To: the General Meeting of Shareholders and the Supervisory Board of ASR Nederland N.V.

Report on the audit of the financial statements 2023 included in the annual report

Our opinion

In our opinion:

the accompanying consolidated financial statements give a true and fair view of the financial position of ASR Nederland N.V. (‘the Group’ or ‘ASR Nederland N.V.’) as at 31 December 2023 and of its result and its cash flows for the year then ended, in accordance with IFRS Accounting Standards as endorsed by the European Union (EU-IFRS) and with Part 9 of Book 2 of the Dutch Civil Code;

the accompanying company financial statements give a true and fair view of the financial position of ASR Nederland N.V. as at 31 December 2023 and of its result for the year then ended in accordance with Part 9 of Book 2 of the Dutch Civil Code.

What we have audited

We have audited the financial statements 2023 of ASR Nederland N.V. based in Utrecht. The financial statements include the consolidated financial statements and the company financial statements.

The consolidated financial statements comprise:

the consolidated balance sheet as at 31 December 2023;

the following consolidated statements for 2023: the income statement, the statements of comprehensive income, changes in equity and cash flows; and

the notes comprising material accounting policy information and other explanatory information.

The company financial statements comprise:

the company balance sheet as 31 December 2023;

the company income statement for 2023; and

the notes comprising a summary of the accounting policies and other explanatory information.

Basis for our opinion

We conducted our audit in accordance with Dutch law, including the Dutch Standards on Auditing. Our responsibilities under those standards are further described in the ‘Our responsibilities for the audit of the financial statements’ section of our report.

We are independent of ASR Nederland N.V. in accordance with the ‘Verordening inzake de onafhankelijkheid van accountants bij assurance-opdrachten’ (ViO, Code of Ethics for Professional Accountants, a regulation with respect to independence) and other relevant independence regulations in the Netherlands. Furthermore, we have complied with the ‘Verordening gedrags- en beroepsregels accountants’ (VGBA, Dutch Code of Ethics).

We designed our audit procedures in the context of our audit of the financial statements as a whole and in forming our opinion thereon. The information in respect of going concern, fraud and non-compliance with laws and regulations, climate-related risks and the key audit matters was addressed in this context, and we do not provide a separate opinion or conclusion on these matters.

We believe the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Information in support of our opinion

Summary

| Materiality of EUR 120 million, based on total equity (approx. 1.3%) |

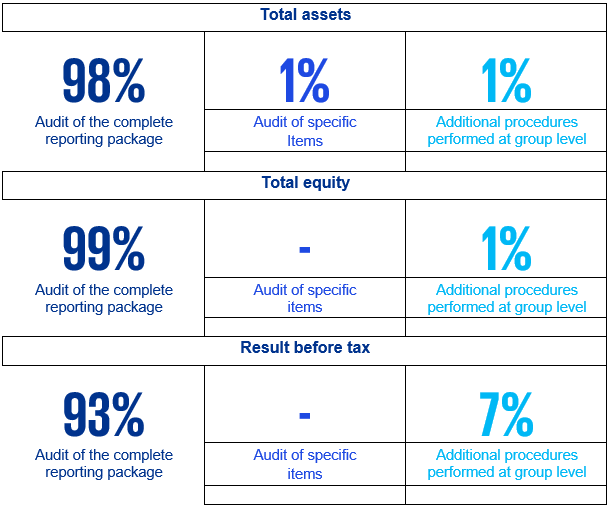

| Audit coverage of: |

|---|

| - 99% of total assets |

| - 99% of total equity |

| - 93% of result before tax |

| Fraud risks: presumed risk of management override of controls and presumed risk of fraudulent revenue recognition identified and further described in the section ‘Audit response to the risk of fraud and non-compliance with laws and regulations’ |

| Non-compliance with laws and regulations (NOCLAR) risks: no reportable risk of material misstatements related to NOCLAR risks identified |

| Going concern risks: no going concern risks identified |

| Climate-related risks: We have considered the impact of climate-related risks on the financial statements and described our approach and observations in the section ‘Audit response to climate-related risks’ |

| - Acquisition accounting for Aegon Nederland N.V. |

| - Adoption of IFRS 17 insurance contracts |

| - Valuation of insurance contract liabilities and related assets |

| - Valuation of hard-to-value assets |

| - Unit-linked exposure |

| - Solvency II disclosure |

Materiality

Based on our professional judgement we determined the materiality for the financial statements as a whole at EUR 120 million (2022: EUR 40 million). The materiality is determined with reference to total equity and amounts to approximately 1.3%.

The amount of the materiality significantly changed compared to last year, mainly as a result of the increase of the size of the Group due to the acquisition of Aegon Nederland N.V., as well as the adoption of IFRS 17 Insurance contracts and IFRS 9 Financial Instruments, whereby both the insurance contract liabilities and investments are measured at fair value.

In 2022 we determined our materiality based on 4% of the average result before tax over the past three years. We believe that, following the adoption of IFRS 17 and IFRS 9, total equity became a more relevant metric. Result before tax became a less relevant metric due to the significant increase in volatility of result before tax resulting from the adoption of IFRS 17 and IFRS 9. Total equity is a key metric as it is important for the dividend paying potential of the Group and it is closely linked to the solvency of the group.

We therefore consider total equity as the most appropriate benchmark based on our assessment of the general information needs of users of the financial statements of listed financial institutions that are predominantly active in the insurance business.

We have also taken into account misstatements and/or possible misstatements that in our opinion are material for the users of the financial statements for qualitative reasons.

We agreed with the Audit & Risk Committee of the Supervisory Board that misstatements identified during our audit in excess of EUR 5 million would be reported to them, as well as smaller misstatements that in our view must be reported on qualitative grounds.

Scope of the group audit

ASR Nederland N.V. is a Dutch company at the head of a group of components. The financial information of this group is included in the (consolidated) financial statements of ASR Nederland N.V.

The Group is structured along six operating segments: Non-life, Life, Asset Management, Banking, Distribution and Services and lastly Holding and Other, some of which comprising of multiple legal entities.

Because we are ultimately responsible for the audit opinion, we are responsible for directing, supervising and performing the group audit. In this respect, we have determined the nature and extent of the audit procedures to be carried out by component auditors.

Our group audit mainly focused on significant components. These significant components are either individually financially significant due to their relative size within the Group or because we have assigned a significant risk of material misstatement to one or more account balances of the component. In addition, we included certain components in the scope of our group audit in order to arrive at a sufficient coverage over all relevant significant account balances.

We sent audit instructions to all component auditors, covering significant areas including the relevant risks of material misstatements and set out the information required to be reported to the group audit team. The components in scope for group reporting purposes related to the former ASR Nederland N.V. group are audited by KPMG. For the former Aegon Nederland N.V. entities we make use of other (non-KPMG) auditors.

Following the acquisition of Aegon Nederland as per 4 July 2023, we included Aegon Levensverzekering N.V. (‘Aegon Leven’), Aegon Spaarkas N.V. (‘Aegon Spaarkas’), Aegon Bank N.V. (‘Aegon Bank’) and Aegon Hypotheken B.V. (‘Aegon Mortgages’) in scope of our group audit. Aegon Schadeverzekering N.V. (‘Aegon Schade’) has been legally merged with ASR Schadeverzekering N.V. (‘ASR Schade’) and the audit of Aegon Schade is therefore part of the ASR Schade’s component audit. As group auditor, we have satisfied ourselves that the audits performed by component auditors are meeting the requirements set out in the audit instructions that we have sent out. Our procedures include regular communication about the assessment of risk and audit response thereto, the discussion of audit observations and reporting by component auditors and the review of the audit files to ensure these are consistent with these instructions and support the audit opinions on the components’ group reporting packages that we relied upon in the completion of the group audit.

For all components in the scope of the group audit, we held video calls and/or physical meetings with the auditors of the components. During these calls/meetings, the planning, risk assessment, procedures performed, findings and observations reported to the group auditor were discussed in more detail and any additional work deemed necessary by the group audit team was then performed. As originally planned for these components, we performed file reviews.

The group audit team has set component materiality levels, which ranged from EUR 18 million to EUR 96 million, based on the mix of size and risk profile of the components within the Group.

The consolidation of the Group, the disclosures in the financial statements and certain centralized processes and accounting matters are audited by the group audit team. The centralized processes and accounting matters on which the group audit team performed audit procedures include, but are not limited to, assessment of the use of the going concern assumption, acquired and divested companies and businesses, the goodwill impairment test, equity, employee benefits, operating expenses, other expenses, certain elements of the risk and capital management disclosures, corporate income tax for the fiscal unity and legal proceedings.

For the residual population not in scope, we performed analytical procedures in order to corroborate that our

scoping remained appropriate throughout the audit. Performing the procedures mentioned above at group components, together with additional procedures at group level, enabled us to obtain sufficient and appropriate audit evidence about the group’s financial information to provide an opinion on the financial statements.

The audit coverage as stated in the section summary can be further specified as follows:

Audit response to the risk of fraud and non-compliance with laws and regulations

In paragraphs 3.5, 3.6, 3.7 and 7.8.1.2 of the annual report, the Executive Board describes its procedures in respect of the risk of fraud and non-compliance with laws and regulations, and the Supervisory Board reflects on this in chapter 5.2.

As part of our audit, we have gained insights into ASR Nederland N.V. and its business environment, and assessed the design and implementation and, where considered appropriate, tested the operating effectiveness of the Group’s risk management in relation to fraud and non-compliance. Our procedures included, among other things, assessing the Group’s code of conduct, whistleblowing procedures, incidents register and its procedures to investigate indications of possible fraud and non-compliance. Furthermore, we performed relevant inquiries with the Management Board and the Audit & Risk Committee of the Supervisory Board and other relevant functions, such as Internal Audit, Legal, Group Compliance, Group Risk Management and business line CFRO’s.

As a result from our risk assessment, we identified the following laws and regulations as those most likely to have a material effect on the financial statements in case of non-compliance:

Financial Supervision Act (‘Wet op het financieel toezicht’ (Wft)) (including the implementation of the Solvency II directive);

regulation related to financial and economic crime (FEC), including Wwft.

Based on the above and on the auditing standards, we identified the following fraud risks that are relevant to our audit, including the relevant presumed risks laid down in the auditing standards in respect of management override of controls and revenue recognition.

We have responded as follows:

Management override of controls (a presumed fraud risk)

Risk:

Management is in a unique position to manipulate accounting records and prepare fraudulent financial statements by overriding controls that otherwise appear to be operating effectively, such as in the areas of: accounting estimates that require significant judgement such as valuation of insurance contract liabilities and assets, solvency II disclosures, and the valuation of hard-to-value assets.

Responses:

We evaluated the design and the implementation and, where considered appropriate, tested the operating effectiveness of internal controls that mitigate fraud risks, such as processes related to journal entries and estimates. Where we considered whether there would be an opportunity for fraud, we performed supplemental detailed risk-based testing.

We performed data analysis of high-risk journal entries and evaluated key estimates and judgements for bias by ASR Nederland N.V., including retrospective reviews of prior years’ estimates. Where we identified instances of unexpected journal entries or other risks through our data analytics, we performed additional audit procedures to address each identified risk, including testing of transactions against source information.

We incorporated elements of unpredictability in our audit, for example, vary the timing of audit procedures including testing of controls: incremental testing and confirmations on balances as part of the work for the purchase price allocation.

We refer to the key audit matters that provide information of our approach related to areas of higher risk due to accounting estimates where management makes significant judgements.

Revenue recognition (a presumed risk)

Risk and response

Revenue from insurance contracts is generally recognized over time as the insurer provides coverage to the policyholder. Revenue stemming from contracts accounted under the General Measurement Model (GMM) approach and Variable Fee Approach are to a large extent determined by the key assumptions used for the measurement of the related insurance contract liabilities.

There is a presumed management incentive to overstate the insurance contract revenue. The company recognises insurance revenue what reflect the reduction in the liability for remaining coverage that relates to services provided in the period.

Based on the aforementioned we concluded that the presumed fraud risk on revenue recognition is linked to the key audit matter “Valuation of insurance liabilities” and in particular related to the valuation of the insurance contract

liabilities for life and disability insurance contracts applying the GMM and/or VFA.

We communicated our risk assessment, audit responses and results to the Executive Board and the Audit & Risk Committee of the Supervisory Board. Our audit procedures did not reveal indications and/or reasonable suspicions of fraud and non-compliance that are considered material for our audit.

Audit response to going concern

As explained in chapter 7.1.1. of the annual report, the Executive Board has performed its going concern assessment and has not identified any significant going concern risks. To assess the Executives Board’s assessment, we have performed, inter alia, the following procedures:

We considered the Executive Board’s assessment of the going concern risks, including all relevant information of which we are aware as a result of our audit.

We assessed whether the scenarios included in the Own Risk Solvency Assessment (ORSA) and Preparatory Crisis Plan that were submitted to DNB and other regulatory correspondence indicate a significant going concern risk. In the ORSA scenario’s the Aegon’s business is included.

We analysed the Group’s financial position and Solvency II ratio as at year-end and compared it to internal minimum capital requirements as set by the Executive Board, the previous financial year and sensitivities of the regulatory capital position to identify potential significant going concern risks.

We evaluated whether the Executive Board’s assessment of going concern, including the Solvency II ratio and sensitivities of the regulatory capital position, is adequately disclosed in the risk management paragraph 7.8. of the financial statements.

The outcome of our risk assessment procedures did not give reason to perform additional audit procedures on management’s going concern assessment.

Audit response to climate-related risks

The Executive Board is responsible for preparing the financial statements in accordance with the applicable financial reporting framework, including considering whether the implications from climate-related risks and commitments have been appropriately accounted for and disclosed.

ASR Nederland N.V. has made an extensive analysis and has set out its commitments and ambitions relating to climate change in the annual report in paragraph 6.2.1. ‘Climate change’ as included in paragraph 2.6.2. ‘Material topics’, this includes the commitments to:

reduce the carbon footprint of the investment portfolios for own account by 65% in 2030 compared to 2015;

ensure that the insurance portfolio is climate neutral by 2050 starting with an absolute reduction of 26% in the non-life insurance portfolio by 2030 compared to 2022; and

reduce the carbon footprint of ASR’s head office in Utrecht by 50% in 2025 compared to 2018 and to become net-zero by 2050.

Climate change is considered a risk for ASR Nederland N.V. to which the company is exposed on both sides of the balance sheet: through the valuation of investments on the asset side and insurance exposure on the liability side.

Paragraph 6.2.1. of the annual report ‘Climate change’ provides an overview of ASR Nederland N.V.’s approach to identify and assess climate-related risks. Climate-related risks are also covered in note 7.8.1.3. ‘Climate change’ of the financial statements. The Executive Board described the climate-related risks and conclude that climate-related risks have limited impact on the accounts and its disclosures.

As part of our audit, we have performed a risk assessment of the potential impact of climate-related risk and the commitments/ambitions made by the company in respect of climate change on the 2023 accounts and disclosures, including significant judgements and estimates in the financial statements to determine whether the financial statements are free from material misstatement.

In doing this we performed the following:

We have made inquiries of the Management Board and Risk Management personnel from both the first and second line of defence to understand the extent of the potential impact of climate-related risk on the financial reporting and the impact on the material individual assets, liabilities and/or disclosures in the financial statements.

We have evaluated climate-related fraud risk factors and we considered the potential pressure to achieve targets tied to climate change or sustainability metrics. This did not result in a fraud risk.

We inspected minutes and other documentation (such as the Strategic Asset Allocation study and the Own Risk and Solvency Assessment (ORSA) as well as external communications by ASR Nederland N.V. regarding significant climate-related commitments, strategies and plans made by the Management Board.

In performing our procedures we involved our own climate risk experts to challenge our risk assessment.

Based on the procedures performed, we consider that climate-related risk has no material impact on the 2023 financial statements under the requirements of the International Financial Reporting Standards as adopted by the European Union (EU-IFRS) and with Part 9 of Book 2 of the Dutch Civil Code and no material impact on our key audit matters.

We audited note 7.8.1.3. and note 7.8.7.1. of the financial statements and assess the climate-related risk disclosures as adequate.

Furthermore, we have read the disclosure of climate-related risk information in the annual report and considered whether such information contains material inconsistencies with the financial statements, or our knowledge obtained through our audit, in particular as described above and our knowledge obtained otherwise.

Our key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements. We have communicated the key audit matters to the Executive Board and the Audit & Risk Committee of the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters discussed.

The 2023 reporting year is significantly impacted by the adoption of IFRS 17 Insurance contracts, the adoption of IFRS 9 Financial instruments and by the acquisition of Aegon Nederland N.V.

Consequently, we have revised and updated our audit approach for these key matters. The audit of the valuation of insurance contract liabilities and related assets led to a revised key audit matter: ‘Valuation of insurance contract liabilities and related assets’. Given the complexity of IFRS 17 and the significant effort and management judgement required to implement the new standard, we also included the ‘Adoption of IFRS 17’ as a key audit matter. Additionally, the IFRS 9 Financial instruments is applied for the first time this financial year. Management explains in note 7.3.1.3. of the financial statements that the impact of IFRS 9 is relates to the remeasurement of investments in mortgage loans from amortised cost to fair value. The audit response is captured in the key audit matter ‘Valuation of hard-to-value assets’ and therefore we have not identified a separate key audit matter for the adoption of IFRS 9.

After the acquisition of Aegon Nederland N.V., management has established an acquisition balance sheet of Aegon Nederland in accordance with IFRS 3 Business combinations. This balance sheet is based on fair value and management judgement is required. Our audit response is included in the key audit matter ‘Acquisition accounting for Aegon Nederland N.V.’

Acquisition accounting for Aegon Nederland N.V.

Description

The acquisition of Aegon Nederland N.V. is considered a significant unusual transaction due to its size and complexity and involves various business activities that are allocated to Cash Generating Units (CGUs) and various intangible assets. The accounting for this acquisition involves significant management judgements that require special audit consideration because of the likelihood and potential magnitude of misstatements relating to the purchase price allocation (PPA).

In addition, the identification and measurement of intangible assets and the preparation of the fair value estimate for the measurement of the assets acquired (in particular level 3 investments), liabilities assumed and/or consideration transferred (in particular the insurance liabilities) involves significant judgements.

Given the financial significance, the complexity and judgement that is required, we considered the valuation and accounting for the acquisition of Aegon Nederland N.V. as a key audit matter.

Our response

With the assistance of our valuation and actuarial specialists, we performed the following procedures:

prior to the acquisition and thereafter, we performed specific procedures such as inquiries with the management, those charged with governance and with the Dutch Central Bank to obtain an understanding of the business purpose of the transaction and the regulatory perspective on the transaction, including the approval thereof;

assessing the governance, processes and design and implementation of internal controls with respect to the valuation and accounting for the acquisition;

assessing the acquisition date criteria of the business acquisition by inspecting the approvals from the regulators and shareholders and by inspecting the legal transaction documentation;

assessing the identification of the assets acquired and the liabilities assumed;

evaluating the relevance and appropriateness of the applied methodology (valuation approach) in determining the fair value of the acquired intangible assets and the Business Equity Value (BEV);

performing an assessment of the appropriateness of the methodology and assumptions used in the fair value measurement of the assets acquired and (insurance contract) liabilities assumed;

assessing the appropriateness of the assumptions applied in the recognition and valuation of the identified intangibles;

evaluating the methodological and arithmetic accuracy of the PPA model, including BEV analysis;

evaluating the consideration transferred and assessing the badwill recognised resulting from the transaction, based on the underlying transaction documentation and payment details;

evaluation of the acquisition disclosure in note 7.4.5. of the financial statements. This includes verifying that the disclosure related to the legal merger between ASR Nederland N.V. and Aegon Nederland N.V. per 1 October 2023. We generally performed substantive audit procedures to determine that the accounting is supported by underlying source documentation.

Our observation

Overall, we found management’s estimate of the fair value of the assets (including identified intangibles) and liabilities (including insurance contract liabilities) as part of the acquisition accounting acceptable. We also found the related disclosures to be adequate. We refer to note 7.3.4.H. and note 7.4.5. of the financial statements.

Adoption of IFRS 17 Insurance contracts

Description

IFRS 17 ‘Insurance Contracts’ was implemented by ASR Nederland N.V. on 1 January 2023. The new IFRS 17 standard requires insurance contract liabilities to be measured by applying a model that estimates the present value of future best estimate cash flows that will arise as these contracts are fulfilled, which includes an explicit risk adjustment and a contractual service margin reflecting unearned profits. This involves significant judgement and estimates and resulted a significant decrease in equity as of 1 January 2022 (transition date).

ASR Nederland N.V. has disclosed the impact of these new standards in accordance with IFRS 17 in note 7.3.1.3.

We determined the initial adoption of IFRS 17 and related disclosures in the 2023 financial statements to be a key audit matter, because of the significance and complexity of the changes introduced by the new standard, including the number of accounting policy choices and new estimates that require significant judgement from management, such as the recognition of the Contractual Service Margin (‘CSM’).

Our response

With the assistance of our valuation and actuarial specialists, we performed the following procedures:

We assessed whether the judgements applied by management in determining their accounting policies are in accordance with IFRS 17 and challenged significant new accounting policies, choices and assumptions made against the requirements of the standard.

We assessed the appropriateness of management’s selection and application of the transition approaches for each group of insurance contracts to determine the transitional adjustments.

We assessed the applied fair value approach for ASR Nederland N.V. at transition date.

In determining the transitional adjustments, we assessed, together with our actuarial specialists, key assumptions in the fair value of contractual cash flows, in particular the cost of capital rate used for the measurement of the risk adjustment and the applied discount curve.

Where a fair value approach is applied, we challenged the assumption input into the valuation model applied and, where possible, the comparison towards market-observable transactions.

We assessed the selection of the General Measurement Models and Variable Fee Approach Measurement Models and the application thereof for the groups of contracts identified.

We involved our actuarial specialists to evaluate the appropriateness of new methodologies and models including estimates and discounting of the IFRS 17 fulfilment cash flows, risk adjustment and CSM. This included consideration of the reasonableness of assumptions and judgements applied, including whether or not there was any indication of intentional management bias.

We compared the outcome of the insurance contract liability measurement under IFRS 17 with the best estimate liability and risk margin under Solvency II, using management’s analysis, and we assessed differences against our expectations for differences in measurement principles and assumptions.

We performed substantive testing procedures on key reconciliations in the process from source data to financial reporting and performed specific procedures on management’s analysis that covered the comparison between IFRS 4 and IFRS 17 for the transition balance sheet.

We assessed the appropriateness of quantitative and qualitative transitional disclosures included in note 7.3.1.1. and 7.3.1.3 in the financial statements against the requirements of the IFRS 17 standard.

Our observation

We consider the transitional impact from the adoption of IFRS 17 Insurance contracts at transition date and related disclosures to be appropriate. We refer to notes 7.3.1.1. and 7.3.1.3. of the financial statements.

Valuation of insurance contract liabilities and related assets

Description

ASR Nederland N.V. has insurance contract liabilities (hereafter: ‘insurance liabilities’) amounting to EUR 98.8 billion as at 31 December 2023 representing 70% of its total liabilities.

The valuation of insurance liabilities and related assets involves the use of cash flow models and valuation methodologies and requires significant management judgement over uncertain outcomes, mainly ultimate settlement value of long-term liabilities.

Elements that give rise to a significant risk of error are the use of incorrect application and selection of models, the selection of assumptions in estimating the fulfilment cash flows under the General Measurement Model (GMM) and Variable Fee Approach (VFA). Key assumptions for the valuation of life insurance contracts relate to expenses (especially in relation to the anticipated cost savings) and the discount curve. For disability contracts key assumptions relate to recoverability rates and the discount curve.

As referred to in the section ‘Audit response to the risk of fraud and non-compliance with laws and regulations’ in this audit opinion, we have included the risk of fraud that management may influence assumptions to manage the outcome of calculations and measurements. The expectation of when claims will incur is reflected in the release from the liabilities from remaining coverage for expected claims and expenses. This release is the basis for the revenue recognition. We consider the most critical assumptions in this regard the expense assumption for life insurance contracts and the recoverability rate assumption for disability contracts.

Given the financial significance, the level of judgement required and the inherent risk of fraud we considered the valuation of insurance contract liabilities for life and disability insurance contracts applying the GMM and VFA, a key audit matter.

Our response

Our audit approach included testing the design and implementation of internal controls around the valuation of the insurance liabilities, as well as substantive audit procedures.

Our procedures over internal controls focused on controls around the relevance and reliability of data, the controls around assumption setting and the internal review procedures performed by the actuarial functions of the underlying insurance businesses. We also assessed the process for the internal validation and implementation of models used for the valuation of the insurance liabilities.

With the assistance of our actuarial specialists, the substantive audit procedures we performed included:

assessment of the appropriateness of the data, assumptions and methodologies applied in the valuation of the insurance liabilities for all significant components. We performed specific procedures on the new models applied whereby we have assessed the model documentation, user acceptance tests performed by the first line and the model validation performed by the second line;

assessment of the appropriateness of assumptions used in the valuation of the insurance liabilities contracts for all significant components by reference to company data as well as relevant market and industry data. We performed specific procedures in response to the impact of the Aegon integration on the expense assumptions and of the disability developments on the recoverability assumptions;

for life insurance contracts, we performed specific procedures in response to the appropriateness of management’s estimate of the expense cash flows, assessing the main assumptions underlying the expected wage costs development, inflation assumptions, future cost savings and cost synergies resulting from the Aegon integration, and the appropriateness of the allocation keys used to allocate holding expenses to the insurance entities and determine the cost per policy;

for disability contracts, we performed specific procedures regarding the appropriateness of the recoverability rates assumption and assessed that this is in line with historical data and expected developments;

assessment and testing of the appropriateness of the discount curve and challenge on the methodology used to determine the discount curve, including management’s assessment of the selection of the first smoothing point and the liability illiquidity premium. We assessed that the liability illiquidity premium is derived from ASR Nederland N.V.’s current asset portfolio using a top-down approach, which includes an adjustment for expected credit loss;

analysis of developments in actuarial results (which includes retrospective review by comparing the expected claims and expenses with the incurred claims and expenses) and movements in the insurance liabilities, the risk adjustment, CSM for each of the significant components and made corroborative inquiries with management and the second line actuarial department;

assessment of the completeness, accuracy and relevance of the required disclosures, including disclosures on assumptions about the future and estimation uncertainty. In particular related to the uncertainty associated to the integration of the Aegon business.

Our observation

Overall, we found management’s assumptions reasonable and the valuation of the insurance liabilities using the General Measurement Model Approach and Variable Fee Approach to be appropriate.

We also found the notes on the insurance contract liabilities and related assets in note 7.3.4.A 7.15.13 and 7.15.14 to be adequate. Our audit procedures did not reveal indications and/or reasonable suspicion of fraud that are considered material to our audit.

Valuation of hard-to-value assets

Description

ASR Nederland N.V. invests in various categories of investments. These consist of financial assets and liabilities measured at fair value as disclosed in note 7.7.1.1 and property as disclosed in note 7.7.1.3. (including land and buildings for own use and plant).

Additionally, the fair value of investments not carried at fair value is separately disclosed in note 6.7.1.2. With the introduction of IFRS 9, the majority of the financial assets and liabilities are carried at fair value in the balance sheet, except for the mortgage loans and saving deposits held at Aegon Bank N.V. as these are carried at amortised costs.

33% (2022: 32%) of the fair value of the investments are classified as Level 3 investments (fair value not based on observable market data).

Fair value measurement, especially the valuation of less liquid Level 3 assets, can be subjective and involves management judgement in relation to valuation techniques and assumptions. For these illiquid investments, estimation uncertainty can be high, especially due to inflation and interest movements. This is mainly applicable to:

property investments;

real estate equity funds;

mortgage equity funds;

mortgage and private loans;

wind and solar farms (which is accounted under property, plant and equipment).

Given the financial significance and the increased level of judgement required, we considered the valuation of hard-to-value assets a key audit matter.

Our response

With the assistance of our valuation specialists, we performed the following procedures:

assessment of ASR Nederland N.V.’s governance, processes and design and implementation of internal controls with respect to the valuation of hard to value assets;

inspection of documentation and held discussions with management’s internal and external experts regarding their judgements and resulting valuations in relation to real estate;

we performed substantive audit procedures on selected high-risk property investments.

This selection is based on the relative size of the objects within their respective asset class and the development of the fair value during the year and was aimed at an appropriate spread over regions and appraisers specifically for the rural investments. We discussed and challenged the assumptions and models used by the external appraisers. We tested their used discount rates and gross investment yields against available market data and object specific underlying data such as (market) rent levels, occupancy rates and contract renewals;

we discussed and challenged the assumptions (e.g. energy prices and discount rate) and models used by management. We tested the assumptions against available market data; we challenged management’s valuation of the plants by reviewing the documentation provided by them and we have compared the valuations with available external market data;

we challenged management’s valuation of real estate equity funds and mortgage equity funds by reviewing the documentation provided by the external fund managers and we compared the movements in valuations with available external market data;

assessment of valuation models used and the (internal) validation thereof, for the determination of the fair value of the mortgage loans. We performed audit procedures on the fair value of the mortgage loans and tested the source data and determined an acceptable fair value range for the mortgage loans;

we carried out a retrospective review of prior-year estimates, e.g. by reconciliation of valuations to financial statements of investments or comparison to sales results;

assessing of the adequacy of the disclosures. This includes notes 7.7.1.1, 7.7.1.2 and 7.7.1.3 on fair value measurement and the market risk disclosure in note 7.8.3 as this note includes sensitivity analysis on the valuation uncertainties that exist on 31 December 2023.

Our observation

We found management’s assumptions for the valuation of hard-to-value assets reasonable and the valuation acceptable. We also found the fair value and property disclosures to be adequate.

Unit-linked exposure

Description

Holders of unit-linked products sold in the Netherlands, or consumer protection organizations on their behalf, have filed claims or initiated legal proceedings against ASR Nederland N.V. and the former Aegon Nederland N.V. entities and may continue to do so. A negative outcome of such claims and proceedings, settlements or any other actions to the benefit of the customers by other insurers or sector-wide measures, may affect the (legal) position of ASR Nederland N.V. and could result in substantial financial losses relating to the compensation.

On 29 November 2023, ASR Nederland N.V. and five consumer protection organization agreed on a settlement of approximately EUR 250 million to be paid to the holders of unit-linked products. All legal proceedings will be discontinued and no new legal proceedings may be initiated by the consumer protection organisations. The agreement will become final once 90% of the affiliated customers agree to the settlement. ASR Nederland N.V. expects this process will be finalised in 2024. A leniency scheme has been set-up for customers unaffiliated with one of the consumer protection organisations who have not previously received compensation. The total additional provision for the leniency scheme amounts to EUR 90 million of which EUR 37 million was already recognized in the insurance contract liabilities as the remaining portion of previous agreements. We refer to the note 7.5.16. Provisions.

Due to the potential significance and the management judgement that is required to assess the developments with respect to the unit-linked exposure and the accounting treatment thereof, we considered this a key audit matter.

Our response

Our audit procedures primarily consisted of the following:

assessment of ASR Nederland N.V.’s governance, processes and design and implementation of internal controls with respect to the unit-linked exposure;

inspection and assessment of supporting legal and complaints documentation and inquiries about the unit-linked exposures with management and head of legal;

this assessment took into account the court decision dated 26 September 2023 of the Court of Appeal in The Hague in the collective proceedings initiated by Vereniging Woekerpolis.nl against Aegon Levensverzekering N.V. and Aegon Spaarkas N.V. and the outcome of unit-linked court activities of other insurers in The Netherlands during the year up to the date of the opinion;

inspection and assessment of the settlement agreement with the consumer protection organisation dated 29 November 2023 and gaining an understanding of the structure and components comprising the agreed settlement amount;

assessment of the recognition and measurement requirements to establish provisions under ASR Nederland N.V.’s EU-IFRS accounting principles and the Solvency II framework for the calculation of the Solvency II ratio. We challenged management’s assessment of the likelihood of a final settlement (90% hurdle) that supports management’s recognition and measurement of the provision of EUR 250 million;

assessed the documentation prepared by management to support the provision for leniency scheme for customers unaffiliated with one of consumer protection organisations who have not previously received compensation. We assessed and challenged the recognition and measurement of this provision;

evaluation of the unit-linked provision disclosure in note 7.5.16 Provisions and the unit-linked remaining exposure in note 7.7.6.2. Unit Linked Products (beleggingsverzekeringen) of the financial statements, where we focused on adequacy of the disclosure of the related risks and management’s judgements.

Our observation

We concur with the recognition and measurement of the provisions to cover the expected settlement expense of the unit-linked exposure and the expected expenses for the leniency scheme. We found management’s valuation of the provision for the leniency scheme acceptable.

We considered the disclosure on the provision in note 7.5.16 and the disclosure on the remaining exposure in note 7.7.6.2. to be adequate.

Solvency II disclosure

Description

Solvency II information is considered to be an important addition to the information provided on an EU-IFRS basis. The Own Funds and Solvency Capital Requirement (SCR) are the main metrics of the Solvency II prudential reporting framework. After the acquisition of Aegon Nederland N.V., ASR Nederland N.V. uses a partial internal model (PIM) approved by the Dutch Central Bank (or DNB) to determine the capital requirements at Aegon Levensverzekering N.V. and Aegon Spaarkas N.V. For the other risks at the other insurance entities, the standard formula (SF) is applied.

The determination of the Solvency II ratio as well as the disclosed sensitivity of the Solvency II ratio is complex and highly judgemental and is based on assumptions which are affected by (future) economic, demographic and regulatory

conditions. The assumptions used relate to risks regarding interest, mortality, longevity, morbidity, catastrophe, lapse and expense as well as the diversification between these risks. The calculations also take into consideration taxation after shock (loss absorbing capacity of deferred tax; ‘LACDT’). Specifically, the following elements included within the calculation of the SCR give rise to a significant risk of error: LACDT, future management actions applied in shock scenarios and the diversification between the SF and PIM models.

Disclosure of the determination of the metrics, changes in the models and assumptions (including the use of the Volatility Adjustment and Ultimate Forward Rate) as well as the sensitivity applied are considered relevant information for understanding the Solvency II metrics.

Given the importance of these regulatory capital requirements for ASR Nederland N.V. and complexity of the application and estimates to determine the Solvency II ratio, we determined the reliability and adequacy of the Solvency II disclosure to be a key audit matter.

Our response

We obtained an understanding of the ASR Nederland N.V.’s application and implementation of the Solvency II directive.

We have assessed the design and implementation of the internal controls over the Solvency II calculations, including the model validation and assumption approval processes and management review controls.

These internal controls covered, among other things, the functioning of the Solvency II key functions on risk management and actuarial. In this context we performed corroborative inquiry with the Actuarial Function Holder and Risk Management Function Holder on their reports. This includes the Actuarial Function Holder report 2023, which sets out conclusions on the reliability and adequacy of the technical provisions as at 31 December 2023 under Solvency II.

Based on the outcome of our assessment of the effectiveness of the internal controls, we performed, among other procedures, the following substantive procedures:

assessing the appropriateness of evidence used and judgement applied in assumption setting for both the BEL and the SCR. This included the evaluation of the substantiation of the loss-absorbing capacity of deferred tax and the application of the future management action applied at disability income and life;

for the aggregation of the outcome of the standard formula and the Partial Internal Model of Aegon Levensverzekering N.V. and Aegon Spaarkas N.V., ASR Nederland N.V. uses the models of Aegon Nederland N.V. The model validation, one of the conditions of DNB approval for using this model, is finalised. The second line has assessed the model as acceptable. We have reviewed the model validation outcome;

verifying the consolidation of the Solvency II reporting by the Group’s components, taking into account the Solvency II-specific requirements for consolidation that deviate from EU-IFRS;

analysing the outcome of the internally prepared calculations and analysis of the movements in the Solvency II capital position during the year and sensitivities as at 31 December 2023 and discussing the outcome with the Group’s actuaries;

verifying that the Solvency II disclosure refers to the fact that the Solvency II ratio is not final until filed with the regulator, DNB. We refer to note 7.9.2.

Our observation

Overall, we found that the calculations of the Solvency II Own Funds and SCR in the risk and capital management disclosures are acceptable in the context of the financial statements. We refer to notes 7.8 and 7.9 of the financial statements.

Report on the other information included in the annual report

In addition to the financial statements and our auditor’s report thereon, the annual report contains other information.

Based on the following procedures performed, we conclude that the other information:

is consistent with the financial statements and does not contain material misstatements; and

contains the information as required by Part 9 of Book 2 of the Dutch Civil Code for the management report and other information.

We have read the other information. Based on our knowledge and understanding obtained through our audit of the financial statements or otherwise, we have considered whether the other information contains material misstatements.

By performing these procedures, we comply with the requirements of Part 9 of Book 2 of the Dutch Civil Code and the Dutch Standard 720. The scope of the procedures performed is less than the scope of those performed in our audit of the financial statements.

The Executive Board is responsible for the preparation of the other information, including the information as required by Part 9 of Book 2 of the Dutch Civil Code.

Report on other legal and regulatory requirements and ESEF

Engagement

We were initially appointed by the General Meeting of Shareholders as auditor of ASR Nederland N.V. on 22 May 2019, as of the audit for the year 2020 and have operated as statutory auditor ever since that financial year.

No prohibited non-audit services

We have not provided prohibited non-audit services as referred to in Article 5(1) of the EU Regulation on specific requirements regarding statutory audits of public-interest entities.

European Single Electronic Format (ESEF)

ASR Nederland N.V. has prepared its annual report in ESEF. The requirements for this are set out in the Delegated Regulation (EU) 2019/815 with regard to regulatory technical standards on the specification of a single electronic reporting format (hereinafter: the RTS on ESEF).

In our opinion the annual report prepared in XHTML format, including the (partly) marked-up consolidated financial

statements as included in the reporting package by ASR Nederland N.V., complies in all material respects with the RTS on ESEF.

The Executive Board is responsible for preparing the annual report including the financial statements in accordance with the RTS on ESEF, whereby the Executive Board combines the various components into one single reporting package.

Our responsibility is to obtain reasonable assurance for our opinion whether the annual report in this reporting package complies with the RTS on ESEF. We performed our examination in accordance with Dutch law, including Dutch Standard 3950N ‘Assurance-opdrachten inzake het voldoen aan de criteria voor het opstellen van een digitaal verantwoordingsdocument’ (assurance engagements relating to compliance with criteria for digital reporting). Our examination included among others:

obtaining an understanding of the entity's financial reporting process, including the preparation of the reporting package;

identifying and assessing the risks that the annual report does not comply in all material respects with the RTS on ESEF and designing and performing further assurance procedures responsive to those risks to provide a basis for our opinion, including:

obtaining the reporting package and performing validations to determine whether the reporting package containing the Inline XBRL instance document and the XBRL extension taxonomy files have been prepared in accordance with the technical specifications as included in the RTS on ESEF;

examining the information related to the consolidated financial statements in the reporting package to determine whether all required mark-ups have been applied and whether these are in accordance with the RTS on ESEF.

Description of responsibilities regarding the financial statements

Responsibilities of the Executive Board and the Supervisory Board for the financial statements

The Executive Board is responsible for the preparation and fair presentation of the financial statements in accordance with EU-IFRS and Part 9 of Book 2 of the Dutch Civil Code. Furthermore, the Executive Board is responsible for such internal control as management determines is necessary to enable the preparation of the financial statements that are free from material misstatement, whether due to fraud or error. In that respect the Executive Board, under supervision of the Supervisory Board, is responsible for the prevention and detection of fraud and non-compliance with laws and regulations, including determining measures to resolve the consequences of it and to prevent recurrence.

As part of the preparation of the financial statements, the Executive Board is responsible for assessing the ASR Nederland N.V.’s ability to continue as a going concern. Based on the financial reporting frameworks mentioned, the Executive Board should prepare the financial statements using the going concern basis of accounting unless the Executive Board either intends to liquidate ASR Nederland N.V. or to cease operations, or has no realistic alternative but to do so. The Executive Board should disclose events and circumstances that may cast significant doubt on the company’s ability to continue as a going concern in the financial statements.

The Supervisory Board is responsible for overseeing the ASR Nederland N.V.’s financial reporting process.

Our responsibilities for the audit of the financial statements

Our objective is to plan and perform the audit engagement in a manner that allows us to obtain sufficient and appropriate audit evidence for our opinion.

Our audit has been performed with a high, but not absolute, level of assurance, which means we may not detect all material errors and fraud during our audit.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. The materiality affects the nature, timing and extent of our audit procedures and the evaluation of the effect of identified misstatements on our opinion.

A further description of our responsibilities for the audit of the financial statements is located at the website of de ‘Koninklijke Nederlandse Beroepsorganisatie van Accountants’ (NBA, Royal Netherlands Institute of Chartered Accountants) at eng_beursgenoteerd_01.pdf (nba.nl). This description forms part of our auditor’s report.

Utrecht, 2 April 2024

KPMG Accountants N.V.

A.J.H. Reijns RA