Integration Aegon Nederland N.V.

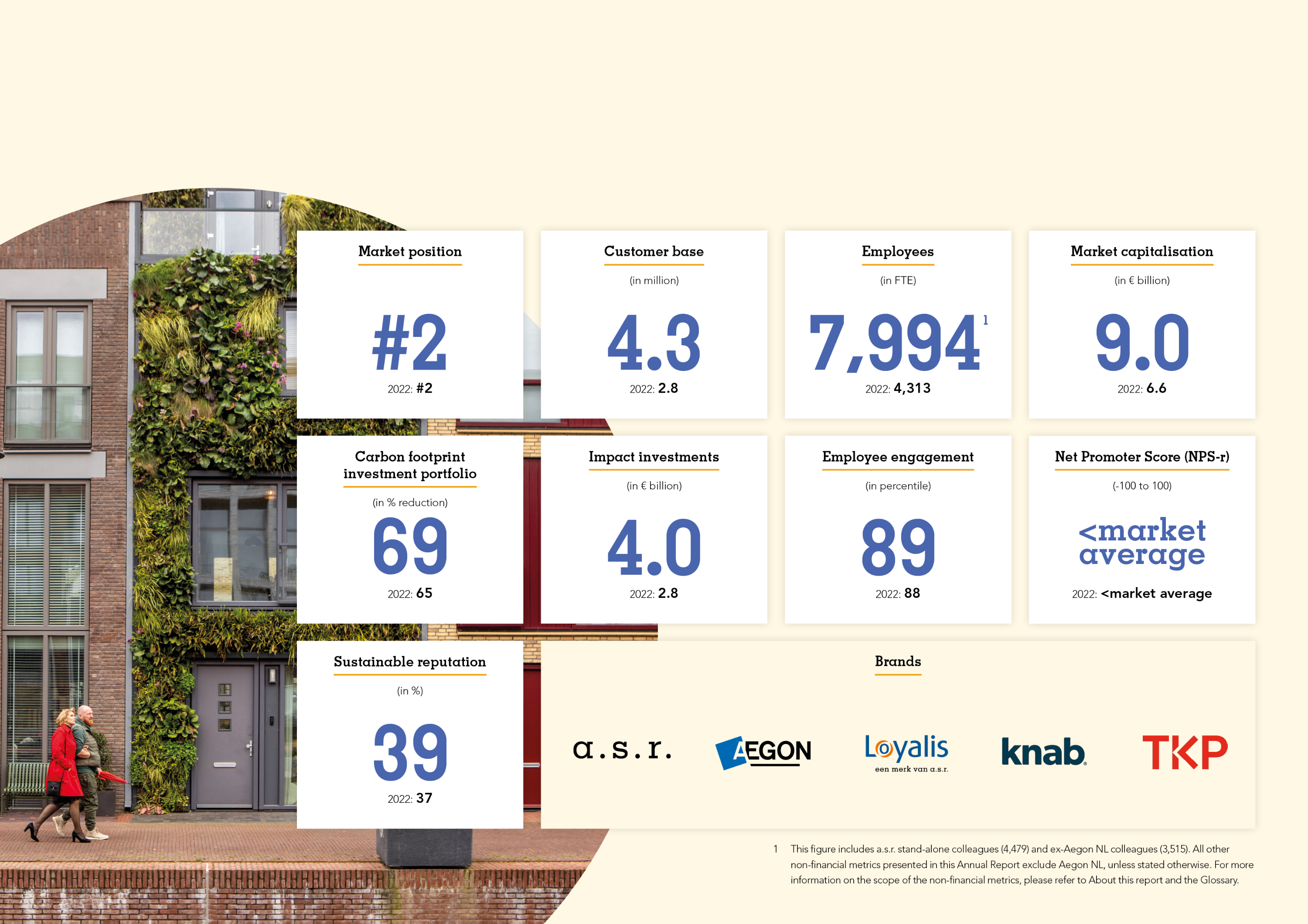

This section describes the business combination with Aegon Nederland N.V. and the first steps in the integration of both companies. In this Annual Report, the financial information for 2023 include ASR Nederland N.V. and its subsidiaries, including Aegon Nederland N.V. The non-financial information in this Annual Report covers ASR Nederland N.V. and its subsidiaries, excluding Aegon Nederland N.V., unless stated otherwise.

On 4 July 2023, ASR Nederland N.V. (hereafter: a.s.r.) announced that it had met all conditions required to complete the business combination with Aegon Nederland N.V. (hereafter: Aegon NL). As a result, the services of Aegon NL in Dutch non-life and life insurance, pensions, mortgages, banking, and distribution and services will be combined with a.s.r. The necessary regulatory approvals have been obtained from the Authority for Consumer & Market (Autoriteit Consument & Markt; ACM), while both the Dutch Central Bank and the European Central Bank issued statements of no objection to the acquisition. Since the works councils of a.s.r. and Aegon Group (former Aegon N.V.; hereafter: Aegon Ltd.) had previously issued a positive opinion, the transaction could be completed. From 4 July 2023 onwards, a.s.r. and Aegon NL began the integration of the two companies. The integration of the various parts of the business will be carried out in phases and with the utmost care for all stakeholders. The integration is expected to be completed by the end of 2026.

Strategic objectives

The combination with Aegon NL reinforces a.s.r.’s overall number two position in the Dutch market, providing a compelling in-market business combination that offers a.s.r. further opportunities to create a leading insurer in the Dutch market. It strongly aligns with the strategic positioning of a.s.r. across all key pillars, creating a robust business combination which is well positioned for the future, with sustainable value creation for all stakeholders. Leveraging its proven integration capabilities, a.s.r. is keen on developing further economies of scale with significant cost reduction potential. The adoption of a partial internal model (PIM) across the group will be accelerated to optimise capital efficiency and improve the sensitivities within risk models for Solvency II. The integration also enables a.s.r. to grow its talent pool with the employees of Aegon NL. The number of brands maintained will be limited. Dual branding in Pensions and Mortgages will exist for a maximum of three years, while some Aegon NL brands, such as TKP, Robidus, and Nedasco, will remain. For the distribution of its product offering, a.s.r. continues to use a multi-channel distribution strategy, leveraging the strengths of both companies in the mandated agents and intermediary channels. With regards to market and location, a.s.r. will continue to operate exclusively in the Dutch market with a concentration of activities at its headquarters in Utrecht.

Achievements to date

Since the announcement of the business combination, much progress has been made with respect to the integration. While receiving the regulatory approvals after the announcement of the transaction on 27 October 2022, a.s.r. worked hard to create a new target operating model which required integration plans from each business unit and staff function. To support these integration plans, transitional service agreements (TSAs) have been agreed between a.s.r. and Aegon Ltd. to safeguard business continuity. These TSAs will safeguard the availability of services between a.s.r. and Aegon Ltd. during the integration, such as IT infrastructure and asset management services. To ensure full disentanglement from Aegon Ltd. over the integration period, strict timelines and a strong governance have been put in place.

Since the completion of the transaction, the integration plans have been further specified. After a thorough and carefull process, the appointment of senior management was one of the first milestones in the integration process. Furhtermore, a.s.r. has been able to validate its integration plans bottom-up, and during the Investor Update on 30 November 2023 a.s.r. confirmed that the initial target run-rate synergies of € 185 million is further increased to € 215 million. To achieve these synergies, the Integration Management Office monitors overall progress, with a focus on value delivery. This enables management to adequately steer in the event of deviations.

In support of the integration plans, and more specifically the IT migrations, choices were made on all major backend systems. Contracts with vendors were (re)negotiated and migration architecture designs drawn out. The IT plans have been internally and externally vetted and the first migrations, such as the HR systems, have already been executed. This marks an important proof point for the road ahead.

A major step in the overall integration was reached on 1 October 2023, when the legal integration of the two Holdings and two Non-life entities were finalised. This also marked the employer integration. From this point onwards, further organisational steps have been taken, creating the outlines of the new combined organisation. 24 requests for advice have been submitted to the Work Council. Full integration will require additional phases which will follow in line with business migrations.

What's next?

The employees of a.s.r. and Aegon NL are key to making the integration a success. For this goal, a.s.r. is strongly focused on defining and fostering a renewed culture. With the addition of Aegon NL, a.s.r. will grow the talent pool and needs to ensure employee engagement over the integration period. The Management Board (MB) will closely monitor the key metrics in this regard, including eMood, turnover, and sick leave to ensure that employee engagement remains at pre-integration levels.

For business lines, the next steps in the integration are focused mainly on migrating products and policies from the Aegon NL administrative systems to the target systems – mostly based on the a.s.r. IT landscape, followed by a decommissioning. Completion of the decommissioning is anticipated to be finalised in 2026. This includes the decommissioning of legacy systems and all IT infrastructure services currently consumed via TSAs. All business lines and staff functions have given their firm commitment to reaching the overall timelines.

Through its commitment, a.s.r. is also dedicated to ensure a seamless integration for its end customers and intermediaries. The necessary adjustments to a.s.r.’s new products will be implemented as seamlessly as possible, to provide a warm welcome to Aegon NL customers. a.s.r. organised numerous information sessions throughout 2023, specifically tailored for intermediaries to keep its business partners well-informed about the integration progress, and how they can best support their clients during this transition. a.s.r. plans to continue these sessions during the remainder of this integration, while migrating the business portfolios.

For the Asset Management business segment, a.s.r. will further develop its way of working, collaboration and product offerings with Aegon Asset Management to deliver integrated product solutions for the IORP offering of Aegon Cappital and a.s.r.’s mortgage funds.

The Integration Management Office and various other governing bodies have been created to oversee and steer all integration efforts. Quality assurance is safeguarded via the involvement of the first line Risk & Control (ERC), second line Group Risk Management (GRM), Compliance and third line Internal Audit. GRM has organised monthly dedicated risk meetings, while audit involvement is focused around quality control for data migrations. Progress with regard to the integration is also discussed at senior management level through steering committees that report to the MB, to ensure sufficient management awareness. Each business line and staff function has a director who is responsible for the delivery of the integration plan and synergy targets. Overall, a.s.r. has committed and executed on the planned milestones thus far and organised itself for the upcoming three years to continue to deliver on the planned integration path ahead.

Financial information

a.s.r. has integrated the financial information in accordance with legislation. Further financial updates are to be expected towards the summer of 2024, when a.s.r. organises a capital markets day at which it will present the updated strategy and new medium-term targets, both financial and non-financial.

Non-financial information

Based on the arguments mentioned below, a.s.r. is convinced that combining the non-financial (quantitative) information would reduce clarity and informative value for stakeholders. It has therefore chosen to present the Aegon NL figures for 2023 in a separate table.

This decision is driven by:

The non-financial topics reported by Aegon NL do not fully correspond to the topics reported by a.s.r. This is partly due to the fact that different topics were reported to varying levels of detail in the past and partly due to differences in definitions and measurement methods. As a result, the data from both companies cannot be added up to a single total;

a.s.r. has obtained external assurance (partly limited/partly reasonable) on the reported non-financial information in recent years. Aegon NL has no assurance on the historical non-financial information;

From 2024 onwards, reporting will be carried out on the entire organisation (a.s.r. and Aegon NL). The process of integrating the non-financial information of a.s.r. and Aegon NL takes place simultaneously with the preparations for Corporate Sustainability Reporting Directive (CSRD) reporting, which requires that the scope of consolidation is the same as for the financial statements.

The non-financial figures for Aegon NL is can be found in section 8.8. This information is not in scope of the assurance procedures from the external auditor. All non-financial information in the rest of this Annual Report - other than section 8.8 - exclude Aegon NL, unless stated otherwise.

This page is intentionally left blank.