility. Investors are increasingly interested in the impact and social relevance of the companies they invest in. It is important to them that a.s.r. represents the interests of all stakeholders to create long-term value and a good return on capital.

Society

As well as the aforementioned stakeholders, a.s.r. has a range of other stakeholders to take into account when doing business, such as civil society organisations, the Dutch government, tax and regulatory authorities, trade unions, the media, suppliers, academics, peers and business partners. Depending on the topic and type of relationship involved, expectations and interests may vary from responsible investments and regulatory compliance to helping people to become financially reliant, inclusiveness and constructive cooperation with business partners in different contexts. Overall, these various stakeholders expect a.s.r. to create sustainable and responsible societal value.

6.1.4.3Double Materiality Assessment

a.s.r. periodically conducts a Double Materiality Assessment (DMA) to determine a.s.r.'s material sustainability matters. As of the financial year 2024 and in line with the CSRD requirements, see section 2.3 for the outcomes of the DMA.

Both the impact materiality and financial materiality perspectives are considered. Impact materiality reflects the inside-out perspective: a.s.r.’s actual or potential, positive or negative impact on people and the environment over the short, medium and long term. Financial materiality reflects the outside-in perspective: the potential effects of sustainability-related risks or opportunities on a.s.r.’s financial position, performance and cash flows over the short, medium and long term. During the identification and the assessment process of the material sustainability matters, an adequate and structured bottom-up approach in close collaboration with the product lines has been adhered to. Furthermore and in accordance with the principle of the DMA, the acquisition of Aegon NL by a.s.r. was classified as a material change in the organisational and operational structure of a.s.r. and was therefore already identified as a material change in the DMA process.

Due diligence is an ongoing practice that responds to and may trigger changes in the company’s strategy, business model, activities, business relationships, operating, sourcing and selling contexts. The double materiality assessment process may also be impacted over time by sector-specific standards to be adopted. In line with the stakeholder policy, a.s.r. continues to engage with its stakeholders on ESG matters to ensure that it remains focused on the most material issues. At least once a year or when a trigger occurs, a.s.r. reviews its material impacts, risks and opportunities as well as the material information to be included in the Sustainability statements. As the DMA is dynamic process, a.s.r. will monitor and update its DMA on an ongoing basis.

The following steps have been performed to determine material sustainability matters from an impact and financial perspective:

Engage stakeholders;

Identify impacts, risks and opportunities;

Assess impact, risks and opportunities;

Determine material sustainability matters.

1. Engage stakeholders

As part of the materiality assessment, a.s.r. has actively engaged with its stakeholders (both internal and external) to gather input on environmental, social and governance topics that may potentially be material for a.s.r. In addition to the continuous stakeholder interaction, a stakeholder dialogue was held. For a comprehensive explanation of stakeholder engagement, including which stakeholders were approached, how they were engaged and the outcomes, see section 6.1.4.2.

2. Identify impacts, risks and opportunities

The starting point of a.s.r.’s materiality assessment was creating a long list of sustainability matters covering environmental, social and governance topics that could potentially be material for a.s.r. This list was based on the sustainability matters as defined by the ESRS and complemented with a.s.r.-specific sustainability matters drawn from previous materiality analyses, stakeholder input and peer analysis.

To understand a.s.r.’s business activities and business relationships, a.s.r.’s value chain is used as a starting point. This value chain is an aggregation of multiple value chains, established for each product line and selected staff functions (i.e. procurement, HR, etc.). Expert judgement was applied at each step of these value chains to identify which sustainability matters are most relevant, ensuring the materiality assessment focuses on the matters with the highest impact or financial materiality.

Impacts were defined by describing the effect that a.s.r. has or could have on the environment and people, including effects on their human rights, connected with its own operations and upstream and downstream value chain, including through its products and services, as well as through its business relationships. The impacts can be actual or potential, negative or positive, intended or unintended, and reversible or irreversible. They can arise over the short, medium, or long term. Impact indicates the undertaking's positive or negative contribution to sustainability.

Risks and opportunities were defined by describing the activities, products or business relationships and stakeholders concerned, and by specifying whether they result from a certain event or development, like laws and regulations, sanctions and lawsuits, shift in supply and demand, and physical or transition risks related to environmental change. Additionally, the identified impacts were considered when defining risks and opportunities. For each risk and opportunity, the potential effect on financial position, financial performance, cash flows, access to finance or cost of capital in the short, medium or long term was determined and whether that might occur in the short, medium, or long term.

3. Assess impacts, risks and opportunities

Impacts

As part of the bottom-up approach, the product lines, together with the sustainability manager of each product line and with the support of subject matter experts, have assessed impacts based on a set of predefined assessment criteria. As part of the assessment process for scoring the attributes scale, scope, irremediable character and likelihood, a 5-point scale has been applied. Negative impacts were assessed by determining and adding up a score for their scale (how grave the impact is), scope (how widespread the impact is) and irremediable character (whether and to what extent the negative impacts could be remediated). Positive impacts were assessed by determining and adding up a score for their scale (how beneficial the impact is) and scope (how widespread the impact is). For potential impacts, likelihood of occurrence was considered by multiplying the materiality score by its likelihood score.

Likelihood was assessed considering the time horizon and circumstances in which the impact might occur, and whether the impacts have occurred before at a.s.r. or in the insurance sector. For adverse impacts on human rights, as stipulated in the Universal Declaration of Human Rights and other UN human rights treaties, the severity of the impact takes precedence over its likelihood, so the materiality score of these impacts is high even if their likelihood of occurrence is small.

The impact was assessed by the sustainability manager and subject matter experts of the product lines. Data such as emission data or externally sourced ESG data for investments was used, when available. In cases where data was not available, external research, industry proxies and expert judgment were applied. The assessment does not consider whether policies are in place to prevent, mitigate or remediate negative impacts, like an exclusion policy for the investment universe and client acceptance policies for certain products.

Risks and opportunities

The product lines, together with the Risk team of each product line, have assessed the anticipated financial effect of each risk and opportunity based on a set of predefined assessment criteria for the magnitude and likelihood of the financial effect. A 5-point scale has been applied for scoring these attributes.

The magnitude of the financial effect was assessed by considering effects on the ability to use resources and the ability to rely on relationships needed in the business processes of a.s.r. and its business partners across its value chain. For resource use, a score was determined reflecting availability of, access to, and prices of resources in the short, medium and long term. For relationships, a score was determined reflecting reputational effects and potential actions by stakeholders in the short, medium and long term. For likelihood, a score was determined similarly to the assessment of impacts.

The risk assessment conducted by the product lines, together with their Risk team was based on data, if available; for example, the percentage of houses in the mortgage portfolio exposed to flooding risk or investment exposure in high-risk countries for human rights violations. If data was not available, expert judgment was applied, considering industry proxies.

The assessment does not consider whether policies are in place to pursue opportunities or manage risks, like the Policy on Responsible Investments.

4. Determine material sustainability matters

For each product line, through a bottom-approach and after assessing impacts, risks and opportunities, a ranked list of negative impacts, positive impacts, risks and opportunities has been created for the identified sustainability matters. By applying a threshold it has enabled a.s.r. to distinguish material sustainability matters from non-material sustainability matters. From a scoring perspective, a.s.r.’s approach entails establishing a threshold for the maximum score that can be allocated to impacts, risks and opportunities. In summary, a score below 33% is categorised as low, a score between 33% and 66% as medium, and a score above 66% is considered high.

Sustainability matters related to impacts with a medium or high score were concluded to be material from the impact materiality perspective. Sustainability matters related to risks and opportunities with a medium or high score were concluded to be material from the financial materiality perspective.

For sustainability matters related to impacts, risks and opportunities with a low materiality score, additional judgement was applied. Representatives from Sustainability, Procurement, ESG Reporting and Group Risk management assessed these sustainability matters on a case-by-case basis to draw conclusions on their materiality, taking into account consistency across product lines and the ranking of the matters by stakeholders. In case the outcome was uncertain, the matter was presented to the Remediation Board to draw a final conclusion.

The process and outcomes of the materiality assessment were reviewed and aligned with the management teams of the product lines. Subsequently, the outcome of the materiality assessment was reviewed by various governing bodies involved in sustainability reporting, such as the Quality Board and the Steering Committee, prior to having the materiality assessment approved by the MB, see section 5.1.6. Going forward, material sustainability matters will be reviewed periodically and at a minimum on an annual basis to ensure that they are up to date with relevant developments within a.s.r. and its value chains.

Consolidation of IRO’s

Impacts, risks and opportunities have been identified bottom-up at the product line level. Each product line identified and assessed its impacts, risks and opportunities. To present a cohesive and integrated view, a comprehensive consolidation process was carried out. This process involved a detailed evaluation to determine which impacts, risks and opportunities could be merged at the sub-sub-theme level. During this consolidation process, each product line, alongside their respective management teams, played a critical role in validating and refining the merged impacts, risks and opportunities. This collaborative approach improved accuracy.

Events after DMA process was finalised, but before year end

In line with the ESRS, a.s.r. has considered potential triggers to update the outcomes of the DMA. Other than the sale of Knab, no such triggers have occurred.

Sale of Knab

In February 2024, a.s.r. sold Knab to BAWAG Group, finalising the transaction on 31 October 2024. This sale was considered during the preparation of The Sustainability Statements. Since Knab no longer forms part of a.s.r. group effective 1 November 2024, an update of the double materiality analysis was conducted. The analysis concluded that no material sustainability matters were identified from a.s.r.’s perspective regarding Knab. Consequently, Knab has been excluded from group targets set beyond 2024 and the corresponding baseline values, and no disclosures about its policies and actions are included in The Sustainability Statements.

However, Aegon Hypotheken BV will continue to manage the Knab mortgage portfolio. As a result, the greenhouse gas (GHG) emissions associated with the mortgage portfolio remain a material topic for a.s.r. and will be included in the disclosures.

Knab is included in metrics relating to the reporting period 2024, until 31 October 2024. For E1-6 Gross scopes 1, 2, 3 and total GHG emissions (Main Table) a disclosure is made to clarify what the metrics pertain to a.s.r. following the sale of Knab.

6.1.4.4Impacts, risks, and opportunities

The following table provides an overview of the material impacts, risks and opportunities identified by a.s.r. The overview includes the areas within a.s.r.'s business model where these impacts, risks and opportunities are concentrated. A distinction is made between own operations and value chain. The description of the material impacts illustrates how a.s.r.’s material positive and negative impacts affect people or the environment. Additionally, the time horizons are included, with a distinction made between short term, medium term and long term. As indicated in the table below, certain staff functions hold an overarching and an oversight responsibility, extending their influence across multiple product lines. For instance HR, Compliance, IT, Services and Procurement are such departments. The organisational scope of these departments encompasses various product lines.

Each impact, risk, and opportunity has been labelled with a number in the table below. This number is used throughout the section to link the Policies, Actions and Targets with the identified material impacts, risks, and opportunities.

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 1.1 a.s.r. enhances climate resilience through improving the climate resilience of properties and through product offerings that help customers adapt to climate risks, leading to reduced financial uncertainty for customers and more sustainability investments. |

| Product lines: Real Estate, Mortgages, P&C | |||||||

| | | | | | | | 1.2 Physical risks such as increased frequency and severity of extreme weather, drought, heat and flood due to climate change pose significant financial risks to a.s.r.'s insurance and real estate assets, leading to increased repair costs, operational disruptions, increased insurance claims and potentially stranded assets. |

| Product lines: Real Estate, Mortgages, P&C | |||||||

| | | | | | | | 1.3 The escalating effects of climate change present a.s.r. with a strategic opportunity to develop new insurance products and services addressing the evolving needs of consumers and businesses, driven by increasing awareness of climate risks, leading to a competitive edge and increased revenue. |

| Product line: P&C | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 2.1 By investing, financing and the insurance of renewable energy solutions and by offering mortgages that support the energy transition a.s.r. has a positive environmental impact by reducing GHG emissions and promoting sustainable practices, driven by active investments in and insurance of renewable energy projects like wind and solar farms, leading to significant environmental benefits. |

| Product line and staff function: Asset Management, Real Estate, Mortgages, P&C, Procurement | |||||||

| | | | | | | | 2.2 a.s.r. has a negative impact on the environment and climate change through its operations and value chain, primarily due to GHG emissions from operational and value chain activities, contributing directly and indirectly to climate change and posing environmental threats. |

| Product line, staff function and/or other: Facilities, Procurement, IT, D&S Holding, Corins, TKP, Robidus, Asset Management, Real Estate, Mortgages, P&C, Health, Individual life and Funeral | |||||||

| | | | | | | | 2.3 The transition risks associated with e.g. new legislation and the energy transition may require a.s.r. to insure new renewable energy solutions or may require a.s.r. to stop insuring in certain sectors or certain assets. This may lead to incorrect pricing and/or to potential market risks. |

| Product line: P&C | |||||||

| | | | | | | | 2.4 Investing in the renewable energy market provides a.s.r. with growth opportunities and positions it to develop new insurance products and services and mortgage products that support the energy transition, driven by the global shift towards renewable energy sources and technological innovations, leading to increased demand and higher revenues. |

| Product lines: Asset Management, Mortgages, P&C | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 3.1 By promoting sustainable farming practices, a.s.r. positively contributes to biodiversity and more sustainable land use, driven by an investment strategy focused on environmental stewardship, leading to enhanced biodiversity and sustainable farming practices. |

| Product line: Real Estate | |||||||

| | | | | | | | 3.2 a.s.r.'s investments and insurance activities may have an impact on biodiversity loss, driven by amongst others land-use change, pollution, resource overexploitation and climate change. |

| Product lines: Asset Management, Real Estate, P&C | |||||||

| | | | | | | | 3.3 Enhancing biodiversity in ecosystems can increase the value of a.s.r.'s rural, farmland and real estate property, benefiting the appeal and sustainability of the properties. |

| Product line: Real Estate | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 4.1 Investments in assets and insurance of activities in certain sectors that have a high impact on ecosystem services may lead to degradation of nearby nature area. |

| Product lines: Asset Management, P&C | |||||||

| | | | | | | | 4.2 Declining biodiversity and ecosystem services can decrease the value of rural real estate and reduce ecosystem productivity. |

| Product line: Real Estate | |||||||

| | | | | | | | 4.3 a.s.r.'s diverse customer base (which includes businesses heavily reliant on ecosystem services) faces increased physical risks due to diminishing availability of ecosystem services, driven by environmental stress and climate change impacting essential resources, leading to higher insurance claims and operational challenges for affected businesses. |

| Product lines: Real Estate, P&C | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 5.1 a.s.r.'s real estate investments that steer towards using secondary materials reduce the inflow of new goods, driven by encouragement of biobased and circular materials, leading to a positive impact on sustainability goals. |

| Product lines: Real Estate | |||||||

| | | | | | | | 5.2 P&C insurance products mandate repair services which is a resource intensive activity. The healthcare sector's large footprint in raw materials usage, covered under a.s.r.'s Health insurance policies, contributes to significant material inflows, driven by production and use of single-use medical products. |

| Product lines: P&C, Health | |||||||

| | | | | | | | 5.3 Shifting market demand towards circular, recycled, and pre-owned products presents an opportunity for a.s.r. to offer new insurance products and services, driven by increasing consumer interest in sustainability, leading to an expanded customer base and increased revenue. |

| Product line: P&C | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 6.1 a.s.r.'s dedication to material reuse in urban and infrastructure development supports the circular economy leading to a positive impact on resource lifecycle extension. |

| Product line: Real Estate | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 7.1 a.s.r.’s specialised insurance proposition for recycling companies addresses the challenge of insuring enterprises that may be considered high-risk due to the nature of their operations. By insuring them P&C facilitates these companies' ability to operate and manage waste effectively which has a positive impact on waste reduction and recycling efforts. |

| Product line: P&C | |||||||

| | | | | | | | 7.2 a.s.r.'s offices and distribution and services entities generate waste in their own operations. Furthermore a.s.r.’s various business activities generate significant material, medical, electronic, and operational waste, through for instance the value chain of Health (i.e. medical supply and P&C (i.e. repair services). |

| Product line, staff function and/or other: Facilities, Corins, Robidus, TKP, D&S Holding, IT, P&C, Health | |||||||

| | | | | | | | 7.3 Offering tailored insurance coverage to recycling businesses presents a revenue opportunity for a.s.r., driven by meeting specific market needs for high-risk industries, leading to increased revenue. |

| Product line: P&C | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 8.1 a.s.r. leverages its scale to foster a positive and equitable work environment, driven by a strategy to cultivate fair treatment and comprehensive well-being, leading to a resilient, satisfied and productive workforce. |

| Staff function and/or other: Corins, D&S Holding, HR, Robidus | |||||||

| | | | | | | | 8.2 The business combination with Aegon may lead to job uncertainties, driven by organisational restructuring, leading to potential redundancies and shifts in job roles, impacting employee morale and employment stability. |

| Staff function: HR | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 9.1 As a prominent employer, a.s.r. is entrusted with considerable amounts of employee data. a.s.r. has a potential negative risk on the privacy of employees if the employee data is not handled in a secured and confidential manner. |

| Staff function and/or other: Corins, D&S Holding, HR, Robidus | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 10.1 Inclusive practices promote equal treatment and opportunities, driven by initiatives like enabling individuals with disabilities to work at a.s.r. and the participation desk, leading to a diverse and supportive work environment. |

| Staff function and/or other: Corins, D&S Holding, HR, Robidus | |||||||

| | | | | | | | 10.2 Organisational practices may lead to unequal pay and limited access to opportunities, driven by unconscious bias and in transparency, leading to negative effects on workplace equality and employee well-being. |

| Staff function and/or other: Corins, D&S Holding, HR, Robidus | |||||||

| | | | | | | | 10.3 a.s.r.'s commitment to fair working conditions attracts talented employees, driven by fair pay, training programs, and inclusive policies, leading to enhanced productivity, employee retention, and innovation. |

| Staff function and/or other: Corins, D&S Holding, HR, Robidus | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 11.1 Investments in high-risk countries may be linked to companies that engage in forced labour and/or child labour practices, driven by less stringent labour laws, leading to serious negative impacts on workers' well-being and work rights. |

| Product lines: Asset Management, Real Estate | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 12.1 Providing clear and accessible information through online portals helps customers make informed decisions, driven by the complexity of services and products, leading to a positive impact on consumer awareness and decision-making. |

| Product line, staff function and/or other: D&S Holding, Disability, Pensions, P&C, Mortgages, Individual life and Funeral, Real Estate, Health, TKP, Robidus | |||||||

| | | | | | | | 12.2 The complexity of a.s.r.'s products and services may make it challenging for customers to understand necessary details, driven by intricate offerings and extensive information, leading to uninformed or incorrect decisions. |

| Product line, staff function and/or other: D&S Holding, Disability, Pensions, P&C, Mortgages, Individual life and Funeral, Health, TKP, Robidus | |||||||

| | | | | | | | 12.3 Inadequate data security management could lead to data breaches, driven by the necessity to store and process sensitive personal data, leading to exposure of customer information. |

| Staff function: Compliance | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 13.1 a.s.r. as an insurance group positively impacts the mental and physical health of consumers and end-users by providing financial security products and supportive services, driven by initiatives enhancing vitality and financial security, leading to improved self-reliance and well-being. |

| Product line, staff function and/or other: D&S Holding, Disability, Robidus, Vitality | |||||||

| | | | | | | | 13.2 a.s.r. has the opportunity to reduce absenteeism by implementing initiatives that support vitality, driven by efforts to enhance client vitality, leading to fewer claims, lower costs, and improved competitive positioning. |

| Product line: Disability | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 14.1 Inclusive initiatives in mortgage offerings, insurance products, and investments promote financial and social inclusivity, driven by a commitment to accessibility and affordability, leading to broader access to essential services and positive societal impact. |

| Product lines: Mortgages, Pensions, Real Estate, Health, P&C, Disability | |||||||

| | | | | | | | 14.2 Non-acceptance of certain consumers or charging higher premiums due to high-risk classification negatively impacts social inclusiveness, driven by internal acceptance policies, leading to limited access to products. |

| Product lines: Disability, P&C | |||||||

| | | | | | | | 14.3 Irresponsible marketing practices could harm a.s.r.'s brand and reputation, driven by potential ethical issues in marketing, leading to financial repercussions and reduced revenue. |

| Staff function: Compliance | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 15.1 a.s.r.'s incorporation of its core values into the Policy on Responsible Investments influences its investment decisions responsibly, driven by a commitment to social responsibility and ethical practices, leading to positive impacts on the investment landscape and alignment of financial growth with ethical conduct. |

| Product line: Asset Management | |||||||

| | | | | | | | 15.2 a.s.r.'s emphasis on fostering a strong corporate culture is reflected through initiatives like the Code of Conduct, driven by a commitment to due care and integrity, leading to a positive impact on the corporate culture and work environment. |

| Staff function: Compliance | |||||||

| | | | | | | | 15.3 a.s.r. faces a negative impact when it is not able to effectively exercise influence in line with its Policy on Responsible Investments, particularly in investments linked to poor governance practices, driven by a lack of power to enforce positive changes, leading to compromised investment efforts. |

| Product line: Asset Management | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 16.1 a.s.r. continuously manages supplier relationships to promote fairness and sustainability, driven by a responsible procurement strategy, leading to encouragement of ethical business conduct. The commitment to ethical procurement practices enhances the stability of small and medium enterprises (SMEs). |

| Product line, staff function and/or other: Procurement, Real Estate, Health, P&C, Individual life and Funeral, and Disability, Robidus, TKP, D&S Holding, Corins | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | 17.1 a.s.r. enforces a rigorous anti-corruption and bribery policy, driven by a commitment to ethical business practices, leading to a reduction in the risk of corrupt practices and enhanced stakeholder trust. |

| Staff function: Compliance | |||||||

6.1.4.5Impacts, risks and opportunities only material at subsidiary level

Pollution of water (part of ESRS E2) and working conditions (part of ESRS S2) are not deemed material for a.s.r. group but are material for a.s.r.'s subsidiaries ASR Basis Ziektekostenverzekeringen N.V. (a.s.r. health basic) and ASR Aanvullende Ziektekostenverzekeringen N.V. (a.s.r. health supplementary), which together form the product line Health. As a result of Health's small market share in the sector, the scale and scope of its potential negative impact on people and the environment is limited. For Health, these topics are material, as they align closely with the core operations and priorities of Health. The strategic importance of these topics within the health sector emphasises their qualitative materiality at this level. However, for the group as a whole, these issues do not carry the same weight, as other sustainability matters where a.s.r. has a greater ability to influence outcomes and make a more substantial impact.

The following table presents an overview of the material impacts identified, along with the corresponding policies, actions and targets. The related policies, actions and targets have been described in section 6.2.2 and section 6.3.2.4.

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | Health insurance offerings (facilitating access to healthcare services and medicines) indirectly lead to the pollution of water. Specifically in relation to the disposal and excretion of medication through urination and defecation which results in trace contaminants entering water systems. |

| Product line, staff function and/or other: Health | |||||||

| Materiality | Value chain | Time horizon | Description | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | Health insurance offerings (facilitating access to healthcare services) indirectly contribute to high work pressure, irregular shifts, inadequate wages and physically and mentally demanding tasks for healthcare workers, leading to potential health issues and sick leave among healthcare workers. |

| Product line, staff function and/or other: Health | |||||||

6.1.4.6Disclosure requirements in ESRS covered by a.s.r.’s Sustainability statements

The CSRD reference table is included in section 6.6.1.

This page is intentionally left blank.