As a real estate investor, a.s.r. recognises its responsibility in contributing towards liveable and sustainable buildings, towns, cities and communities. By investing in appropriate and sustainable real estate, a.s.r. aims to make a positive impact on the built environment, for current and future generations. In 2023, a.s.r. refined its real estate ESG vision and came up with four strategic themes:

Reduce energy intensity & greenhouse gas (GHG) emissions;

Adapt to climate change & related risks;

Regenerate biodiversity & ecosystems;

Improve well-being & social equality.

These themes have been translated into ambitions. The various objectives are reviewed annually for their contribution to the long-term strategy and tightened where necessary.

Reduce energy intensity & GHG emissions

a.s.r. committed to a GHG neutral real estate portfolio in 2045 and is decarbonising its portfolio to reach this goal. To meet it, a.s.r. has drawn up a Paris-Proof roadmap for each asset type, using Carbon Risk Real Estate Monitor (CRREM) pathways. These pathways were developed by the EU to help investors in real estate measure their exposure to emission-related risks. The Paris-Proof roadmaps are based on the current energy intensity and reduction measures at the level of individual assets.

a.s.r. invested in a new software platform for ESG data, enabling the Funds to use a highly visual online dashboard. This has led to improved insights at the level of both the portfolio and individual assets, allowing the Funds to increase their focus on properties with higher energy intensity levels and leading to a cost-efficient reduction path.

In the coming years, a.s.r. real estate will continue to execute asset-level reduction strategies and refine the Paris-Proof roadmaps with annual consumption data, lessons learned and evolving insights.

Renewable energy

a.s.r. owns four wind farms and one solar park. As a result, a.s.r. owns 48 wind farm turbines and 60,000 solar panels with a combined capacity of 205 megawatts, and generates power equivalent to the annual consumption of 218,000 households per year. In 2023, a.s.r. installed 2,367 solar panels on roofs of its own real estate objects, bringing the current total to 22,940. In this way, a.s.r. contributes towards the energy transition and a more sustainable living environment.

Adapt to climate change & related risks

As the impact of climate change becomes more evident, the importance of a resilient portfolio equally becomes increasingly important. By understanding and anticipating the long-term risks of climate change, a.s.r. strives to build a portfolio that is progressively adaptable in order to ensure long-term sustainability, resilience and profitability.

a.s.r. conducted comprehensive climate risk assessments for all properties in its portfolio based on the Framework for Climate Adaptive Buildings (FCAB). This assessment identifies vulnerabilities to climate-related impacts, including four major climate risks: heat, drought, flooding and extreme weather. The climate risk score is based on:

The environmental score is an estimate of the climate effects for the immediate vicinity of a building;

The building score is an estimate of the vulnerability of a building to the various climate effects, based on building-specific characteristics.

a.s.r. identified the assets which are exposed to high risks and defined a risk appetite to determine the extent to which climate risks are acceptable and what actions are appropriate to mitigate climate risk as effectively as possible.

Regenerate biodiversity & ecosystems

Biodiversity is a fundamental pillar of ecological balance and sustainability. Loss of biodiversity leads to adverse impacts on the wellbeing and quality of life, as well as on food security, resilience to natural disasters and the availability of water and resources. The built environment disrupts important habitats for animal and plant species. a.s.r. therefore aims to contribute as far as possible to conserving and enhancing the biodiversity on and around its properties.

a.s.r. has drawn up a Biodiversity Framework in collaboration with an external ecologist to further improve the biodiversity of its portfolio. This Framework contains quantitative and qualitative guidelines to increase the natural variation on and around properties. a.s.r. will further implement this framework in its day-to-day operations.

Rewarding sustainable farming

The ASR Dutch Farmland Fund has a reward system for its farmers who operate sustainably, to help safeguard the continuation of farming and challenge climate change and the loss of biodiversity. Under certain conditions, new and current lessees who comply with certain sustainability requirements such as using sustainable fertilisation can be awarded discounts of 5%-10% on the ground rent they pay for leasing land. In 2023, 84 new green lease contracts were concluded, representing 86% (1,335 of 1,546 hectares) of the new contracts. The total number of green lease contracts is 331 (6,004 of 37,646 hectares).

Embodied carbon: the next step in decarbonising a.s.r.'s portfolio

In the Netherlands, 11% of total GHG emissions take the form of embodied carbon emissions. Embodied carbon emissions are GHG emissions arising from the extraction, production, transportation and assembly of construction materials, but also from dismantling and demolition processes.

a.s.r. has undertaken a study to identify and evaluate existing standards for measuring and limiting embodied

carbon. Currently, the Dutch Green Building Council (DGBC) standard is the most suitable standard for real estate in the Netherlands. It uses a Global Warming Potential (GWPa) indicator and establishes target values for embodied carbon per asset type.

a.s.r. is assessing the integration of the GWPa indicator in its acquisition and renovation plans. The goal is to collect project data and challenge partners to adopt an integrated approach that addresses both operational and embodied carbon emissions.

Improve well-being & social equality

To ensure liveable and sustainable buildings and communities, a healthy living environment and social equality are key. Equal treatment and opportunities for all are not self-evident. a.s.r. makes a positive contribution to social issues by investing in affordable dwellings and housing for senior citizens. It extends its portfolio to include dwellings in these segments and takes these needs into account in its rental policy.

a.s.r. believes that tenants who are more involved with their buildings, environment and landlord are more satisfied and aware. a.s.r. focuses on improving tenant satisfaction, health and wellbeing, and awareness of sustainable living. a.s.r. therefore works continuously on a participation programme involving various forms of tenant participation. Activities range from taking an active role in sustainability projects and tenants’ associations to ESG newsletters and tenant events.

Impact investments

The GIIN defines impact investments as: Investments made in companies, organisations and funds with the intention of generating positive, measurable social and environmental impacts alongside a financial return. This definition is used by a.s.r. to calculate a quantifiable impact investment for real estate activities.

In 2023, a.s.r. focused on the following real estate impact themes:

Affordable housing;

Dutch Science parks;

Renewable energy;

International non-listed real estate;

Sustainable mobility.

Affordable housing

The ASR Dutch Core Residential Fund has a clear focus on affordable housing. The Fund designates rents of up to € 1,350 as affordable, and keeps a considerable part of the portfolio in this segment. To keep affordable dwellings in the standing portfolio affordable in future, the Fund implements moderate rental increases, caps rents in line with current market trends and actively lowers living costs by implementing energy-saving measures.

Dutch Science parks

The ASR Dutch Science Park Fund strives to make a positive societal impact by encouraging the further development of science parks in the Netherlands by investing in real estate for the broad range of functions that are needed for science park ecosystems to thrive. By doing so, the Fund provides room for companies to work on a wide range of innovative and sustainable products and solutions that contribute to a better world.

Renewable energy

ASR Renewables makes impact investments through acquiring and managing wind parks and solar farms. In this way, a.s.r. is contributing to the energy transition and a sustainable living environment.

International non-listed real estate

a.s.r.'s strategic asset allocation in real estate includes an allocation to European non-listed real estate. Within these investments, there are opportunities for achieving impact through the following themes: Affordable Housing, Green Buildings and Health. a.s.r. intends to increase the assets which meet the criteria of these themes over the coming years.

Sustainable mobility

The ASR Dutch Mobility Office Fund makes a positive environmental impact through enabling CO2 emission reductions for tenant employee mobility to the Fund’s office buildings. The Fund does this by investing exclusively in offices located on public transport hubs, adding office stock on these locations, and through specific measures aimed at stimulating sustainable mobility for each of the Fund’s office buildings.

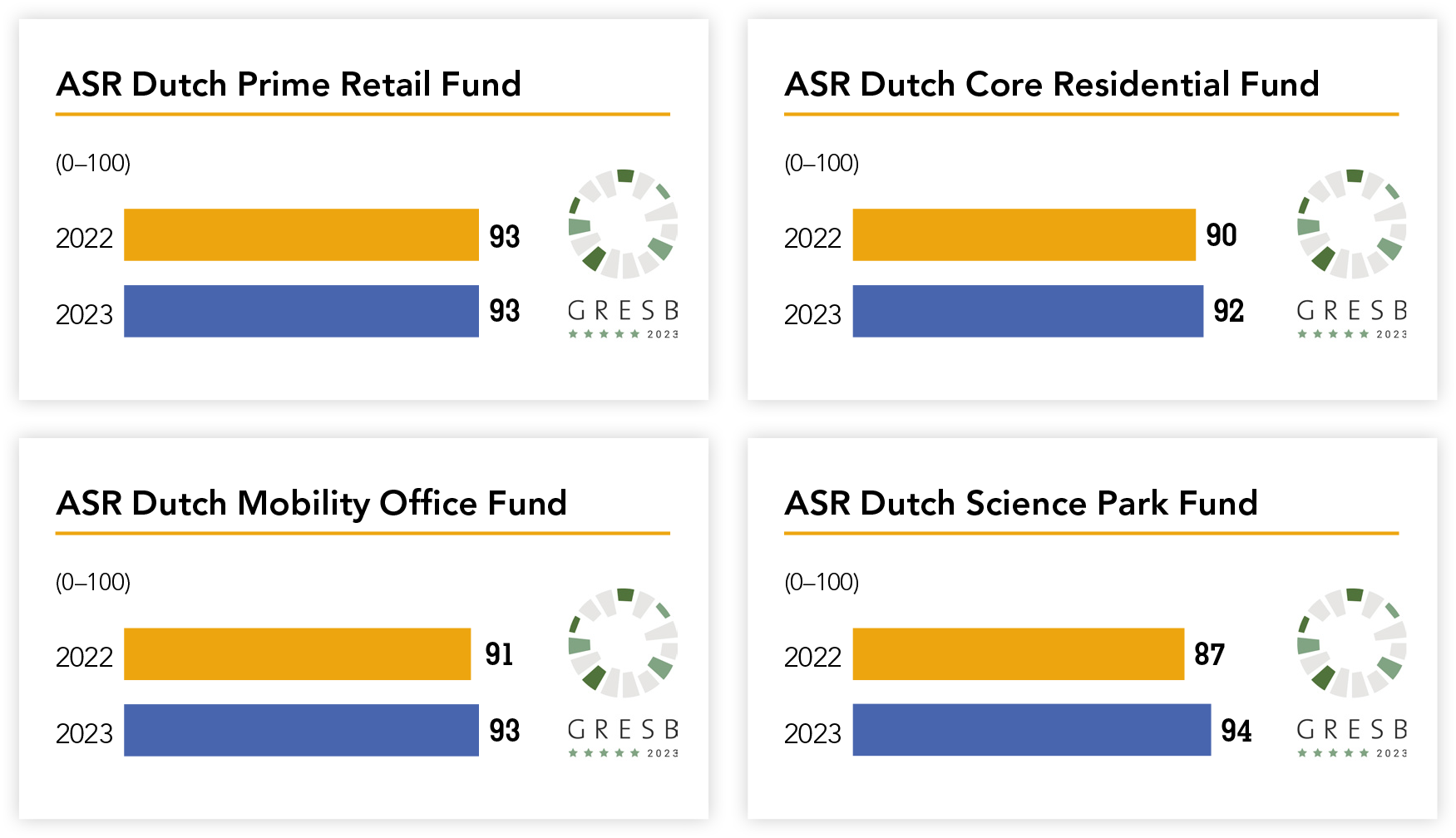

Sustainable investing – GRESB benchmark

The real estate funds were assessed for their sustainability by the Global Real Estate Sustainability Benchmark (GRESB) in 2023. The ASR Dutch Prime Retail Fund (ASR DPRF), the ASR Dutch Core Residential Fund (ASR DCRF), the ASR Dutch Mobility Office Fund (ASR DMOF) and the ASR Dutch Science Park Fund (ASR DSPF) were each awarded the maximum score of five stars, placing them in the top 20% of best performing funds. The ASR Dutch Science Park Fund (DSPF) improved from four stars in 2022, was first in its peer group and appointed as global sector leader.