The EB is the statutory board in accordance with Dutch corporate law and as described in the articles of association. The EB is collectively responsible for the day-to-day conduct of business at a.s.r. and for its strategy, structure and performance. In carrying out its duties, the EB is guided by a.s.r.’s interests, which include the interests of the businesses connected with it, which in turn include the interests of customers, employees, investors and society. The EB is accountable to the SB and the AGM regarding the performance of its duties.

Certain resolutions made by the EB require the approval of the SB and/or the AGM. These resolutions are outlined in the articles of association and the rules of procedure of the EB and Management Board (MB). Both documents can be viewed at www.asrnl.com.

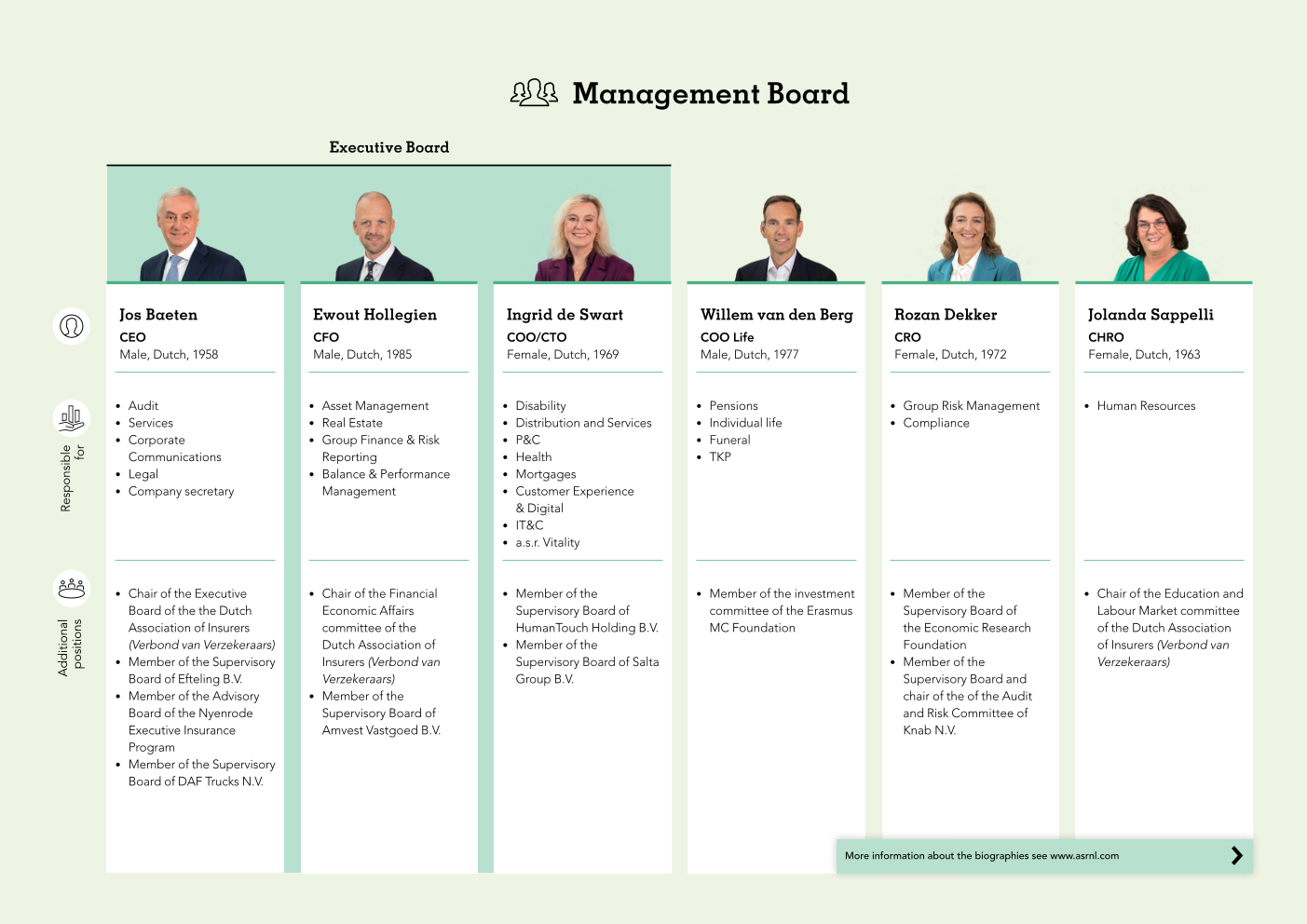

Composition of the Executive Board

The articles of association specify that the EB must consist of a minimum of two members, including at least a Chief Executive Officer (CEO) and a Chief Financial Officer (CFO). Only candidates found to meet the fit and proper test under the Dutch Financial Supervision Act are eligible for appointment. In accordance with Article 2.2 of the Rules of Procedure of the EB and MB and Article 7.1 of the Rules of Procedure of the SB, the SB appoints the members of the EB and may suspend or dismiss an EB member at any time. In case a.s.r.’s current CEO, due to his earlier resignation or dismissal, does not serve his full term until the 2026 AGM, the appointment of the successor will require a unanimous vote of the SB (Schedule 8, part 2, Relationship Agreement). The SB notifies the AGM of proposed (re)appointments. During 2024, the composition of the EB remained unchanged, consisting of the following three members:

Jos Baeten, CEO;

Ewout Hollegien, CFO;

Ingrid de Swart, COO/CTO.

| Name | Years on Board | Date of initial appointment | Date of reappointment | Appointed until | Years of experience in insurance industry |

|---|---|---|---|---|---|

| Jos Baeten | 16 | 26 January 2009 | EGM 2023 | AGM 2026 | 44 |

| Ewout Hollegien | 3 | 1 December 2021 | - | AGM 2025 | 17 |

| Ingrid de Swart | 5 | 1 December 2019 | AGM 2023 | AGM 2027 | 25 |

Management Board

The MB was established in 2023 and meets every week. The MB conducts the day-to-day business at a.s.r. and implements and realises the business strategy.

Composition of the Management Board

Article 2.4 of the Rules of Procedure of the EB and MB specifies that the MB consists of all EB members, the CRO, the CHRO and the COO Life. MB members not being EB members are appointed, suspended and dismissed by the EB, with due observance of the DEI Policy. The SB is involved in the recruitment and selection of MB members, as prior coordination with the SB is required. During 2024, the composition of the MB remained unchanged, consisting of:

The members of the EB;

Rozan Dekker, CRO;

Jolanda Sappelli, CHRO;

Willem van den Berg, COO Life.

Permanent education

In 2024, specific permanent education sessions were attended by the SB, EB, and the MB, for the purpose of further education. A session, organised by representatives of the Pensions business unit, Asset Management and TKP, focused on the Future Pensions Act (Wet toekomst pensioenen - WTP). During this session the SB, EB and MB were educated on the developments and opportunities due to the WTP and the status of implementation of this legislation. Another session focused on sustainability. This session was led by the Sustainability team and professors of the University of Groningen, whom provided an update on (legislation regarding to) sustainable entrepreneurship, (governance regarding to) CSRD and on the a.s.r. Policy on Sustainable Insurance. Furthermore a session was held to educate the SB, EB and MB on US GAAS. In this session, led by Group Finance and Legal, an introduction of Generally Accepted Auditing Standards (US GAAS), the legal aspects and the impact on a.s.r. were given. As a US listed entity, Aegon Ltd. is audited under US GAAS . Due to Aegon Ltd.’s shareholding in ASR Nederland N.V., US GAAS regulatory requirements have become (partly) applicable to a.s.r. A session led by the Data Office provided an update on developments with respect to Generative AI and the application within a.s.r. The final session focused on two subjects, the Major Model Change for the MR1 Interest Rate model (‘MMC MR1’) and the Strategic Asset Allocation (‘SAA’) and investment plan 2025. In the first part of the session the SB, EB, and the MB were educated by Group Risk Management on the MMC MR1, it’s background and implications. The second part of the session, organised by representatives of Asset Management, focused on an analysis of the current investment policy and optimisation opportunities.

Evaluation

In 2024, the EB and MB conducted a comprehensive self-evaluation to assess its composition, role, and functioning. The self-evaluation session was conducted on the basis of a questionnaire and interviews. The outcome of the questionnaire was discussed with the MB and the company secretary. The evaluation highlighted the strength of the MB in its diversity, complementarity of roles, and effective communication. The MB operates as a cohesive team, demonstrating effective collaboration even in complex and large dossiers. The open and transparent communication within the MB allows for the discussion of sensitive issues and encourages members to challenge each other constructively. The collaboration with the SB has also been rated positively, with the SB effectively fulfilling its sparring partner role. The MB's decision-making processes are seen as effective and balanced, with a strong focus on the interests of key stakeholders, including customers, employees, shareholders, and society. The MB plans to continue fostering an open culture where diverse perspectives are valued and constructive challenges are encouraged. The MB's commitment to structured meetings, high participation, and productive discussions will remain a cornerstone of its operations, contributing to the overall success and growth of a.s.r.

The performance of the EB was also assessed by the SB as part of the scope of the annual assessment process; see section 5.3. In this context, interviews are held twice a year with the individual EB members (by two SB members on each occasion) in which the results of the aforementioned self-evaluation are included.

The performance of MB members not being EB members was assessed by the CEO, with prior input from the SB. The assessment takes place through interviews held twice a year with the individual MB members, in which the results of the aforementioned self-evaluation are included.

Remuneration

See section 5.3 for information on the Remuneration Policy for EB members and their individual remunerations.

- 1Section 5.1.3 is in scope of CSRD and limited assurance (ESRS 2 GOV-1).