The remuneration of current and former EB members is in accordance with the remuneration policy. Neither a.s.r. nor any Group company provides any loans, advances or guarantees on behalf of an EB member.

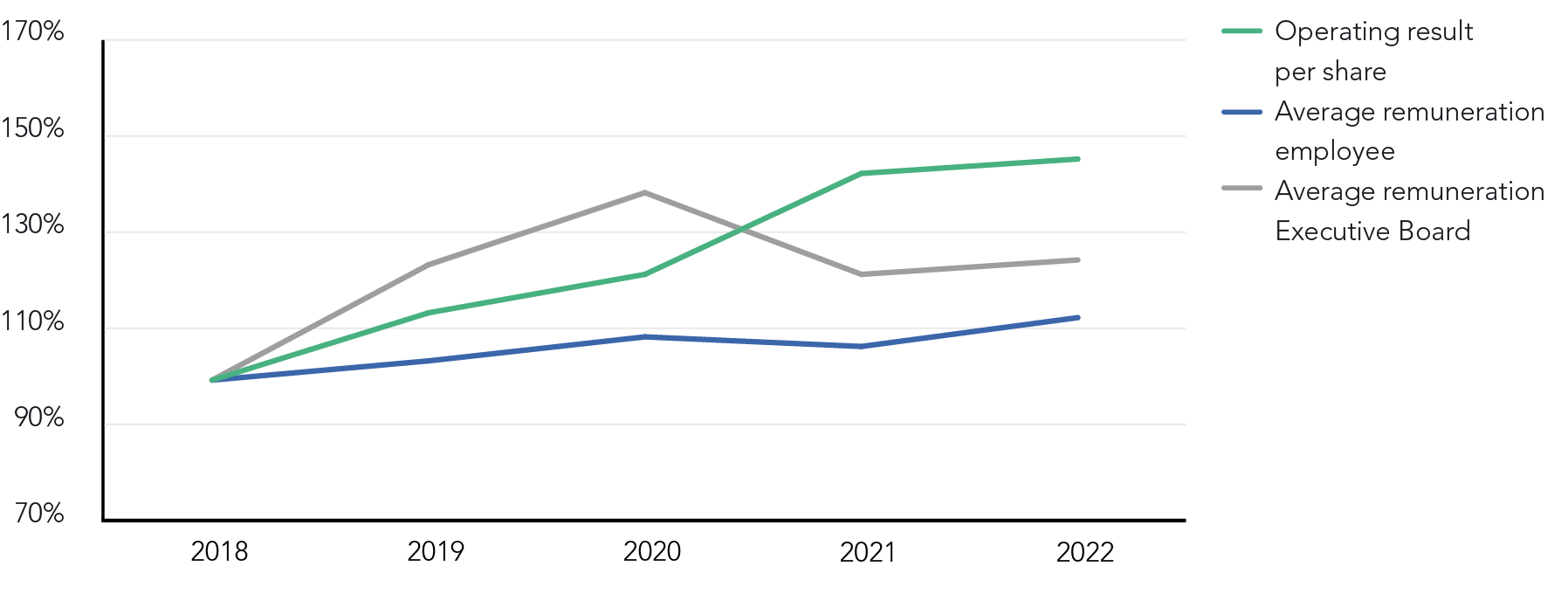

The comparative chart above shows the remuneration and company performance over the last five reported financial years. Company performance is expressed in terms of operating result per share. The average remuneration of employees (who are not EB members) is also shown, and this is also used to calculate the pay ratio. Finally, the average EB remuneration (CEO and CFO) is presented.

The full remuneration policy can be found at www.asrnl.com.

Pensions

The calculation of annual pension expenses is based on the total pension rights granted during a term of service at a.s.r. Pension expenses include:

Pensions based on a maximum pensionable salary cap (€ 114,866, fiscal maximum).

Compensation for the maximum pensionable salary cap (to be used for pensions at the employee’s discretion).

Pension benefits related to historically awarded pension rights.

VPL (early retirement and life cycle; ‘VUT, Prepensioen en Levensloop’) (vervroegde pensioenleeftijd).

All components of EB remuneration are included in the basis used for calculating pension benefits. EB members have the same pension scheme as a.s.r. employees.

In 2022, a.s.r. and the labour unions came to an agreement (and thereby a commitment) to add additional funds to the indexation of the defined benefit plan, which until the commitment could not be allocated to the individual participants in the defined benefit plan. As a result of the commitment, the indexation granted to EB members in 2022 is as follows: Jos Baeten € 234,351 and over 2021 € 329,120, Ewout Hollegien € 6,866 and over 2021 € 11,047 and Ingrid de Swart € 823 and over 2021 € 1,222. In addition, the indexation granted in 2022 to former EB members who are participants in the defined benefit plan is € 1,503,676 and over 2021 € 719,771.

Remuneration in 2023

Based on the benchmark and in line with the remuneration policy, the CEO’s salary scale is currently between € 764,363 and € 1,091,948. A salary scale of € 592,676 to € 846,679 applies for the CFO. For the COO, a scale of € 584,500 to € 835,000 applies. The benchmark is set every two years. The positioning, scale maximum and resulting bandwidth of the scales are then assessed and may be adjusted in relation to the resulting median.

The reference group 2022, which consists of 20 companies, is shown in the overview of the right.

The financial results for 2022 are strong and, in addition, a.s.r. is on track to achieve the medium term targets for the period 2022-2024. Strategic developments are also exceptional with the Aegon Transaction and the largely completed financing of the cash consideration. Further to the advice of the Remuneration Committee, it was therefore decided to grant a salary increase of 3% to all members of the EB as of 1 January 2023.

Furthermore, under the new CLA (applicable from 1 January 2023 until 1 July 2024), a.s.r. employees were given an indexation of their salary of 4% from 1 December 2022 and will receive another 3% from 1 July 2023. This increase also applies to EB members.

Participation in a.s.r. shares

In addition to the remuneration policy, EB members have committed to acquiring a certain percentage of their remuneration in a.s.r. shares (75% for the CEO and 50% for other EB members). These percentages must be achieved by 2026 and the shares must be held for a minimum of five years (blocking period). The percentages may be considered low in relation to other companies, but the fact that EB members use their own financial resources to purchase the shares should be taken into account. The shares are therefore not variable remuneration, nor a remuneration in shares.

As of 1 March 2023, the current EB members hold at least the following numbers of shares:

Jos Baeten 10,213 (40.4% of latest gross salary);

Ewout Hollegien 1,640 (10.1% of latest gross salary);

Ingrid de Swart 4,539 (22.1% of latest gross salary).

Reference group| Organisation | Index |

|---|

| Aalberts Industries | AMX |

| Arcadis | AMX |

| BAM Groep | AScX |

| Boskalis | AMX |

| Fugro | AMX |

| GrandVision | AMX |

| KPN | AEX |

| PostNL | AMX |

| SBM Offshore | AMX |

| Sligro | AScX |

| Signify | AEX |

| TomTom | AScX |

| Vopak | AMX |

| ABN AMRO | AMX |

| Achmea | Not listed |

| Aegon | AEX |

| NN Group | AEX |

| Triodos Bank | Not listed |

| Van Lanschot Kempen | AScX |

| Volksbank | Not listed |

2022 remuneration for members of the Executive Board| (in € thousands) | Fixed remuneration | Variable remuneration | | | | |

|---|

| Executive Board member | Base salary | Fees | Fringe benefits | One-year variable | Multi-year variable | Extraordinary items | Pension expense | Total remuneration |

Fixed portion of the total remuneration |

|---|

| Jos Baeten, CEO | 946 | - | 14 | - | - | - | 255 | 1,215 | 100% |

| Ewout Hollegien, CFO | 664 | - | 23 | - | - | - | 82 | 769 | 100% |

| Ingrid de Swart, COO / CTO | 777 | - | 19 | - | - | - | 152 | 948 | 100% |

| | | | | | | | | | |

| Total | 2,388 | - | 55 | - | - | - | 489 | 2,932 | 100% |

2021 remuneration for members of the Executive Board| (in € thousands) | Fixed remuneration | Variable remuneration | | | | |

|---|

| Executive Board member | Base salary | Fees | Fringe benefits | One-year variable | Multi-year variable | Extraordinary items | Pension expense | Total remuneration |

Fixed portion of the total remuneration |

|---|

| Jos Baeten, CEO | 861 | - | 13 | - | - | - | 233 | 1,108 | 100% |

| Ewout Hollegien, CFO | 51 | - | 2 | - | - | - | 3 | 57 | 100% |

| Ingrid de Swart, COO / CTO | 713 | - | 16 | - | - | - | 141 | 869 | 100% |

| | | | | | | | | | |

| Former member | | | | | | | | | |

| Annemiek van Melick | 653 | - | 14 | - | - | - | 95 | 762 | 100% |

| Total | 2,279 | - | 44 | - | - | - | 473 | 2,796 | 100% |