Dealing with climate change is one of the greatest challenges of our time. a.s.r. will step up its efforts towards a climate-neutral society. a.s.r. is aware of the importance of this and, as an insurer and investor, wants to play a role in the energy transition. In this chapter a.s.r. briefly describes how a.s.r. identifies, measures and manages climate risks and opportunities for its business in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. For a more detailed description, please refer to a.s.r.’s separate Climate Report 2022.

Governance

Sustainability is embedded within a.s.r. at different levels in the organisation. Within the EB, the CEO has final responsibility for sustainability. The EB shares responsibility for the implementation of the sustainability strategy and is supported in its implementation by the Business Executive Committee (BEC). The Sustainability Workforce and the TCFD Working Group support the BEC in its responsibility for policy development and implementation. The Sustainability Workforce reports quarterly on the climate related targets and other sustainability targets and KPIs to the BEC. The Corporate Sustainability quarterly reports including targets for each business unit provide the EB with a good overview of strategy, progress and resources so that any adjustments can be made. Since 2021, an Nomination & ESG committee was established within the SB. This Nomination & ESG Committee advises and supports the SB with its supervisory role regarding ESG developments and results of the sustainable business strategy.

Within the separate business segments, the management teams are responsible for sustainability. This includes monitoring and managing climate risks and opportunities. Within each management team, one member is responsible. This member is assisted by a sustainability or ESG committee, or by a sustainability specialist, in combination with the business risk manager of the relevant business unit.

Strategy

a.s.r.’s climate policy consists of four strategic pillars, through which a.s.r. manages the risks associated with its investments and insurance products, while at the same time aiming to contribute to solutions:

Helping customers to prevent or reduce climate risks;

Stimulating the energy transition;

Incorporating climate risks into business processes;

Contributing to sector initiatives.

For a.s.r., climate change is a direct and indirect risk to both its assets and its liabilities. At the same time, opportunities are also created for operating performance, including by helping customers reduce climate risks and facilitating them in the energy transition. This makes a.s.r. an insurer that moves with the transition its customers are going through, which in effect means a.s.r. is an interesting party to (continue to) house their assets and risks. More information on this and the four pillars of the a.s.r. climate strategy can be found in the Climate Report 2022.

The following section describes how climate change affects a.s.r.’s product lines, how this is measured and how a.s.r. deals with it.

Asset management

Since 2018, a.s.r. validates its investment strategy by analysing the impact on various metrics in its Risk Appetite Statement due to climate change, based on climate scenario sets. a.s.r. has incorporated the impact of the different climate pathways on all assets in the annual Strategic Asset Allocation study.

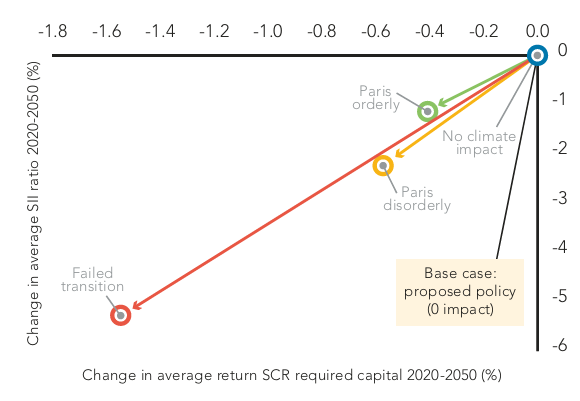

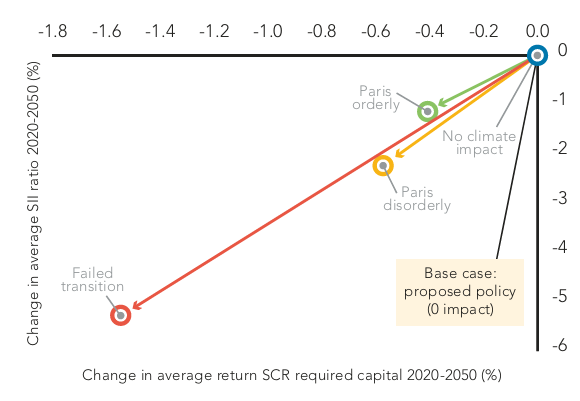

a.s.r. considers itself resillient to climate change under different climate scenarios. The impact of the three climate pathways on the Solvency II ratio and the average return on capital is limited. The main reasons for the limited impact are: the European focus of the investment portfolio, the ESG policy, and the dynamic investment policy. All of which results in a.s.r. investing less in countries, markets and companies that are hit harder by climate change and climate adaptation. The dynamic investment policy also provides for de-risking in the event of market stress due to climate change and thus supporting the overall solvency ratio.

Average SCR ratio vs. average return on SCR

The return on SCR (Solvency Capital Requirement) becomes lower as the Paris Agreement target is not achieved compared to when the Paris agreement is achieved. This is due to the direct impact of physical risks and therefore also indirectly due to a decrease in return expectations under the different climate pathways;

Within the Paris disorderly scenario, abrupt sales of stranded assets are expected around 2025. This will cause a major financial crisis. The solvency development in that period is slightly different, but because of the dynamic investment policy and the ESG policy a.s.r. is well able to withstand this;

A failed transition to the Paris Agreement is a.s.r.’s largest risk. In such a case the average SCR ratio will fall more sharply as a result of lower returns in particular, due to physical risks.

Real estate

Climate change poses risks to the built and rural property managed by a.s.r. Physical risks include inundation from large amounts of precipitation, but drought, heat and flooding can also cause damage to buildings, land and its users. These risks are incidental in the short term. If the trend of climate change continues, turning these risks into patterns, it will result in increasing damage and in changing desires of users (tenants). In the long term, this could result in changing demand for property and possible decreases in value for property susceptible to the effects of climate risks.

Attention is also paid to transition risks involving financial investments. For example, new legislation and regulations are being drawn up at the national and international level in the context of making real estate more sustainable and reducing chemical substances such as PFAS and NO2. In addition to applicable legislation and regulations, Real estate contributes to the energy transition and a sustainable living environment through investments in wind and solar parks. For developments in 2022, refer to chapter 4.4.

Mortgages

Physical climate risks within the mortgage portfolio may be caused by damage to houses due to climate-related events, which either lead to a decrease in the value of the collateral and/or affect homeowners’ ability to pay or repay their mortgage.

To reduce the risks of climate change within our real estate and mortgage portfolios, a.s.r. investigates where these risks are greatest. By combining data from the Climate Impact Atlas with portfolio data in the Geographical Information System (GIS), a.s.r. can see how vulnerable and sensitive locations in the Netherlands are to climate change. a.s.r. uses that data, among other things, in decision-making around acquisitions and maintenance of our property portfolios and now also to assess the risks of the collateral in the mortgage portfolio. Drought/heat, storm and flood risks were considered. Most risks are covered by the building insurance that homeowners are obliged to have on a mortgage-backed collateral, such as storm damage to a home. The National Contingency Fund also covers some forms of climate risks. Of the climate risks not covered, a.s.r.'s mortgage portfolio has moderate to almost no risk (total 97% of the portfolio).

Where these risks are not covered, such as pile rot, settlement risk, subsidence, groundwater nuisance and other foundation problems, they occur in specific regions in the Netherlands. a.s.r.'s mortgage portfolio is particularly susceptible to groundwater flooding in 2050. Next year and beyond, a.s.r. will investigate this further and also hope to gain more insight into the government's role in this.

P&C

Climate risks affect non-life insurance. In the short-term, a.s.r. has identified risks in property and traffic products, among others, due to an increase in extreme weather. This results in more and higher claims. In the medium-term, a.s.r. may also be confronted more frequently with floods from non-primary water defences and the resulting cost of claims. In the long term, drought, heat and wild fires may influence P&C's claims burden.

The impact of extreme weather conditions clearly revealed itself during three consecutive storms in early 2022. This resulted in a € 38 million cost of claims for Non-life after reinsurance. In Southern Europe, as well as in the Netherlands, more forest fires occurred in the summer of 2022 due to high temperatures and severe drought which resulted in damage to customers’ properties. The flooding in the Dutch province of Limburg in 2021, with a total cost of insurance claims estimated at € 200 million, highlighted that flood cover is essential for customers.

a.s.r. regularly determines the total loss ratio per product in relation to climate change over the past period and makes forecasts for several years in order to set its premiums, partly with the aid of Royal Netherlands Meteorological Institute (Koninklijk Nederlands Meteorologisch Instituut; KNMI) data. For the longer term, a.s.r. uses climate analyses. On the basis of several climate scenarios, these analyses provide insight into the long- term effects of climate risks in the Netherlands. These insights are used in a.s.r.’s calculations and have an effect on the development of premiums and coverage on the long term pricing policy, and reinsurance strategy for non- life products that involve climate cover.

In order to reduce risks, a.s.r. continuously monitors developments in climate influences and adjusts its acceptance policy (underwriting), products, claims handling, and communications accordingly. In addition, a.s.r. encourages its customers to take preventive measures in order to avoid damage and save energy, e.g. by providing tailor-made advice after inspection visits.

a.s.r. works with annual contracts and can therefore make quick adjustments if required due to physical climate risks such as changing weather conditions. To mitigate transition risks created by new technologies in areas such as climate mitigation, a.s.r. works with various research institutes and other knowledge-holders to gain as much knowledge as possible about the new technologies and thus determine the right price and conditions to insure them responsibly.

Health and Income

Climate change may affect the development of disease and pandemics with potential implications for healthcare costs, absenteeism and disability. Therefore, a.s.r. has identified and estimated the main health risks due to climate change with an impact on labour and healthcare costs. By investigating the impact of climate change on key medical conditions at an early stage, a.s.r. is trying to get a better grip on the potential impact this will have, enabling a.s.r. to take timely measures to mitigate the impact of these risks. Timely recognition and anticipation of risks affecting customers is also important in the context of customer interests.

Three medical conditions with the greatest potential impact on the cost of claims for healthcare costs, absenteeism and disability are expected to become more common as a result of climate change:

Tick-borne communicable diseases, such as Lyme disease (caused by a Borrelia bacteria);

Increased airborne exposure to allergens from pollen, dust mites and caterpillars. Higher temperatures cause existing plants and trees to flower earlier and possibly more intensely. New (non-native) species may also become established. Increases in air pollution and heat stress in cities amplify this aforementioned effect and lead to more lung diseases;

Increased UV light, in particular, will greatly increase the incidence of skin cancer in a specific period.

There is also an important uncertain factor, namely zoonoses, infectious diseases that can spread from animals to humans. Zoonosis can lead to new diseases or variants of known diseases that can be (extremely) harmful to health. Rapid spread of a zoonosis is one of the symptoms of climate change.

With today’s knowledge, the expected financial impact for the next 10 years seems limited because the increase in absenteeism or disability will mostly fall within the deductible period and the net effect on healthcare costs is limited due to the current equalisation system in the Netherlands.

Funeral and Individual life

The effects of temperatures rising seem limited for Funeral and Individual life, due to the fact that most insurance portfolios have a short-term lifetime/premium cycle or will mature before the anticipated long-term climate changes might affect the risks insured. Future pricing can therefore most likely be targeted to an acceptable level of investment return. In the near future, more attention will be paid to analysing climate risks and making them measurable in order to target them for the Funeral and Individual life portfolio.

Risk management

To fully understand the potential physical and transition impacts of climate change on its business, a.s.r. has developed a top-down and bottom-up management approach.

The bottom-up approach revolves around the relevant business segments within a.s.r. developing measures and tools to identify and to mitigate identified climate-related risks or capture its opportunities. This ranges from portfolio construction, exclusions and engagement within its asset management activities to underwriting taking into account climate risks, client engagement and developing new products and services.

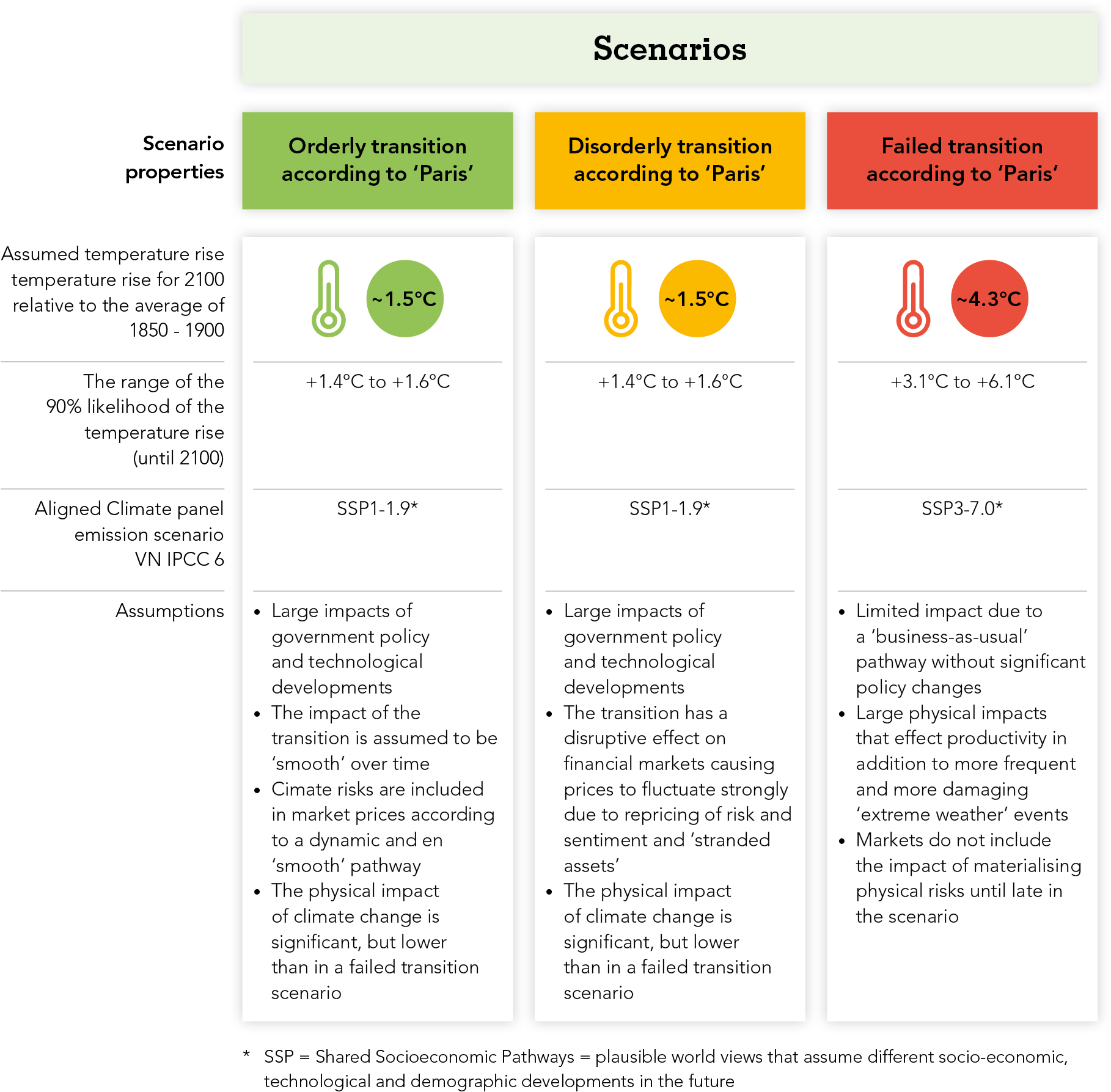

In the top-down approach a.s.r. analyses the impact of three climate scenario-driven insights into the resilience of the business, mainly focused on the impact of climate change on assets. These are attained using three climate scenarios with a 30-year horizon based on the Strategic Asset Allocation (SAA) model.

Three climate scenarios with a 30-year horizon

For Real estate, the Climate Risk Monitor was developed to manage climate risks within the urban property portfolio. This is an analysis tool for decision-making in acquisitions, disinvestments and portfolio maintenance. The Climate Risk Monitor contains building-specific data combined with climate data from the Climate Effect Atlas. These datasets are then combined in the GIS to generate cartographic layers that provide a quantitative insight into the level of risk per asset. By 2021, the climate dataset was embedded in the business processes.

A risk analysis was also carried out for the mortgage portfolio on the basis of the climate effect atlas in order to generate insight into the risk areas for flooding, for example. Because mortgages at a.s.r. can run for up to 40 years, it is important to have insight into the long-term risks for this portfolio.

a.s.r. Non-life identified its most important climate risks in a brainstorming session with knowledge holders and stakeholders. When climate change risks were included in the strategic risk analysis (SRA), measures were identified to mitigate the risks. These measures are regularly monitored for progress and effectiveness.

As of August 2022, the Solvency II regulation is enhanced with sustainability risk endorsed by an amendment of the Delegated Regulation (EU) 2015/35. Herein, sustainability risk is described as environmental, social or governance event or circumstance that, if it occurs, could cause an actual or potential adverse effect on the value of the investment or the value of a liability.

Overall, climate risks as a result of climate change and the energy transition are incorporated into a.s.r.’s risk appetite and part of the regular risk management processes such as the annual group-wide SRA process. Material climate risks identified in the SRA process, including storms and floods, are incorporated into the scenario analysis of the Own Risk and Solvency Assessment (ORSA) and quantified by the business actuary teams. Physical risks are mainly associated with the non-life portfolio. With life and health insurance, the impact is mainly in the longer term and not quantified in the ORSA horizon of 5 years. Transition risks apply in particular to investments and financing The ORSA assesses the overall solvency needs of a.s.r. in the context of the strategic plans, making allowance for the current and expected solvency positions, the risk appetite and solvency targets.

Metrics and targets

a.s.r. believes it can make a positive impact through a sustainable investment policy and by developing insurance products and services that support the energy transition and help customers adapt to climate risks. In addition, a.s.r. continuously works to reduce its own (indirect) negative impact.

The climate metrics and targets are shown in the table on this page.

Climate metrics and targets| KPIs | Target | 2022 progress |

|---|

| Reduction of carbon footprint of the investment portfolio’s in-house own funds | 65% by 2030 | 65% |

| Impact investments | € 4.5 billion in 2024 | € 2.8 billion |

| Reduction of carbon emissions in the insurance portfolio | Climate neutral by 2050 | Methodology report and target setting protocol have been launched. a.s.r. will publish first interim targets mid 2023. |

| Make P&C’s insurance products, as far as they are influenced by climate risks and opportunities, more resilient and enhance these products with (more) sustainable covers | 100% by 2025 | 60% |

| Reduction of carbon footprint of operations at a.s.r. | 50% in 2025 (base year 2018) | 62% |