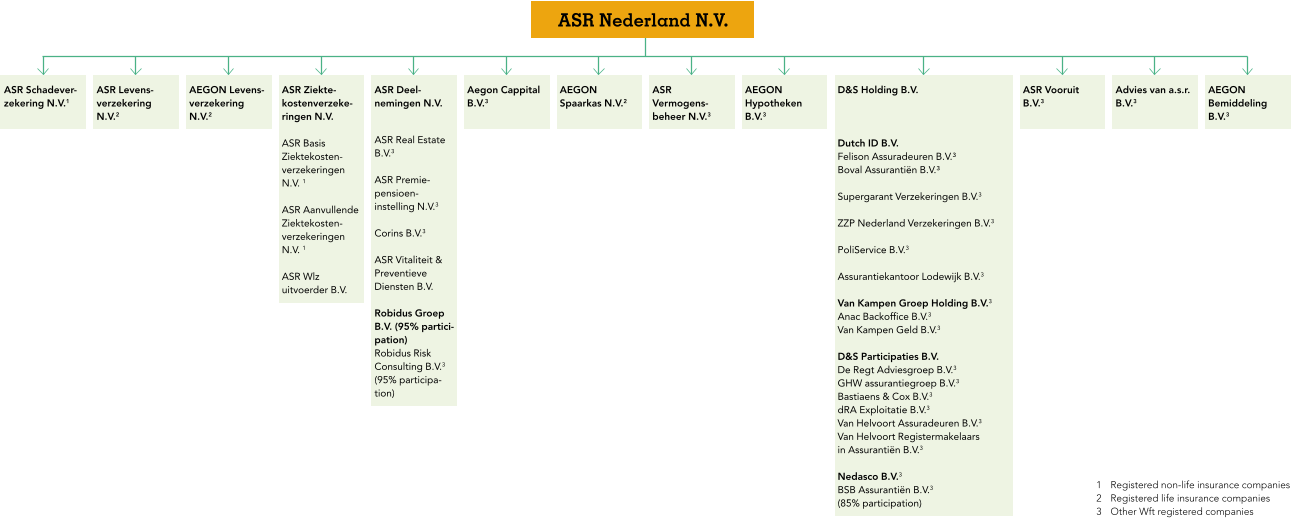

The Group comprises a number of operating and holding companies. Except where indicated, a.s.r. is 100% shareholder of these companies.

Segment information

The operations of a.s.r. have been divided into five operating segments (2023: six, including Bank). The main segments are the Non-life and Life segment in which all insurance activities are presented. The other activities are presented as three separate segments being Asset Management, Distribution and Services and Holding and Other.

Intersegment transactions or transfers are concluded at arm's length conditions.

Insurance activities

Insurance entities are entities that accept the transfer of insurance risks from policyholders. The Non-life segment consists of non-life insurance entities and their subsidiaries. These non-life insurance entities offer non-life insurance contracts such as disability insurance and P&C insurance and health insurance. The Life segment mainly comprises the life insurance entities and their subsidiaries. This life insurance entities offer financial products such as life insurance contracts and life insurance contracts on behalf of policyholders. The Life segment also includes ASR Premiepensioeninstelling N.V. (a.s.r. IORP) and Aegon Cappital B.V. (Aegon IORP) which offer investment contracts to policyholders that bear no insurance risk and for which the actual return on investments allocated to the contract is passed on to the policyholder. The Life segment also includes ASR Vooruit B.V., the investment firm that performs activities related to private investing for customers. The Non-life and Life segments have different levels of profitability and growth opportunities, as well as a different outlook and risk profile. See section 7.7.9 for a list of principal group companies and associates in the relevant segments.

Other activities

The other activities consist of:

The Asset Management segment involves all activities related to asset management including investment property management. These activities include amongst others ASR Vermogensbeheer N.V., ASR Real Estate B.V. and Aegon Hypotheken B.V. (Aegon hypotheken);

The Distribution and Services segment includes the activities related to distribution of insurance contracts and include amongst others the financial intermediary business of PoliService B.V., Van Kampen Groep Holding B.V. (and Van Kampen Geld B.V. and Anac Backoffice B.V.), Dutch ID B.V. (and Felison Assuradeuren B.V. and Boval Assurantiën B.V.), Corins B.V., SuperGarant Verzekeringen B.V., D&S Participaties B.V., (and ZZP Nederland Verzekeringen B.V. and Bedrijfsartsengroep B.V.), Nedasco B.V., Robidus Groep B.V., TKP Pensioen B.V., Advies van a.s.r. B.V. and AEGON Bemiddeling B.V.;

The Holding and Other segment consists primarily of the holding activities of a.s.r. (including the group related activities), other holding and intermediate holding companies, the real estate development business (ASR Vastgoed Projecten B.V.), ASR Vitaliteit & Preventieve Diensten B.V (Vitality) and the minority participations of ASR Deelnemingen N.V.

The former Banking segment consisted of the Knab activities (Aegon Bank N.V.), which were sold during 2024, see section 7.4.6.

The eliminations applied in the reconciliation of the segment information to the consolidated balance sheet and the consolidated income statement are separately presented in section 7.4.2 and 7.4.3.

The a.s.r. segment reporting shows the financial performance of each segment. The purpose is to allocate all items in the balance sheet and income statement to the segments that hold full management responsibility for them.

Segment information has been prepared in accordance with the accounting principles used for the preparation of a.s.r.’s consolidated financial statements (see section 7.3). Goodwill and other intangibles are presented in the related cash generating unit's segment. Intersegment transactions are conducted at arm’s length conditions. In general, costs related to centralised services are allocated to the segments based on the utilisation of these services.

The segments are assessed on their operating result as defined in section 7.10.