The remuneration of current EB members is in accordance with the remuneration policy. Neither a.s.r. nor any Group company provides any loans, advances or guarantees on behalf of an EB member.

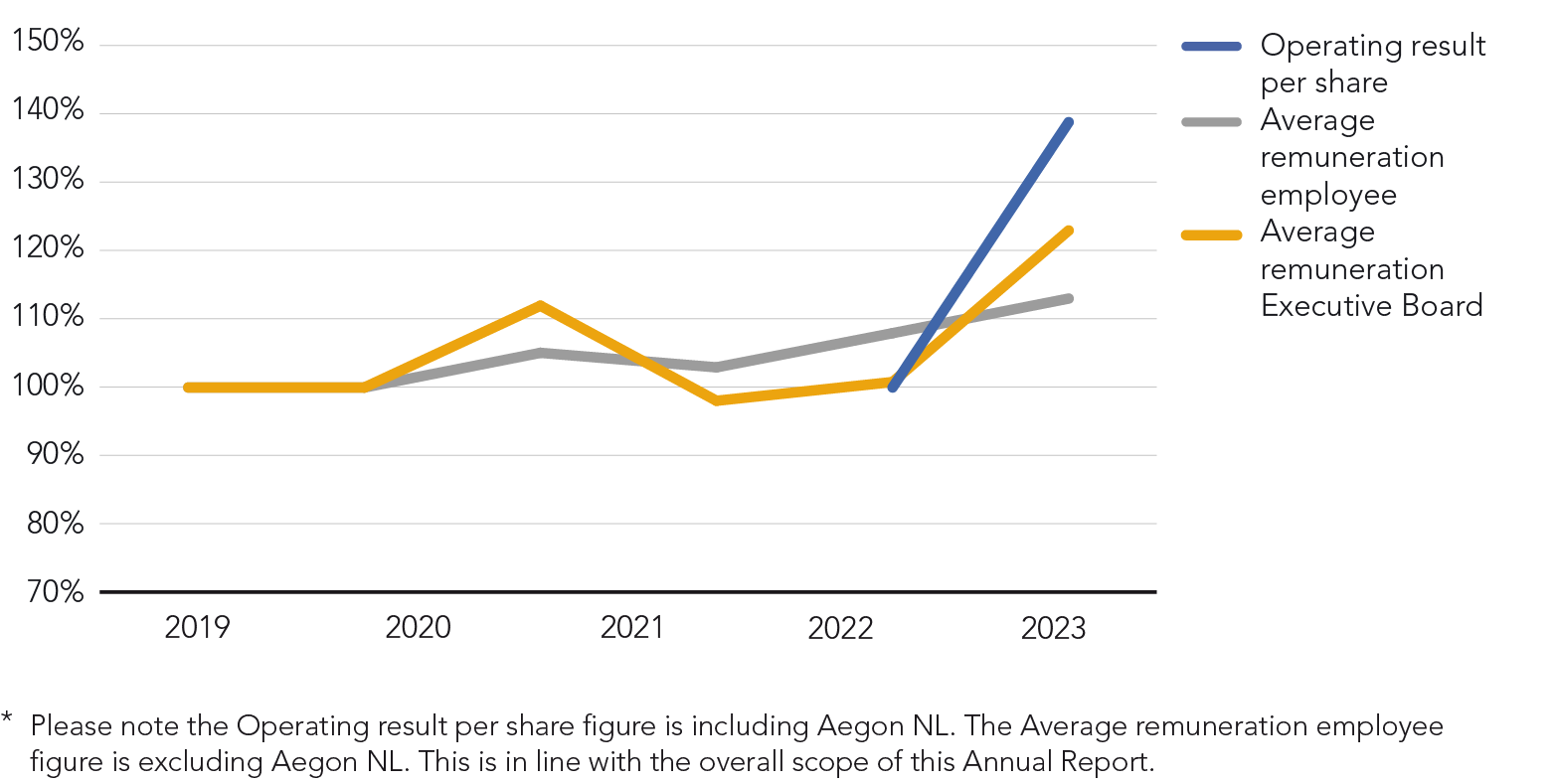

The comparative chart below shows the remuneration and company performance over the last five reported financial years. Company performance is expressed in terms of operating result per share. The average remuneration of employees (who are not EB members) is also shown, and this is also used to calculate the pay ratio. Finally, the average EB remuneration (CEO and CFO) is presented.

The full remuneration policy can be found at www.asrnl.com.

Pensions

The calculation of annual pension expenses is based on the total pension rights granted during a term of service at a.s.r. Pension expenses include:

Pensions based on a maximum pensionable salary cap (€ 128,810, fiscal maximum);

Compensation for the maximum pensionable salary cap (to be used for pensions at the employee’s discretion);

Pension benefits related to historically awarded pension rights;

VPL (early retirement and life cycle; ‘VUT, Prepensioen en Levensloop’).

All components of EB remuneration are included in the basis used for calculating pension benefits. EB members have the same pension scheme as a.s.r. employees.

In 2022, a.s.r. and the labour unions came to an agreement (and thereby a commitment) to add additional funds to the indexation of the defined benefit plan, which until the commitment could not be allocated to the individual participants in the defined benefit plan. As a result of the commitment, the indexation granted to EB members in 2023 is as following: Jos Baeten € 253,853 and over 2022 € 234,351, Ewout Hollegien € 4,880 and over 2022 € 6,866 and Ingrid de Swart € 751 and over 2022 € 823. In addition, the indexation granted in 2023 to former EB members who are participants in the defined benefit plan is € 1,256,396 and over 2022 € 1,503,676.

Remuneration in 2023

Based on the benchmark and in line with the remuneration policy, the CEO’s salary scale is currently between € 977,412 and € 1,396,304. For the CFO and the COO/CTO, a salary scale of € 757,871 to € 1,082,673 applies. The benchmark is set every two years. The positioning, scale maximum and resulting bandwidth of the scales are then assessed and may be adjusted in relation to the resulting median.

The reference group 2023, which consists of 16 companies and the Europe Control group currently consists of 16 financial companies.

| Organisation | Index |

|---|---|

| Aalberts N.V. | AMX |

| ABN AMRO Bank N.V. | AEX |

| Achmea B.V. | Not listed |

| Aegon Ltd. | AEX |

| ASM International N.V. | AEX |

| Coöperatieve Rabobank U.A. | Not listed |

| De Volksbank N.V. | Not listed |

| IMCD N.V. | AEX |

| ING Groep N.V. | AEX |

| JDE Peet's N.V. | AMX |

| Koninklijke KPN N.V. | AEX |

| Koninklijke Vopak N.V. | AMX |

| NN Group N.V. | AEX |

| OCI N.V. | AMX |

| Signify N.V. | AMX |

| Van Lanschot Kempen N.V. | Not listed |

| Organisation |

|---|

| Ageas SA/NV |

| Bâloise Holding AG |

| Beazley plc |

| Direct Line Insurance Group plc |

| Gjensidige Forsikring ASA |

| Grupo Catalana Occidente, S.A. |

| Hannover Rück SE |

| Helvetia Holding AG |

| Hiscox Ltd |

| Phoenix Group Holdings plc |

| SCOR SE |

| Storebrand ASA |

| Tryg A/S |

| Unipol Gruppo S.p.A. |

| UnipolSai Assicurazioni S.p.A. |

| Wüstenrot & Württembergische AG |

2023 was a phenomenal year for a.s.r. with strong financial results. Also the closing of the acquisition of Aegon Nederland N.V. was achieved on schedule in July. Various integration milestones were also achieved with tight deadlines. The employer integration on 1 October 2023 is one example, as is the HR payroll migration per January 2024. Further to the advice of the Remuneration Committee, it was therefore decided to grant a salary increase of 6% to all members of the EB as of 1 January 2024.

Furthermore, under the CLA (applicable from 1 January 2023 until 1 July 2024), a.s.r. employees were given an indexation of their salary of 3% from 1 July 2023. This increase also applies to EB members.

Remuneration in a.s.r. shares

As from 1 July 2023, part of the (fixed) remuneration of the EB members is paid in a.s.r. shares, being 20% of the fixed cash remuneration. For the current CEO, an exception applies until the end of his term of appointment (2026 AGM): 30% of his fixed cash remuneration is paid in a.s.r. shares. All shares must be held for at least five years. Furthermore, EB members (as long as they are employed) must hold at least 100% of their fixed gross annual salary in shares before they are allowed to sell any shares. Any sale of shares is subject to the a.s.r. regulations on the handling of private transactions in financial instruments and applicable law. The following table shows how much remuneration for each EB member was paid in a.s.r. shares in 2023.

Participation in a.s.r. shares

Until the amendment of the remuneration policy as per 1 July 2023, EB members were committed to purchasing a certain percentage of their remuneration in a.s.r. shares (75% for the CEO and 50% for other EB members) and holding these shares for at least five years. The shares are not variable remuneration, nor a remuneration in shares.

The number of shares that are allocated (granted) to EB members are calculated as a function of (1) the defined percentage of the fixed salary at allocation date and (2) the applicable stock price at Euronext. The applicable stock price is defined as the opening stock price on the 1st trading day after the salary-payment date in each month. The salary payment dates are pre-defined in the salary payment schedule and set by the Human Resources department. The shares are purchased by the EB at a discount of 18.5%. The average grant price of the shares was € 32.12, which is equal to the opening stock price on the Euronext Amsterdam stock exchange on the 1st trading day after the salary-payment date in each month in the period July to December 2023, taken into consideration the aforementioned discount. The shares granted in 2023 relate to the period July-December, as the modified remuneration policy came into force. The shares are in a lock-up period of five years.

The participation of shares of the EB can be found in the table on the next page.

| (in €) | As at 1 January 2023 | Participation in a.s.r. shares in 2023 | Granted and vested in 2023 | As at 31 December 2023 | In % of gross annual salary1 |

|---|---|---|---|---|---|

| Jos Baeten | 8,827 | 1,386 | 2,471 | 12,684 | 40.3 |

| Ewout Hollegien | 911 | 729 | 1,252 | 2,892 | 14.0 |

| Ingrid de Swart | 3,810 | 729 | 1,350 | 5,889 | 24.1 |

| Total | 13,548 | 2,844 | 5,073 | 21,465 | |

- 1 Base salary in cash and shares

| (in € thousands) | Fixed remuneration | Variable remuneration | | | | | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Executive Board member | Base salary in cash | Base salary in shares | Fees | Fringe benefits1 | One-year variable | Multi-year variable | Extraordinary items | Pension expense2 | Total remuneration | Fixed portion of the total remuneration |

| Jos Baeten, CEO | 1,033 | 157 | - | 15 | - | - | - | 264 | 1,469 | 100% |

| Ewout Hollegien, CFO | 756 | 80 | - | 24 | - | - | - | 100 | 960 | 100% |

| Ingrid de Swart, COO / CTO | 846 | 86 | - | 24 | - | - | - | 161 | 1,117 | 100% |

| Total | 2,635 | 323 | - | 63 | - | - | - | 525 | 3,547 | 100% |

- 1 Variations arise as a result of the fiscal treatment of lease vehicles depending on the price and private use of the car, personal allowance and social security.

- 2 The post-employment defined benefit plan of a.s.r. ended 31 December 2020. A new defined contribution plan started from 1 January 2021. The defined benefit obligation will continue to exist, but no further regular annual premium contributions will be paid to the plan. All members of the Executive Board participate in the defined contribution plan. The annual pension expenditure is based on a premium table. Further changes in the cost of pension benefits are mainly due to the impact of age. The pension costs include defined contribution pensions based on maximum pensionable salary cap, compensation for the maximum pensionable salary cap (to be used for pensions at the employees’ discretion in total), and VPL. The amount presented is excluding amounts related to the indexation of the defined benefit plan, as they are not expenses in the current year.

| (in € thousands) | Fixed remuneration | Variable remuneration | | | | | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Executive Board member | Base salary in cash | Base salary in shares | Fees | Fringe benefits1 | One-year variable | Multi-year variable | Extraordinary items | Pension expense2 | Total remuneration | Fixed portion of the total remuneration |

| Jos Baeten, CEO | 946 | - | - | 14 | - | - | - | 255 | 1,215 | 100% |

| Ewout Hollegien, CFO | 664 | - | - | 23 | - | - | - | 82 | 769 | 100% |

| Ingrid de Swart, COO / CTO | 777 | - | - | 19 | - | - | - | 152 | 948 | 100% |

| Total | 2,388 | - | - | 55 | - | - | - | 489 | 2,932 | 100% |

- 1 Variations arise as a result of the fiscal treatment of lease vehicles depending on the price and private use of the car, personal allowance and social security.

- 2 The post-employment defined benefit plan of a.s.r. ended 31 December 2020. A new defined contribution plan started from 1 January 2021. The defined benefit obligation will continue to exist, but no further regular annual premium contributions will be paid to the plan. All members of the Executive Board participate in the defined contribution plan. The annual pension expenditure is based on a premium table. Further changes in the cost of pension benefits are mainly due to the impact of age. The pension costs include defined contribution pensions based on maximum pensionable salary cap, compensation for the maximum pensionable salary cap (to be used for pensions at the employees’ discretion in total), and VPL. The amount presented is excluding amounts related to the indexation of the defined benefit plan, as they are not expenses in the current year.