Climate change is one of today’s greatest challenges. A transition to a net-zero economy and a society that is resilient to the effects of climate change is crucial for the liveability of our planet. a.s.r. acknowledges the importance of this transition and, as an insurer and investor, wants to contribute to it.

The following table presents an overview of the material climate-related impacts, risks and opportunities identified, along with the corresponding policies, actions and targets. The purpose of this table is to highlight the linkages and dependencies among these elements.

| Materiality | IRO Description | Product line, staff function and/or other | Policies | Actions | Targets |

|---|---|---|---|---|---|

| Positive impact | 1.1 a.s.r. enhances climate resilience through improving the climate resilience of properties and through product offerings that help customers adapt to climate risks, leading to reduced financial uncertainty for customers and more sustainability investments. | 1. Real Estate 2. Mortgages 3. P&C | 1. ESG Policy of Real Estate 2. Mortgages Transition Plan 3. Policy on Sustainable Insurance | 1. Assess adaptation solutions for highly exposed assets. 2. Increase climate adaptive thinking for residential homes. 3. Develop products which incentivise prevention measures. | None |

| Financial risk | 1.2 Physical risks such as increased frequency and severity of extreme weather, drought, heat and flood due to climate change pose significant financial risks to a.s.r.'s insurance and real estate assets, leading to increased repair costs, operational disruptions, increased insurance claims and potentially stranded assets. | 1. Real Estate 2. Mortgages 3. P&C | 1. ESG Policy of Real Estate 2. Mortgages Transition Plan 3. Policy on Sustainable Insurance | 1. Assess adaptation solutions for highly exposed assets. 2. Increase climate adaptive thinking for residential homes. 3. Develop products which incentivise prevention measures. | None |

| Financial opportunity | 1.3 The escalating effects of climate change present a.s.r. with a strategic opportunity to develop new insurance products and services addressing the evolving needs of consumers and businesses, driven by increasing awareness of climate risks, leading to a competitive edge and increased revenue. | 1. P&C | 1. Policy on Sustainable Insurance | 1. Develop products and services to address evolving needs. | None |

| Materiality | IRO Description | Product line, staff function and/or other | Policies | Actions | Targets |

|---|---|---|---|---|---|

| Positive impact | 2.1 By investing, financing and the insurance of renewable energy solutions and by offering mortgages that support the energy transition a.s.r. has a positive environmental impact by reducing GHG emissions and promoting sustainable practices, driven by active investments in and insurance of renewable energy projects like wind and solar farms, leading to significant environmental benefits. | 1.Asset Management 2.Real Estate 3. Mortgages 4. P&C 5. Procurement | 1. Policy on Responsible Investments 2. ESG Policy of Real Estate 3. Mortgages Transition Plan 4. Policy on Sustainable Insurance 5. Further agreement, Code of Conduct, outsourcing policy | 1. Make impact investments, participate in industry collaborations. 2. Invest in renewable energy, increase on-site renewable energy generation. 3. Engage through sustainable living platform/partner network. 4. Make renewable energy initiatives insurable, develop products, engage through various platforms. 5. None | 1. Impact investment target 2. Impact investment target 3. Impact investment target 4. None 5. None |

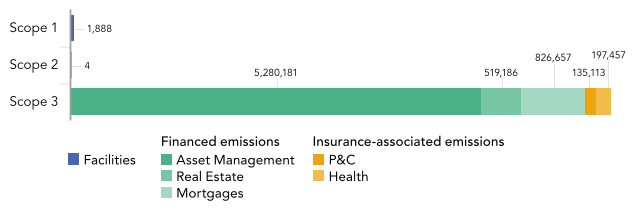

| Negative impact | 2.2 a.s.r. has a negative impact on the environment and climate change through its operations and value chain, primarily due to GHG emissions from operational and value chain activities, contributing directly and indirectly to climate change and posing environmental threats. | 1. Facilities 2. Procurement 3. IT 4. D&S Holding, Corins, TKP and Robidus 5. Asset Management 6. Real Estate 7. Mortgages 8. P&C 9. Health 10. Funeral | 1. Environmental Policy of Facilities 2. Not applicable 3. Not applicable 4. Not applicable 5. Policy on Responsible Investments 6. ESG Policy of Real Estate 7. Mortgages Transition Plan 8. Policy on Sustainable Insurance 9. Procurement Policy of Health 10. Not applicable | 1. Use renewable energy, purchase market-based green electricity, promote eco-friendly transportation/hybrid working. 2. Not applicable 3. Use renewable energy for data centres, extend use of hardware. 4. Corins: promote eco-friendly transportation, hybrid working. 5. Exclude investments in certain activities/sectors, carry out active ownership. 6. Minimise energy consumption, reduce environmental impact, increase on-site renewable energy generation. 7. Offer specific mortgage products/opt-in mortgage offers. 8. Apply underwriting criteria, engage and support, refer to certified repairers. 9. Stimulate to: reduce GHG emissions/provide mobility plan/design framework for real estate action/produce GHG roadmaps. 10. Develop products, engage with network, support the development of industry-wide GHG calculation methodology. | 1. Emission reduction target (scope 1 and 2 - own operations) 2. None 3. None 4. None 5. Emission reduction target (scope 3 - financed emissions) 6. Emission reduction target (scope 3 - financed emissions). 7. Emission reduction target (scope 3 - financed emissions). 8. Emission reduction target (scope 3 - insurance associated emissions of P&C). 9. Joint emission reduction target (scope 1 and 2 emissions of healthcare providers). 10. None |

| Financial risk | 2.3 The transition risks associated with e.g. new legislation and the energy transition may require a.s.r. to insure new renewable energy solutions or may require a.s.r. to stop insuring in certain sectors or certain assets. This may lead to incorrect pricing and/or to potential market risks. | 1. P&C | 1. Policy on Sustainable Insurance | 1. Apply underwriting criteria. | None |

| Financial opportunity | 2.4 Investing in the renewable energy market provides a.s.r. with growth opportunities and positions it to develop new insurance products and services and mortgage products that support the energy transition, driven by the global shift towards renewable energy sources and technological innovations, leading to increased demand and higher revenues. | 1. Asset Management 2. Mortgages 3. P&C | 1. Policy on Responsible Investments 2. Mortgages Transition Plan 3. Policy on Sustainable Insurance | 1. Make impact investments. 2. Offer specific mortgage products/opt-in mortgage offers. 3. Make renewable energy initiatives insurable. | 1. Impact investment target 2. Impact investment target 3. Impact investment target |

6.2.1.1Managing impacts, risks and opportunities

Description of the processes to identify and assess material climate-related impacts, risks and opportunities

a.s.r. has identified and assessed several climate-related impacts, risks and opportunities. Climate related risks can be climate-related physical risks (risks related to climate hazards) or climate-related transition risks (risks related to the transition to a net-zero economy and a society that is resilient to the effects of climate change).

See section 6.1.4.3 for more information about the process to assess material impacts, risks and about the consolidation process.

Impacts

a.s.r.'s product lines and entities identified their impacts on climate change, in particular their GHG emissions, in expert sessions and by making use of various guidance and standards.

This resulted in the identification of short-, medium- and long-term actual and potential impacts for some of the Supporting Processes departments (Facilities, Procurement and IT), all distribution and services entities and almost all product lines (except Pensions, Income and Individual life).

Physical risks

a.s.r.'s product lines and entities also identified their physical risks and opportunities related to the sub-topic climate change adaptation in expert sessions and by making use of various tools.

This resulted in the identification of short-, medium- and long-term actual and potential risks for the product lines Real Estate, Mortgages and P&C.

Real Estate

Real Estate has made use of its Climate Risk Monitor to identify climate-related hazards in its value chain over the short, medium and long term. This is an in-house-developed tool, with which Real Estate has implemented the Framework for Climate Adaptive Buildings (FCAB) for its portfolio. This framework was drawn up by the Dutch Green Building Council (DGBC) together with a variety of financial institutions (including Real Estate), knowledge institutes, advisors and solutions to achieve a smooth and sector-wide methodology for assessing physical climate risks at property level1.

To screen whether its assets may be exposed and are sensitive to the identified climate-related hazards, creating gross physical risks, Real Estate identified the expected climate impacts on the environment of the buildings in the portfolio and combined this with the vulnerability of the buildings themselves.

Real Estate used a long-term horizon, which is defined as 2050. This is in line with the Strategic Asset Allocation long-term time horizon, which is 25 years forward-looking.

For the assessment of the extent to which real estate objects are exposed and sensitive to the identified climate-related hazards, Real Estate made use of the FCAB to calculate the climate risk score, a combination of the environmental score and the building score. This methodology made it possible to identify and prioritise climate risks through screening (or 'red flagging') the total real estate portfolio. For the properties identified with a material risk, an in-depth analysis (‘deep dive’) was carried out to identify the adaptation solutions that can reduce the identified physical risks.

Identification and assessment were informed by at least high-emissions climate scenarios, as the FCAB works with the KNMI’14 projections for 2050 which contain high-emissions climate scenarios. The KNMI’23 projections will be applied when available in a resolution that meets the requirements for the analysis.

Mortgages

Mortgages has made use of the Climate Risk Monitor of Real Estate to identify the climate-related hazards in its value chain over the short, medium and long term.

To screen whether its assets may be exposed and sensitive to the identified climate-related hazards, creating gross physical risks, Mortgages identified the risks specifically for residential buildings in the Netherlands and identified the expected climate impacts on the environment of the buildings in the mortgage portfolio.

Mortgages has used a long-term time horizon, which is defined as 2050. This is in line with the Strategic Asset Allocation long-term time horizon, which is 25 years forward-looking.

For the assessment of the extent to which residential objects are exposed and sensitive to the identified climate-related hazards, Mortgages made use of the FCAB, taking only the environmental score into account. This methodology made it possible to identify and prioritise climate risks through 'red flagging’.

Identification and assessment were informed by at least high-emissions climate scenarios as the FCAB works with the KNMI’14 projections for 2050, which contain high emissions climate scenarios. The KNMI'23 projections will be applied when available in a resolution that meets the requirements for the analysis.

P&C

P&C made use of the findings in the report “Accelerating climate adaptation”, which was published by the Working Group on Climate Adaptation Finance Sector, a multi-stakeholder working group of the Sustainable Finance Platform, to identify the climate-related hazards in its value chain over the short, medium and long term.

To screen whether its underwriting activities may be exposed and sensitive to the identified climate-related hazards, P&C also made use of the findings in the report “Accelerating climate adaptation”, which provides an indication of whether the underwriting activities of insurers may be affected by climate-related hazards, thereby creating risks.

P&C has defined short-, medium- and long-term horizons in accordance with the definitions used in the Strategic Risk Analysis (SRA) and which are linked to the strategic planning horizons.

To assess the extent to which insured residential objects are exposed and sensitive to the identified climate-related hazards, P&C made use of the Dutch Association of Insurers’ Climate Damage Monitor, which demonstrates the effect extreme weather events have on the claims burden of property insurers.

Identification and assessment were informed by at least high-emissions climate scenarios, as the report “Accelerating climate adaptation” works with the KNMI’23 climate scenarios, which contain high emissions climate scenarios.

Information that applies to all the product lines that have identified climate-related physical risks

How the identification and assessment of climate-related physical risks by the entities and product lines were informed by the climate-related scenario analysis, which includes a range of climate scenarios, is described below. As to how the climate scenarios used are compatible with critical climate-related assumptions made in the financial statements; no critical climate-related assumptions are made in the financial statements.

Transition risks

a.s.r.'s product lines and entities identified their transition risks and opportunities related to the sub-topic climate change mitigation in expert sessions and by making use of several tools.

This resulted in the identification of short-, medium- and long-term actual and potential transition risks and opportunities for the product lines Asset Management, Real Estate, Mortgages and P&C.

Asset Management

Asset Management has identified potential transition events over the short-, medium- and long-term in its value chain by using the latest climate science to identify how different sectors and companies might be impacted by various transition events, such as regulatory changes, market shifts and technological advancements, depending on the speed of the low-carbon transition.

Asset Management screened whether the investment decisions it has made may be exposed to transition events by analysing its exposure to high-risk sectors using guidance from bodies such as the European Insurance and Occupational Pensions Authority (EIOPA), complemented by research from a.s.r.’s ESG data providers on company-level exposure to transition risks. Additionally, Asset Management performed activity-based screening to identify its exposure to companies involved in activities that are incompatible with achieving the goals of the Paris Agreement. These methods collectively enabled the evaluation and management of transition risks across clients' portfolios.

To assess the extent of the exposure and sensitivity of its assets to the identified transition events, Asset Management made use of EIOPA’s NACE codes associated with transition risk.

The identification of transition events and the assessment of exposure were informed by climate-related scenario analysis, considering at least a scenario consistent with the Paris Agreement, to understand what is required to limit global warming to ideally 1.5°C.

Asset Management identified assets that are incompatible or may need significant efforts to become compatible with a transition to a climate-neutral economy by using data from a.s.r.’s ESG research providers on transition risk management and exposure to activities that may be incompatible with achieving the goals of the Paris Agreement.

Real Estate

Real Estate has identified potential transition events over the short, medium and long term in its value chain by using various documents, research papers and sectoral guidelines, including European legislation, publications of the Dutch Central Bank (De Nederlandsche Bank - DNB), the Authority for the Financial Markets (Autoriteit Financiële Markten - AFM) and the ESG risk framework of the European Association for Investors in Non-Listed Real Estate Vehicles (INREV).

Real Estate screened whether its assets may be exposed to the identified transition events by making use to the Carbon Risk Real Estate Monitor (CRREM) and applicable legislation such as the Energy Performance of Buildings Directive (EPBC IV) and the EU Taxonomy Regulation.

To assess the extent of the exposure and sensitivity of its assets to the identified transition risks, Real Estate has identified the assets that are at transition risk based on the actual (energy intensity) and theoretical (energy label) energy performance that is available for the real estate property.

The identification of transition events and the assessment of exposure were informed by climate-related scenario analysis, considering at least a scenario consistent with the Paris Agreement, as Real Estate uses the 1.5°C CRREM Pathway consistent with the Paris Agreement to identify stranded assets based on the actual energy performance.

Real Estate has not identified any assets that are incompatible or may need significant efforts to be compatible with a transition to a climate-neutral economy.

Mortgages

Mortgages has identified potential transition events in the short, medium and long term by using various documents and research, including applicable legislation, publications of the DNB, the AFM and the Dutch government’s National Energy and Climate Plan, including the National Climate Agreement.

Mortgages screened whether its assets may be exposed to the identified transition events, by conducting an analysis of the portfolio to determine which mortgaged assets have a potential transition risk.

To assess the extent of assets’ exposure and sensitivity to the identified transition risks, Mortgages identified the assets that are at transitional risk based on the energy labels that are available for the buildings in the portfolio.

The identification of transition events and the assessment of exposure were informed by climate-related scenario analyses, considering at least a scenario consistent with the Paris Agreement, during the aforementioned research to determine the least energy-efficient houses and the steps that need to be taken to become compatible with achieving the goals of the Paris Agreement.

Mortgages identified assets that are incompatible or may need significant efforts to be compatible with a transition to a climate-neutral economy by assessing the energy labels of the buildings in the portfolio.

P&C

P&C has identified potential transition events over the short, medium and long term in its value chain by using the Dutch government’s National Energy and Climate Plan, including the National Climate Agreement, as well as forecasts by various Dutch banks, which both contain information on the plans of the Dutch government and the various sectors in the Netherlands to transition to climate neutral.

P&C screened whether its underwriting activities may be exposed to the identified transition events, by making use of information from the Dutch Association of Insurers, as well as expert findings.

To assess the extent of the exposure and sensitivity of underwriting activities to the identified transition events, P&C calculated the share (percentage) of Insurance Contract Revenue (ICR) that is related to NACE codes, which are connected to the fossil fuel industry.

The identification of transition events and the assessment of exposure were informed by climate-related scenario analysis, considering at least a scenario consistent with the Paris Agreement, as the aforementioned National Climate Agreement is based on a scenario consistent with the Paris Agreement.

By calculating the ICR related to NACE codes, which are connected to the fossil fuel industry, P&C has identified the underwriting activities which may be incompatible or may need significant efforts to be compatible with a transition to a climate-neutral economy.

Information that applies to all the product lines that have identified climate-related transition risks

The identification and assessment of climate-related transition risks by the entities and product lines was informed by the climate-related scenario analysis which includes a range of climate scenarios is described below. In regard to how the climate scenarios used are compatible with critical climate-related assumptions made in the financial statements, no critical climate-related assumptions are made in the financial statements. This may be considered in the future.

Material impacts, risks and opportunities and their interaction with strategy and business model

For each material climate-related risk which a.s.r. has identified, an explanation of whether a.s.r. considers it to be a climate-related physical risk or a climate-related transition risk can be found in section 6.1.4.4.

The analysis of the resilience of its strategy and business model in relation to climate change is part of the resilience analysis which in its turn is part of the Strategic Asset Allocation (SAA) study. The scope of the SAA is the whole of a.s.r., and specifically the supervised entities (OTSOs). For the non-supervised entities, a static cash flow was assumed and the sensitivity to climate change of the cash flows generated for a.s.r. was not taken into account. All material climate-related physical risks and transition risks are part of the analysis on an aggregated level. One of the constraints of the model is that all climate-related risks, both physical and transitional, are evaluated in a combined manner. Also, the scenarios do not contain the climate-related tipping point effects nor biodiversity-related impacts. All company-level scenarios are based on national data from the relevant countries or regions in which a.s.r. invests or operates. For the underlying risk assessment for the product lines (e.g. Mortgages and Real Estate) the data are linked to geospatial coordinates specific to investment locations.

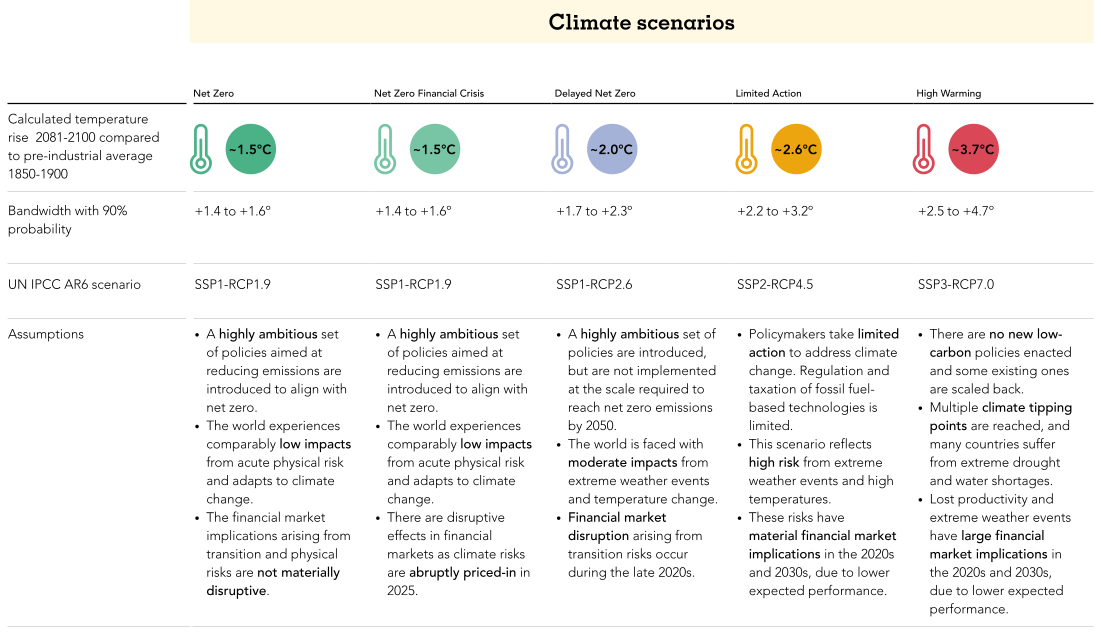

The resilience analysis was carried out in 2024 as part of the Strategic Asset Allocation study which takes place annually. The study uses five climate scenario analysis.

The orderly net zero scenario assumes a temperature rise of 1.5°C. The assumptions were made that a highly ambitious set of policies aimed at reducing emissions are introduced, the world experiences comparably low impacts from acute physical risk and that the financial market implications arising from transition and physical risks are not materially disruptive.

The disorderly net zero scenario assumes a temperature rise of 1.5°C. The assumptions were made that a highly ambitious set of policies aimed at reducing emissions are introduced, the world experiences comparably low impacts from acute physical risk and that there are disruptive effects in financial markets as climate risks are abruptly priced-in in 2025.

The delayed net zero scenario assumes a temperature rise of 2.0°C. The assumptions were made that a highly ambitious set of policies aimed at reducing emissions are introduced but are not implemented on the scale that is required to reach net zero emissions by 2050. Also, the world is faced with moderate impacts from extreme weather events and temperature change and financial market disruption arising from transition risks occur during the late 2020s.

The too little too late scenario assumes a temperature rise of 2.6°C. The assumptions were made that policymakers take moderate steps to address climate change, thus regulation and taxation of fossil fuel-based technologies is limited. This scenario reflects high risks from extreme weather events and high temperatures and these risks have material financial market implications in the 2020s and 2030s, due to lower expected performance.

The failed transition scenario assumes a temperature rise of 3.7°C. The assumptions were made that there are no new low-carbon policies enacted and some existing ones are scaled back. Also, multiple climate tipping points are reached and many countries suffer from extreme drought and water shortage. The lost productivity and extreme weather events have large financial market implications in the 2020s and 2030s, due to lower expected performance.

The above mentioned key forces and drivers, taken into consideration in each scenario, are macroeconomic trends and assumptions relevant to a.s.r.

A time horizon of 25 years is applied, which is considered long-term in the context of the Strategic Asset Allocation. This endpoint was chosen in line with the Paris Agreement aim for net zero by 2050 and should therefore cover plausible risks and uncertainties. The time horizon for GHG emission reduction targets, on the other hand, focuses on the nearer term with a time horizon of six years. This deviation is a result of immediate emission reduction action being required now, whereas climate risk impact on the business is expected to have a significant impact in the longer term.

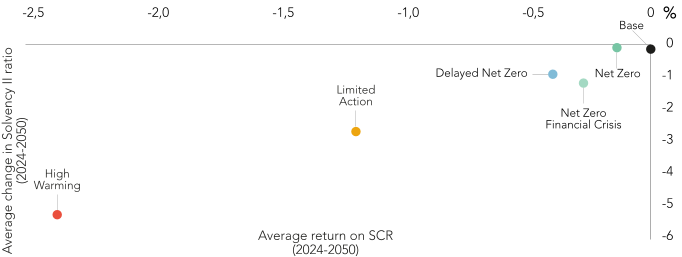

The resilience analysis has led to the following results:

The model was created in collaboration with ORTEC Finance and is aligned with state-of-the-art science by translating biophysical impacts to economic impacts of climate change. For the biophysical impacts a.s.r. uses the UN IPCC 6 climate scenarios as a basis. These impacts are then interpreted using a sophisticated non-equilibrium econometric model. In comparison to an equilibrium model, it has the advantage of not assuming optimising behaviour, not deriving historical relationships, having a bounded rationality with uncertainty, including path dependence and learning effects, and assuming endogenous money.

This resilience analysis has resulted in the conclusion that a.s.r. does not need to adjust its strategy and business model now. a.s.r. will keep assessing the resilience of its strategy and business model to climate change in the coming years. If at any time necessary, a.s.r. believes that it will be sufficiently able to adjust or adapt its strategy and business model to climate change over the short, medium and long term, including securing ongoing access to finance at an affordable cost of capital, the ability to redeploy, upgrade or decommission existing assets, shifting its products and services portfolio, or reskilling its workforce.

6.2.1.2Transition plan

Transition plan for climate change mitigation

a.s.r. has determined several GHG emission reduction targets, of which currently some, but not all, are compatible with the limiting of global warming to 1.5°C in line with the Paris Agreement. a.s.r. is committed to submit near-term science-based targets compatible with limiting global warming to 1.5˚C in line with the Paris Agreement, to the Science Based Target Initiative (SBTi) for validation. See section 6.2.1.4 for more information about a.s.r.'s GHG emission reduction targets.

a.s.r. has determined various decarbonisation levers and has planned key actions, varying per product line, to achieve its GHG emissions reduction targets. Levers include a.o. product development (e.g. insurance products which encourage the use of green alternatives), engagement (e.g. engagement actions which aim to stimulate customers and investees to make the energy transition) and impact investing (e.g. investments in renewable energy solutions), see section 6.2.1.3 for more information about a.s.r.'s key climate mitigation actions and decarbonisation levers.

Investments and funding may be needed to support the implementation of a.s.r.'s transition plan for climate change mitigation, including action plans of the various product lines. See section 6.2.1.3 for an explanation and quantification of the investments and funding to support the action plans of the various product lines, where significant. a.s.r. has not identified material locked-in GHG emissions in its products or services so it does not currently expect any such emissions to jeopardise the achievement of its GHG emission reduction targets or drive transition risk.

a.s.r. has economic activities that are covered by delegated regulations on climate adaptation or mitigation under the EU Taxonomy Regulation but a.s.r. has not yet established any formal objectives or plans for aligning its economic activities with the criteria established in the EU Taxonomy environmental objectives. a.s.r. does not deem this a risk for achieving its emission reduction targets though. There are no significant CapEx amounts invested during the reporting period related to coal, oil, and gas-related economic activities and a.s.r. is not excluded from EU Paris-aligned benchmarks.

a.s.r. has embedded its transition plan for climate change mitigation in and aligned it with its broader business and financial planning:

Key elements of integrating climate considerations into its business strategy include the setting of a non-financial target for emission reduction of financed emissions, the development of central sustainability policies, setting up a central sustainability risk framework and introducing sustainable central value chain and contract management. These cascade through to the decentralised targets, policies, operational processes, risk management frameworks, and value chain and contract management of the various product lines.

Climate-related considerations are integrated into the organisation’s SAA, which includes various climate scenarios and safeguards a.s.r.’s financial performance. See section 6.2.1.1 for further information. The SAA cascades through to a.s.r.’s reinsurance schemes and investment and pricing policies of the various product lines.

Please see section 6.1.3.1 for more information on the role of the administrative, management and supervisory bodies with regard to the transition plan for climate change mitigation.

a.s.r. has already made progress on implementing its transition plan for climate change mitigation across the organisation. See section 6.2.1.4 for further information on already achieved emission reductions, how the progress of the emission reduction targets is monitored and reviewed and whether progress is in line with the initial planning.

a.s.r. has also published a more comprehensive Climate Transition Plan on its website.

6.2.1.3Policies and actions

Policies

Policies related to climate change mitigation and adaptation

a.s.r. has several policies in place to manage its material impacts, risks and opportunities related to climate change mitigation and adaptation:

The Environmental Policy Statement of Facilities;

The Policy on Responsible Investments;

The ESG Policy of Real Estate;

The Mortgages Transition Plan;

The Policy on Sustainable Insurance;

The Procurement Policy of Health.

The Environmental Policy Statement of Facilities 2.2

The general objective of the Environmental Policy Statement of Facilities is for a.s.r. to maintain its own environmental performance at a socially responsible level. The policy’s key content is a framework set up to reduce a.s.r.’s scope 1 and 2 emissions as well as a.s.r.'s scope 3 emissions related to its own operations.

The scope of the Environmental Policy Statement is the activities conducted in connection with a.s.r.'s office locations. The policy covers direct emissions from owned or controlled sources, indirect emissions from the generation of purchased electricity and indirect emissions that occur from business travel, employee commuting and waste.

The Environmental Policy Statement mainly addresses climate change mitigation. This is supported by actions aimed at improving a.s.r.’s environmental performance. Additionally, energy efficiency is a core aspect that the policy addresses. a.s.r. has committed to improving the energy performance of its head office, aiming to meet the Paris Proof standard by 2030. This includes reducing energy consumption for heating, cooling and ventilation to a maximum of 50 kWh per gross square metre in line with and even exceeding the Paris Proof standard. Furthermore, the policy supports the use of renewable energy wherever possible, for example by stimulating the use of the solar panels placed on and around a.s.r.'s head office.

Procurement 2.12.2

Procurement does not yet have a dedicated environmental procurement policy but it has included ESG criteria in its 'Further agreement', its Code of Conduct for Suppliers, and in its outsourcing policy.

IT 2.2

IT currently has no formal policy concerning climate change. However, IT's management team has a clear understanding of how decisions on power purchase and consumption impact a.s.r.'s carbon footprint. There is a clear ambition to incorporate climate change into IT's procurement policy in 2025.

Distribution and services entities 2.2

The distribution and services entities do not yet have environmental policies; some of them are currently in the process of developing one, where possible in line with the Environmental Policy Statement of Facilities.

The Policy on Responsible Investments 2.12.22.4

The Policy on Responsible Investments of Asset Management sets out a framework for integrating ESG factors into all investment decisions. A key focus of the policy is on mitigating climate-related risks and supporting the transition to a low-carbon economy. The policy outlines clear criteria for excluding investments in sectors and companies that conflict with the goals of the Paris Agreement, such as those involved in coal mining or unconventional oil and gas. The policy also includes requirements for active ownership: where a.s.r. engages with companies to encourage better climate practices, and impact investing: where a.s.r. finances sectors and projects that directly contribute to the energy transition.

The Policy on Responsible Investments applies to all assets managed by Asset Management. This includes proprietary assets of a.s.r., investment mandates managed on behalf of clients, and funds created and offered by Asset Management.

The Policy on Responsible Investments is guided by the goals of reducing harm, driving change and creating positive impact. In order to address climate change mitigation, the policy contains exclusion rules that aim to avoid investing in activities with an outsized impact on climate change or that are incompatible with the low-carbon future needed to achieve the goals of the Paris Agreement. Asset Management focuses on engaging with companies to develop climate strategies and transition plans that align their businesses with the Paris Agreement. Additionally, Asset Management supports the energy transition through investments in renewable energy and low-carbon technologies via impact investments.

The ESG Policy of Real Estate 1.11.22.12.22.3

The ESG Policy of Real Estate has the following strategic themes: Reduce energy intensity & GHG emissions; Adapt to climate change & related risks; Regenerate biodiversity & ecosystems; and Improve well being & social equality. The scope of the ESG Policy of Real Estate is all assets under management.

The ESG Policy of Real Estate addresses climate change mitigation as it sets out a framework to acquire low-carbon assets. The policy also addresses climate change adaptation and energy efficiency by setting up rules for renovating standing investments. Additionally, it addresses renewable energy by setting out a framework to acquire renewable energy projects such as windmill parks.

The Mortgages Transition Plan 1.11.22.12.22.4

The Mortgages Transition Plan sets out a framework to reduce negative impact on climate change and mitigate climate-related physical and transition risks in the portfolio. The scope of the Mortgages transition plan is Mortgages' scope 3 financed emissions (limited to scope 1 and 2 emissions of the property financed by the mortgage).

The Mortgages Transition Plan addresses climate change mitigation and energy efficiency by setting up a framework for more accessible and less costly mortgage lending to make homes more sustainable and energy efficient. Additionally, the Mortgages Transition Plan supports climate change adaptation by facilitating participation in partnerships to increase awareness and knowledge surrounding this theme.

The Policy on Sustainable Insurance 1.11.21.32.12.22.32.4

P&C makes use of the Policy on Sustainable Insurance. An objective of the policy is to reduce negative impact on climate change, manage climate-related physical and transition risks and seize climate-related opportunities. The Policy on Sustainable Insurance contains rules on sustainable underwriting, the policy has a key focus on insuring the energy transition and the policy sets out frameworks for sustainable product development and sustainable claims adjustment. The scope of the Policy on Sustainable Insurance is Non-life and Life insurance products and services. The most relevant parts for P&C are highlighted below.

In order to manage its impact on climate change and with regards to object related insurance only, the Policy on Sustainable Insurance contains a set of exclusion rules that aim to avoid insuring companies with an outsized impact on climate change, such as producers of thermal coal and unconventional gas and oil. Producers of conventional energy products are required to commit to the Paris Agreement target and to have a transition plan. For other companies with a substantial volume operating in the chain of the fossil fuel industry or in a sensitive sector, an ESG risk assessment needs to be carried out. Furthermore, the Policy on Sustainable Insurance addresses climate-related physical and transition risks and seizing climate-related opportunities by setting out a framework for sustainable product development.

To support the energy transition to renewable energy, the Policy on Sustainable Insurance addresses insuring companies in the renewable energy sector through the P&C's Sustainability Desk. It addresses climate change mitigation by setting out a framework for sustainable claims adjustment with a focus on repair instead of replace of damaged items by certified sustainable repair network companies. Certification entails limitations on GHG emissions during the repair process. Climate adaptation is also part of the Policy on Sustainable Insurance as it sets out a framework for sustainable product development.

The Procurement Policy of Health 2.2

Agreements from the joint policy in the healthcare sector which follows the GDDZ 3.0 have been translated into the Procurement Policy of Health. Consequently, the policy objectives of the Procurement Policy of Health are:

Making healthcare real estate more sustainable;

Working towards sustainable mobility;

Discovering and tackling other GHG hotspots.

The Procurement Policy of Health addresses climate change mitigation by aiming to make healthcare real estate more sustainable, working towards sustainable mobility and discovering and tackling other GHG hotspots in the healthcare sector. Third-party standards that Health commits to respect through the implementation of the Procurement Policy of Health are the GDDZ 3.0.

Consideration is given to the interests of key stakeholders when setting the Procurement Policy of Health in alignment with the GDDZ 3.0 through reducing administrative burdens for healthcare providers. The current Procurement Policy has been published on 1 April 2024 and has been discussed during meetings with healthcare providers.

Funeral

Due to the type of insurance (largely capital insurance) and the lack of insight into how the insurance compensation is spent, it is difficult for Funeral to determine which frameworks and rules it can introduce to effectively address its impact on climate change. Funeral is committed to being able to draw up a policy that provides a framework or set of rules to prevent or limit negative impact.

Information that applies to all the entities and product lines which have policies in place

The management teams of the relevant product lines are accountable for the implementation of the various policies, including the monitoring of the effectiveness of the policy. Through the implementation of the various policies, a.s.r. commits to respect the Climate Commitment for the Dutch financial sector.

Actions

Actions in relation to climate change policies

a.s.r. has taken various key actions to manage its climate related impacts, risks and opportunities and, where applicable, achieve its policy objectives.

Key actions of Facilities 2.2

In collaboration with HR, Facilities has determined a set of key actions aimed at reducing its negative impact, in line with the Environmental Policy Statement. The key actions presented by outcome and in case of a climate mitigation action the decarbonisation lever, are:

Increase energy efficiency of a.s.r.'s office locations by optimising the use of office locations and space and implementing measures to reduce energy usage;

Increase the use of renewable energy at a.s.r.'s office locations by using renewable energy from its own solar panels and purchasing market-based green electricity;

Reduce GHG emissions by company vehicle mobility through electrification of the lease car fleet (decarbonisation lever: electrification of transportation reduces emissions);

Reduce GHG emissions of employee commuting by promoting eco-friendly transportation options by offering an NS-Business Card and a tax benefit for new bicycles used for commuting as well as promoting hybrid working by optimising hybrid working systems and an envisaged 0.4 workstation per FTE at a.s.r.'s head office (decarbonisation lever: low/no carbon/no transportation reduces emissions).

The scope of these key actions is direct emissions from owned or controlled sources, indirect emissions from the generation of purchased electricity and indirect emissions that occur from business travel, employee commuting and waste generated in own operations.

Facilities with the co-operation of HR implements its key actions on an ongoing basis. The reduction of carbon emissions of company vehicle mobility runs until 2028 when a.s.r.'s entire lease car fleet is expected to be fully electric.

The key climate mitigation actions of Facilities have already led to concrete results, such as a reduction in emissions of a.s.r.'s head office and vehicle fleet. In 2024, Facilities reduced its own operations GHG emissions in scope of its emission reduction target by 37% compared to the base year 2023. The expected emission reduction will continue to increase as these initiatives are further implemented.

Procurement 2.12.2

Procurement has not yet initiated key actions as they plan to adopt these after they have set up a dedicated environmental procurement policy.

Key actions of IT 2.2

IT has adopted a set of actions to reduce its negative impact on climate change. The key actions presented by outcome and in case of a climate mitigation action the decarbonisation lever, are:

Increase energy efficiency by purchasing modern data centre hardware with a lower carbon footprint;

Increase the use of renewable energy by using green energy for the data centres.

Reduce carbon emissions by longer use of current employee hardware where possible, leading to less carbon emissions in connection to replacements of employee hardware (decarbonisation lever: extend lifetime instead of replace hardware reduces emissions).

These key actions concern the data centre hardware in Utrecht and Woerden and the end-user hardware for all a.s.r. employees. The actions are continuously carried out by IT, as there will always be changes in a.s.r.’s data centre composition and workforce composition, which require the organisation to fulfil the need to continue business as requested.

IT has already delivered concrete results in relation to its climate mitigation actions: GHG emissions of the energy consumption at the Utrecht data centre were zero in 2024 following a transition to green energy consumption. It is expected that the GHG emissions of the energy consumption at the Woerden data centre will also be reduced to zero in due course.

Key actions of distribution and services entities 2.2

The distribution and services entities have not yet initiated any key actions, as their environmental policies are still under development, and actions related to these policies will be implemented thereafter, with the exception of Corins, which has nevertheless adopted a set of key actions aimed at reducing its negative impact in line with a.s.r.'s Environmental Policy Statement.

Key actions of Asset Management 2.12.22.4

Asset Management has adopted a set of actions to manage and mitigate the material impacts, risks and opportunities related to climate change. These actions are integral to the Policy on Responsible Investments and align with the organisation’s commitment to supporting the transition to a low-carbon economy. Key actions by outcome and in case of a climate mitigation action the decarbonisation lever, include:

Manage risks by investment criteria: Asset Management, for example, excludes investments in sectors and activities that are incompatible with achieving the goals of the Paris Agreement, such as thermal coal production and coal-fired power generation. The exclusion rules and criteria are regularly reviewed and may be tightened where deemed necessary.

Mitigate impact and manage risks by active ownership: Asset Management actively engages with companies within its investment portfolios to encourage the development and implementation of robust climate strategies and transition plans. Asset Management collaborates with like-minded peers to strengthen its engagement efforts and increase its influence with investee companies (decarbonisation lever: engagement leads to investees developing and implementing transition plans).

Support the transition to a low-carbon economy by impact investing: Asset Management supports the transition to a low-carbon economy by making impact investments in renewable energy and other low-carbon technologies. These investments aim to contribute positively to global climate mitigation efforts.

Support the transition to a low-carbon economy by industry participation and collaboration: Asset Management aims to stimulate positive change in the financial sector through active participation in industry bodies and collaborations focused on climate action. For example, a.s.r. is a member of initiatives such as the Dutch Climate Coalition and the Net Zero Asset Managers initiative (NZAM), where it works alongside other investors to promote policies and practices that support the transition to a net-zero economy. The scope of the exclusions and impact investing actions is a.s.r.'s own account investments, and investments on behalf of policyholders and third-party clients. Engagement activities primarily focus on investments in corporate bonds and equities. The scope of industry participation and collaboration actions is mainly within the financial sector and at research centres in universities.

Asset Management implements its climate-related actions on an ongoing basis. A number of specific climate-related actions are expected to be completed by the end of 2027. These include the completion of initial phase three engagements of the fossil fuel exit strategy, where Asset Management will engage with at least 15 companies on the demand side for fossil fuels from the manufacturing, mining, and utilities sectors to understand the sector-specific risks and opportunities posed by climate change, and to request the creation of robust transition plans.

Since 2021, Asset Management has been engaging with companies involved in the production of traditional oil and gas to establish whether they are aligned with the Paris Agreement. In line with its fossil fuel exit strategy, Asset Management completed its engagements with these companies before the end of 2024. In 2024, Asset Management also took the decision to exclude traditional oil and gas producers that do not meet its requirements for alignment with the Paris Agreement and started the process to phase out its remaining positions in these companies.

In relation to its key climate mitigation actions, Asset Management reduced its financed GHG emissions in scope of the emission reduction target by 9% in 2024 compared to the base year 2023. With regards to expected GHG reduction emissions in the real economy: Asset Management's financed emissions arise from the real-world activities of the companies and countries in which it invests. Reductions in financed emissions (i.e. GHG emissions reductions) depend primarily on external factors, such as government policy, technological advancements, and shifts in consumer behaviour. Asset Management contributes to the net-zero transition through active ownership (e.g., engaging with investee companies to create and implement robust transition plans) and impact investing (e.g. funding renewable energy projects and low-carbon technologies). These actions aim to stimulate real-world decarbonisation and support alignment with net-zero. However, the reduction of emissions in the real economy remains the primary driver of expected GHG emissions reductions and achievement of the carbon reduction target.

Key actions of Real Estate 1.11.22.12.2

Real Estate manages its climate-related impact, risks and opportunities by taking the following key actions presented by outcome and in case of a climate mitigation action the decarbonisation lever.

Real Estate property

Support climate change mitigation in existing and new real estate assets: Real Estate aims to reduce the energy usage of individual assets by executing asset-level reduction plans. A Paris Proof roadmap using the Carbon Risk Real Estate Monitor (CRREM) pathways is in place for each Real Estate fund and the own account assets. The Paris Proof roadmap is based on the current energy intensity and reduction measures at the level of individual assets to reach net-zero in 2045. In addition, Real Estate focuses on acquiring or developing new properties with lower carbon footprints (decarbonisation lever: less energy usage of property reduces emissions) and office buildings located near public transport hubs (decarbonisation lever: impact investing in locations near public transport hubs reduces car trips and promotes sustainable travel),

Advance climate change adaptation in existing and new real estate assets: Real Estate strives to build a portfolio that is progressively adapted to long-term climate-related hazards by both understanding and anticipating the long-term effects of climate change. For the assets that are exposed to high long-term physical climate risks, an assessment of adaptation solutions that could reduce the impact of the identified physical climate risks is carried out and the results are used to draw up a high-level adaptation plan, which aims to ensure these assets are resilient to climate.

Increase energy efficiency: Real Estate engages with tenants to agree on making the leased asset more sustainable. Green leases are added to new and existing contracts, whereby tenant and landlord enter into a partnership for joint energy-reducing efforts, with the aim of bringing and keeping the energy-intensity in line with the CRREM pathway and to reach net-zero in 2045.

Support renewable energy deployment: Real Estate aims to implement renewable energy solutions within its Real Estate portfolio. PV panels are the most suitable solution for buildings and are installed when feasible. Real Estate also procures 100% renewable energy from the Netherlands for the areas controlled by the landlord and encourages tenants to do so as well.

Farmland and Rural estates

Support climate change mitigation through green leases and reduction measures by farmers: Real Estate promotes sustainable agricultural practices through green leases. By 2025, a.s.r. aims for 100% of new and at least 30% of existing ground lease agreements to be green leases. These leases incentivise farmers with annual reductions in lease payments (10% over the first three years and 5% thereafter) for meeting sustainable farming criteria. Real Estate also engages with farmers. The objective is to facilitate at least 15 farmers with emission reduction plans by 2025. This initiative involves collaborating with farmers to develop tailor-made solutions that reduce emissions and improve soil health. In 2024, The Fund began projects with 10 farmers, guided by advisors, stewards, and science experts, to create customized emission reduction plans. The Fund covers the cost of creating these plans and works jointly with farmers to seek funding for implementing necessary measures. Furthermore, a.s.r. engages farmers through events, client panels, and newsletters to share insights and successful strategies. a.s.r. aims to set a knowledge-sharing hub for tenants by 2027 (decarbonisation lever: price incentives and engagement leads to farmers developing and implementing transition plans).

Advance climate change adaptation in existing and new farmland assets: Real Estate strives to build a portfolio that is progressively adapted to long-term climate-related hazards by both understanding and anticipating the long-term effects of climate change. Real Estate conducted a comprehensive climate risk assessment for all plots in its portfolio. This assessment helped to gain insight into the climate effects relevant to various landscape types and identify opportunities to enhance climate resilience. Based on the assessment, Real Estate identified vulnerabilities to climate-related impacts, including thirteen climate risks divided into three main categories: water, drought and salinisation. And Real Estate identified adaptation solutions to mitigate the identified climate risks and aims to assess and integrate these climate adaptation solutions into its acquisition, investment and disposition strategies. In addition, Real Estate aims for at least 2% of the farmland portfolio's hectares to be dedicated to climate-positive crops, which include leguminous and biobased building varieties, in 2025. The cultivation of these crops is considered an adaptation solution and offers a sustainable alternative to traditional agricultural practices.

Renewable energy

Support the energy transition: Real Estate does (impact) investments in renewable energy deployments such as wind and solar farms.

The scope of first four key actions is the a.s.r. urban real estate property under management of a.s.r. Real Estate. The scope of the second two key actions relates to Real Estate's farmland property and rural estate portfolio. The last key action relates to Real Estate's renewable energy property. The time horizon to complete these actions is, unless described otherwise in the above, 2045.

Real Estate's key climate mitigation actions have already delivered concrete results. The investments in wind and solar farms currently include four wind farms and one solar farm. Together they generate an amount of power comparable to the annual consumption of 231,000 households. The real estate funds' emissions however remained the same (0% emission reduction) in 2024 compared to the base year 2023. In the coming years, the funds will continue to execute asset-level reduction strategies and further refine the Paris Proof roadmap with annual consumption data, lessons learned and evolving insights on an annual basis, which are expected to lead to alignment with the Paris Agreement targets in 2045 at the latest.

Key actions of Mortgages 1.11.22.12.22.4

Mortgages has adopted a set of key actions towards customers and advisors to stimulate them to make the transition to a net-zero home. The key actions presented by outcome and in case of a climate mitigation action the decarbonisation lever are:

Reduce GHG emissions and manage risks by offering specific products for making homes more sustainable, such as the Verduurzamingshypotheek which provides the opportunity to borrow up to 65,000 euros which can only be used to finance sustainable home improvements at a reduced tariff compared to the standard mortgage product (decarbonisation lever: financial (impact) incentive leads to making homes more sustainable and reducing emissions).

Reduce GHG emissions and manage risks by making it more accessible for customers to borrow up to € 10,000 additionally for making their houses more sustainable through an opt-in on the mortgage offer (decarbonisation lever: accessibility of additional (impact) finance incentivises making homes more sustainable and reducing emissions).

Support the energy transition by setting up the sustainable living platform: on this platform, a.s.r. mortgages helps consumers by sharing other people's experiences and practical advice about sustainable living, such as insulating homes, saving on energy use and how to make a house more climate-resistant.

Support the energy transition by setting up a partner network for helping customers to realise sustainable home improvements.

Advance climate change adaptative thinking by increasing knowledge and awareness on climate adaptiveness of residential homes through engagement in partnerships.

The scope of these key actions is emissions of private individuals who take out a mortgage for their homes. Time horizons for the actions to complete is 2050 when a Paris Agreement aligned mortgages portfolio is expected to be achieved.

Mortgages has already delivered concrete results in relation to its key climate mitigation actions: in 2024, Mortgages reduced its GHG emissions by 5% compared to the base year 2023 (please note that this outcome is based on the old CBS lookup tables from PCAF as the new CBS lookup tables were not yet available at the moment of calculating the figures). In the coming years, Mortgages will continue to stimulate and help homeowners to make their homes more sustainable. The organisation has made a reduction pathway but is still dependant on the actions homeowners, advisors, funders, the government and other parties in the mortgage chain to achieve its goals. Mortgages will continue to stimulate and encourage them.

Key actions of P&C 1.11.21.32.12.22.32.4

P&C has initiated various actions to manage its climate-related impacts, risks and opportunities. Key actions of P&C by outcome and in case of a climate mitigation action the decarbonisation lever type are:

Reduce carbon emissions and manage risks: in the underwriting process, P&C excludes producers of thermal coal and unconventional oil and gas, requires other producers in the fossil fuel sector to commit to the Paris Agreement and to have transition plans, and performs ESG risk assessments on other parties with substantial volume in the fossil fuel industry or in sensitive sectors (decarbonisation lever: underwriting criteria incentivise companies to develop and implement energy transition plans).

Support the energy transition by making renewable energy initiatives insurable through the sustainability desk.

Support climate adaptation and energy transition by sustainable product development which incentivises prevention measures and renewable energy alternatives.

Support the energy transition by setting up the sustainable living platform: P&C helps consumers by sharing other people's experiences and practical advice about sustainable living, such as insulating homes and saving on energy use and how to make a house more climate-adapted, on this platform.

Support the energy transition by setting up the sustainable mobility webpage: P&C provides advice on eco-friendly transport with lower GHG emissions on this webpage.

Reduce carbon emissions by sending out information in customer communications: in welcome messages to new customers, a.s.r. provides information on the importance of emissions reduction (decarbonisation lever: engagement creates knowledge and awareness amongst customers about the possibilities to reduce emissions).

Support energy efficiency by setting up the sustainable business webpage: P&C helps entrepreneurs by sharing other entrepreneurs' experiences and practical advice about sustainable entrepreneurship, such as how to save energy at the workplace on this webpage.

Reduce GHG emissions by setting up a collaboration with Klimaatroute: P&C works with this organisation, which carries out energy scans on business customers at reduced rates and prepares a report on possible actions the customer can take to reduce GHG emissions within the company. If the business customers so wish, Klimaatroute can also help obtain quotes, subsidies and permits (decarbonisation lever: the information and support by Klimaatroute leads to more knowledge and removes barriers amongst business customers in relation to reducing emissions).

Reduce GHG emissions by referring customers with damaged items which can be repaired by repairers that meet the stringent requirements of sustainable GroenGedaan! and Erkend Duurzaam certifications (decarbonisation lever: extending lifetime instead of replacing (decarbonisation lever: accessibility of additional finance incentivises making homes more sustainable and reducing emissions) items reduces emissions).

The scope of the actions regarding underwriting criteria and the sustainability desk are commercial customers wishing to purchase object related insurance. The scope of P&C's key actions related to the platform and webpages is the general public, the welcome letter action applies to P&C customers in general, where the collaboration with Klimaatroute focuses on commercial P&C customers specifically. The scope of the actions regarding referring to repairers is claims adjustment of damaged items insured on car and property insurance.

The execution of sustainable underwriting criteria and the sustainability desk will probably need to continue until 2050, new content is placed on the platforms and in the welcome messages regularly throughout the year, with time horizons of 2050 as well. The collaboration with Klimaatroute is set up until 2030. Product development and referral to certified repairers is ongoing.

With regards to its climate mitigation actions, P&C has reduced its insurance associated emissions in scope of its emission reduction target by 3% in 2024 compared to the base year 2022. With regards to emission reductions in the real economy: P&C expects that its product development, engagement and claims adjustment actions have supported the energy transition, energy efficiency and carbon reduction of consumers and entrepreneurs. However, it is unclear by how much emissions in the real economy have been reduced specifically through these actions. In the coming years, P&C will continue these actions and expects that these will keep encouraging consumers and entrepreneurs to reduce their GHG emissions.

Key actions of Health 2.2

Joint actions that follow from the Green Deal Duurzame Zorg (GDDZ) 3.0 to mitigate negative impacts on climate change - presented by outcome and in case of a climate mitigation action the decarbonisation lever, are:

Reduce GHG emissions by stimulating healthcare providers via healthcare purchasing policy to reduce their GHG emissions in a uniform manner (decarbonisation lever: emission reduction incentives in purchasing policy lead to less emissions).

Reduce GHG emissions by asking healthcare providers with more than 100 employees for a mobility plan to reduce GHG emissions and requesting health insurers to include GHG emissions when contracting patient transport (decarbonisation lever: requests to make plans for no/low carbon transportation leads to less emissions).

Reduce GHG emissions by designing a framework for action for future-proof healthcare real estate (decarbonisation lever: designing actions for future proof healthcare buildings leads to less emissions).

Reduce GHG emissions by stimulating and supporting the preparation and implementation of GHG emission reduction roadmaps by larger healthcare providers (decarbonisation lever: engagement and support incentivises healthcare providers to develop and implement GHG emission reduction roadmaps lead to less emissions).

Support the energy transition by providing sustainability training for healthcare purchasers, with the aim of having purchasers discuss sustainability with healthcare providers.

In scope are contracted healthcare providers. Time horizon for the completion of the GDDZ 3.0 is 2026 when a revision will take place. There are no data available yet on the achieved and expected GHG emissions related to the climate mitigation actions.

Key actions of Funeral 2.2

Funeral has set various actions to manage its impact. The key actions presented by outcome and in case of a climate mitigation action, the decarbonisation lever, are:

Reduce GHG emissions by sustainable product development and by contributing positively to making its network of funeral undertakers more sustainable (decarbonisation lever: product development and engagement incentivises reducing emissions).

Support energy transition by engaging with its customers to make sustainable choices.

Reduce GHG emissions by developing an industry-wide calculation methodology and definition with sector colleagues to provide insight into GHG emissions of funeral insurance (decarbonisation lever: knowledge of GHG emissions drives emission reduction).

Scope of these actions is Funeral's network and customers with a.s.r. funeral insurance policies. Time horizons for completion of Funeral's key actions is 2050 at the latest.

Due to the lack of methodology and definition to measure GHG emissions of funeral insurance, there are no data available yet on the achieved GHG emission reductions related to the climate mitigation actions. The development of a methodology and a definition is expected to start in 2025 so there is no insight yet, on the expected GHG emission reductions either.

Resources in relation to climate change policies

In some cases, the implementation of an action plan may depend on the availability and allocation of resources, which require significant operational expenditures (OpEx) and/or capital expenditures (CapEx). These are stated in the table below and are primarily related to the implementation of the various key actions of Facilities, Mortgages and Asset Management.

| | Unit of measure | 2024 |

|---|---|---|

| Current operational expenditure allocated to action plan | in € million | 5 |

| Future operational expenditure allocated to action plan | in € million | 18 |

| Total operational expenditure | in € million | 23 |

| | | |

| Current capital expenditure allocated to action plan | in € million | 2 |

| Future capital expenditure allocated to action plan | in € million | 0 |

| Total capital expenditure | in € million | 2 |

Operational expenditures

The implementation of the above key actions has led to significant additional operational expenditures for various entities and product lines this year and in the coming years, as is set out in the above table.

For Facilities, this mainly concerns supplier costs related to reducing energy usage, closing some office locations (The Hague in 2025 and Leeuwarden around 2027), promoting eco-friendly transportation options for employees and hybrid working. For Mortgages, this concerns several ESG projects aimed at customers and advisors to encourage them to transition to a net-zero home, including energy-efficient mortgages. The above table also includes the operational expenses related to the implementation of the action plans at Asset Management to manage and mitigate the material impacts, risks, and opportunities related to climate change.

For Real Estate, operational expenditures are made by the Real Estate funds, not by a.s.r. as an investor or by Real Estate as a fund manager. Therefore, these are not included in the above table. The funds focus on reducing energy consumption through asset-level execution plans and increasing on-site renewable energy. As a fund manager, Real Estate encourages, advises, and supports the funds in achieving the Paris Agreement goals.

Operational expenses for the other entities and product lines do not exceed the materiality threshold per action plan of € 1 million yet and are therefore not considered significant expenditures.

The aforementioned operational expenditures are classified in the financial statements as insurance service operating expenses and are part of the insurance service result.

Capital expenditures

The expenses related to the implementation of the various action plans are normally not capitalised on the balance sheet but are directly written off as an expense in the results. An exception to this is the investment of Facilities to make the lighting in the a.s.r. headquarters more sustainable. These are reflected in the table above as current capital expenditures allocated to action plan.

Not all entities and product lines were able to determine their exact operational costs and capital expenses in relation to their action plans yet. Also, action planning is a continuous process, so additional CapEx and OpEx may be necessary to carry out further action plans.

See section 6.5.3.1 for CSRD reporting policies.

6.2.1.4Targets and metrics

Targets

Targets related to climate change mitigation and adaptation 2.2

Facilities, Asset Management, Real Estate, Mortgages and P&C have set targets related to climate change mitigation and adaptation to track the effectiveness of their actions to address their climate-related impacts, risks and opportunities and to meet their policy objectives. Health supports the joint target resulting from the GDDZ 3.0.

Procurement, IT, distribution and services entities and Funeral have not yet determined targets, as they are still in the process of developing policies. Targets will be set once policies are finalised. These entities and product lines are currently not tracking the effectiveness of any policies or actions in relation to material sustainability-related impacts, risks and opportunities, as there are no policies or actions yet, except for the actions of Corins to reduce carbon emissions of which effectiveness is also not tracked yet.

Impact investment target - investments (Asset Management, Real Estate and Mortgages) 2.12.4

A key focus of the Policy on Responsible Investments of Asset Management is supporting the energy transition by creating a positive impact through investments. One of the strategic themes of the ESG Policy of Real Estate is to reduce GHG emissions through impact investments in renewable energy. The Mortgages Transition Plan sets out a framework to reduce negative impact on climate change by financial (impact) incentives. Setting an impact investment target for investments helps to track the effectiveness and progress of the impact investing actions taken to achieve these policy objectives.

Although the impact investment target mainly relates to impact investing actions taken to support the energy transition, impact investments can also be made with the intention to generate social and biodiversity impact.

The target level to be achieved is 10% of the assets under management, in 2027. In scope are a.s.r. own account investments and internally managed affiliated assets. Out of scope are externally managed affiliated assets and internally and externally managed investments on behalf of third-party clients.

The period to which the target applies is three years (until 2027). Regarding the methodologies used and significant assumptions made, impact investing is defined as an investment approach that seeks to generate positive, measurable social and environmental impact alongside financial returns, in line with the Global Impact Investing Network (GIIN). The impact investing selection criteria are detailed in the various policies. The impact investment target is not based on conclusive scientific evidence. No stakeholders were involved in the target setting.

No changes have been made yet to the current target and corresponding metrics. The current impact investment target for a.s.r., including Aegon NL, was defined after having set the previous impact investment target to a nominal amount of € 4.5 billion for a.s.r. standalone in 2024. In 2024, impact investments amounted to 8.7% of the portfolio in scope, which is in line with what has been initially planned. In regard to how the progress is monitored and reviewed and to the metrics used, the product lines calculate the total euro amount related to impact investments as a percentage of the total euro amount related to assets under management in scope in the reporting year at year-end.

| Relationship to policy objectives | A key focus of the Policy on Responsible Investments of Asset Management is supporting the energy transition by creating a positive impact through investments. One of the strategic themes of the ESG Policy of Real Estate is to reduce GHG emissions through impact investments in renewable energy. The Mortgages Transition Plan sets out a framework to reduce negative impact on climate change by financial (impact) incentives. Setting an impact investment target for investments helps to track the effectiveness and progress of the impact investments to achieve these policy objectives. |

| IRO's addressed by the target | 2.12.4 |

| Scope of the target | In scope are a.s.r. own account investments and internally managed affiliated assets. Out of scope are externally managed affiliated assets and internally and externally managed investments on behalf of third-party clients. |

| Methodologies and significant assumptions | Impact investing is defined as an investment approach that seeks to generate positive, measurable social and environmental impact alongside financial returns, in line with the Global Impact Investing Network (GIIN). |

| Scientific basis | The impact investment target is not based on conclusive scientific evidence. |

| Stakeholder involvement | No stakeholders were involved in the target setting. |

| Changes in targets and metrics | No changes have been made yet to the current target and corresponding metrics. The current impact investment target for a.s.r., including Aegon NL, was defined after having set the previous impact investment target to a nominal amount of € 4.5 billion for a.s.r. standalone in 2024. The scope of the current target is covers a.s.r. own account investments and internally managed affiliated assets. In addition, different corresponding metrics are used in that, compared to the Non-Financial Target (NFT) figures as communicated in the 2023 Annual Report, the current target is measured in percentage instead of euro. |

| Performance against targets | In 2024, impact investments amounted to 8.7% of the portfolio in scope which is in line with what has been initially planned. In regard to how the progress is monitored and reviewed and to the metrics used, the product lines calculate the total euro amount related to impact investments as a percentage of the total euro amount related to assets under management in scope in the reporting year at year-end. |

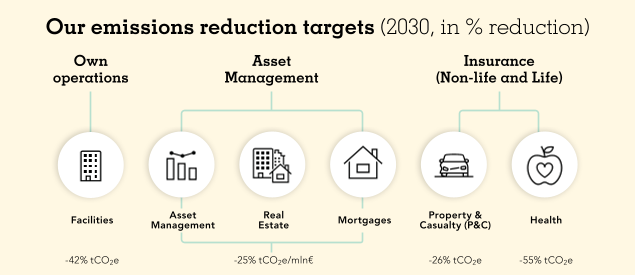

Emission reduction targets

Emission reduction targets of the product lines and entities that have set these to support their policies and to address their climate-related impacts, risks and opportunities, have been consolidated to group level emission reduction targets in the categories own operations, financed emissions and insurance-associated emissions. Due to differences in scope between E1-4 targets and E1-6 metrics, the 2024 emissions as disclosed for the E1-4 targets below differ from the emissions as disclosed in E1-6. See below and section 6.5.3.2 for CSRD reporting policies for further information.

| | Unit of measure | Base year | Baseline value | 2024 | 2024 reduction in %1 | Target 2030 reduction in %1 |

|---|---|---|---|---|---|---|

| Own operations (scope 1 + 2)2 | in tCO2e | 2023 | 2,246 | 1,424 | 37% | 42% |

| | | | | | | |

| Financed emissions (scope 3) | in tCO2e / € 1 million | 2023 | 41 | 39 | 5% | 25% |

| Equity | in tCO2e / € 1 million | 2023 | 38 | 33 | 15% | |

| Government bonds | in tCO2e / € 1 million | 2023 | 196 | 187 | 5% | |

| Corporate bonds | in tCO2e / € 1 million | 2023 | 40 | 36 | 10% | |

| Mortgages | in tCO2e / € 1 million | 2023 | 10 | 10 | 5% | |

| Real Estate | in tCO2e / € 1 million | 2023 | 123 | 123 | 0% | |

| | | | | | | |

| Insurance-associated emissions (scope 3) | | | | | | |

| Personal lines (Personal car) and Commercial lines | in tCO2e | 2022 | 138,739 | 135,113 | 3% | 26% |

- 1 % reduction compared to base year.

- 2 Market-based approach included in scope 2.

Emission reduction target - own operations (Facilities) 2.2

The general objective of the Environmental Policy Statement of Facilities is for a.s.r. to maintain its own environmental performance at a socially responsible level. Setting an emission reduction target for own operations GHG emissions helps to track the effectiveness and progress of the climate mitigation actions taken to achieve this policy objective.

The target level to be achieved is a 42% reduction compared to the own operations GHG emissions in the base year. In scope are scope 1 and 2 GHG emissions of a.s.r.'s own buildings in Utrecht, Rotterdam, Enschede, Heerlen, Den Haag and Leeuwarden. Out of scope are the entities Corins, D&S Holding, Knab, Robidus and TKP and scope 3 emissions related to own operations such as GHG emissions of employee commuting.

The base year is 2023 and the baseline value is 2,246 tCO2e. The base year was chosen in line with SBTi's best practice to choose the most recent reporting year for which data are available as a base year. The baseline value in 2023 is considered representative because it covers a.s.r.'s most relevant own operations GHG emissions and minimised external factors such as COVID-19. The period to which the target applies is 2030.