Governance

Within the Executive Board (EB), the CEO has final responsibility for the sustainability theme. The EB shares responsibility for the implementation of the business strategy and is supported in its implementation by the Business Executive Committee (BEC). The Sustainability Workforce and the TCFD Working Group support the BEC in its responsibility for policy development and implementation. TheSustainability Workforce reports quarterly on the climate targets and other sustainability targets and KPIs to the BEC. The BEC discusses the results together with the risks and makes adjustments where necessary. In 2021, an ESG committee was established within the Supervisory Board (SB). This Nomination & ESG Committee advises and supports the SB with its supervisory role regarding ESG developments and results of the sustainable business strategy.

Strategy

a.s.r.’s climate policy consists of four strategic pillars, through which a.s.r. manages the risks associated with its investments and insurance products, while at the same time aiming to contribute to solutions.

Helping customers to prevent or reduce climate risks.

Stimulating the energy transition.

Incorporating climate risks into business processes.

Contributing to sector initiatives.

The Climate report 2021 explains how a.s.r. gives substance to these pillars.

For a.s.r., climate change is a direct risk, both to its assets and liabilities.

Asset Management

Since 2018, a.s.r. validates its investment strategy by analysing the impact on various metrics in its RAS due to climate change, based on climate scenario sets. a.s.r. has incorporated the impact of the different climate pathways on all assets in the annual SAA study.

a.s.r. considers itself resilient to climate change under different climate scenarios. The impact of the three climate pathways on the Solvency II ratio and the average return on capital is limited. The main reasons for the limited impact are: the European focus of the investment portfolio, the ESG policy and the dynamic investment policy. a.s.r. invests less in countries, markets and companies that are hit harder. The dynamic investment policy also provides for de-risking in the event of falling solvency due to climate change.

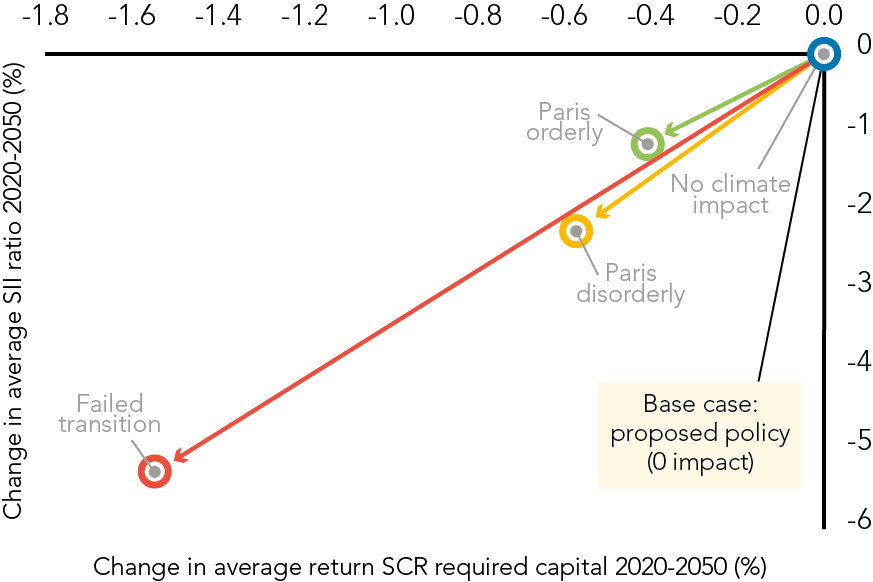

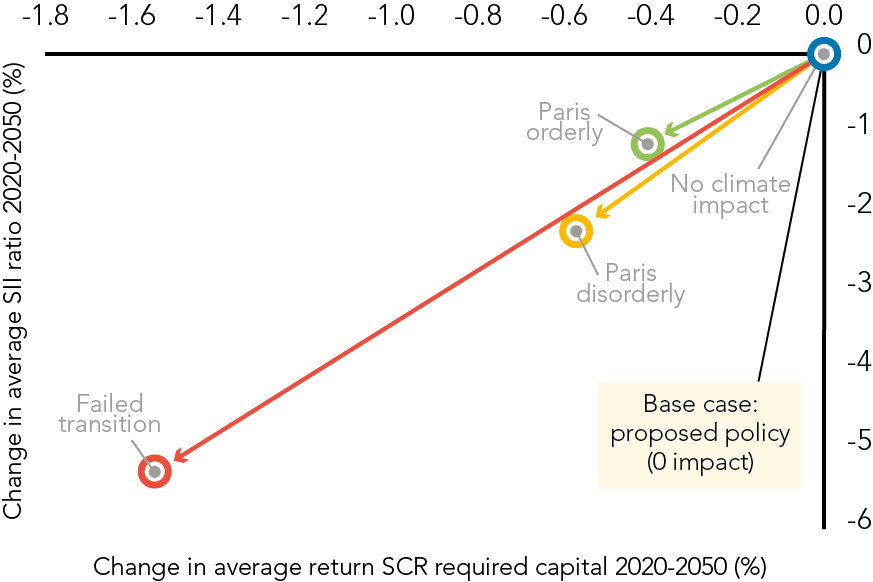

Average SCR ratio vs. average return on SCR

The return on SCR (Solvency Capital Requirement) becomes lower as the Paris Agreement target is not achieved. This is due to the direct impact of physical risks and therefore also indirectly due to a decrease in return expectations under the different climate pathways.

Within the Paris disorderly scenario, abrupt sales of stranded assets are expected around 2025. This will cause a major financial crisis. The solvency development in that period is slightly different, but because of the ESG policy a.s.r. is well able to withstand this.

A failed transition to the Paris Agreement is a.s.r.’s largest risk. In such a case the average SCR ratio will fall more sharply as a result of lower returns due, in particular, to physical risks.

Real Estate

Climate change poses risks to the built and rural property managed by a.s.r. Physical risks include inundation from large amounts of precipitation, but also drought, heat and flooding can cause damage to buildings, land and its users. Attention is also paid to transition risks involving financial investments. For example, new legislation and regulations are being drawn up at the national and international level in the context of making real estate more sustainable and reducing chemical substances such as PFAS and NO2. In addition to applicable legislation and regulations, a.s.r. real estate contributes to the energy transition and a sustainable living environment through investments in wind and solar parks, and a.s.r. works with the agricultural sector on sustainable soil management and increasing biodiversity. In addition, a.s.r. is constantly working on making the homes and buildings in its property portfolio more sustainable.

High risk of flooding

(in % of mortgages)

0.11

High risk of flooding

(in % of mortgages)

0.11

Mortgages

Physical climate risks within the mortgage portfolio may be caused by damage to houses due to climate-related events, which either lead to a decrease in the value of the collateral and / or affect homeowners’ ability to pay or repay their mortgage. The floods in Limburg in the summer of 2021 showed that much of the damage caused by floods may be covered by insurance, provided the damage comes from secondary flood defences. In addition, the government stepped in for uninsurable risks, such as flooding from primary water defences. The climate risks analysed relate to heat stress and water damage in 2050. The greatest climate risk is that of flooding, as the collateral may become damaged or uninhabitable. For the a.s.r. portfolio, 0.11% of the homes are at high risk of flooding and 5.94% of the homes are at medium risk. High risk within this portfolio is >1/30 per year and medium risk is 1/30 to 1/300 per year. On none of the tested risks does a.s.r.’s portfolio run a significantly higher risk than the average Dutch residential portfolio.

In order to make homes more sustainable, a.s.r. helps its mortgage customers to obtain financing on favourable terms.

P&C

Climate risks also affect non-life insurance. P&C takes into account the increasing climate influences in its medium and long-term strategy. In the short and medium-term, a.s.r. identifies risks in fire and traffic products, among others, due to an increase in extreme weather. This results in more and higher claims. In the medium-term, a.s.r. may also be confronted more frequently with floods from non-primary water defences and the resulting cost of claims. P&C regularly determines the total loss ratio per product in relation to climate change over the past period and makes forecasts for several years for setting its premiums, among other things using Royal Netherlands Meteorological Institute (KNMI) data.

For the longer term, a.s.r. used climate analyses. On the basis of several climate scenarios, these analyses provided insight into the long-term effects of climate risks in the Netherlands. These insights are used in a.s.r.’s long-term calculations and thus have an effect on long-term premiums, long-term cover, and acceptance policy and reinsurance strategy for non-life products that involve climate cover. This analysis showed that reinsurance continues to provide sufficient cover for the increasing physical risks.

Increasing legislation and regulations, as well as new risks resulting from the energy transition and new sustainable technologies, constitute transition risks for the P&C business.

In order to reduce risks, a.s.r. continuously monitors developments in climate influences and adjusts its acceptance policy (underwriting), products, claims handling and means of communication accordingly. In addition, a.s.r. encourages its customers to take preventive measures in order to avoid damage, e.g. by providing tailor-made advice during inspection visits.

Risk management

To fully understand the potential physical and transition impacts of climate change on its business, a.s.r. has developed a top-down and bottom-up management approach.

The bottom-up approach revolves around the relevant business lines within a.s.r. developing measures and tools to mitigate identified climate-related risks or capture its opportunities. This ranges from portfolio construction, exclusions and engagement within its asset management business, to underwriting taking into account climate risks, client engagement and developing new products and services within mortgages and P&C businesses.

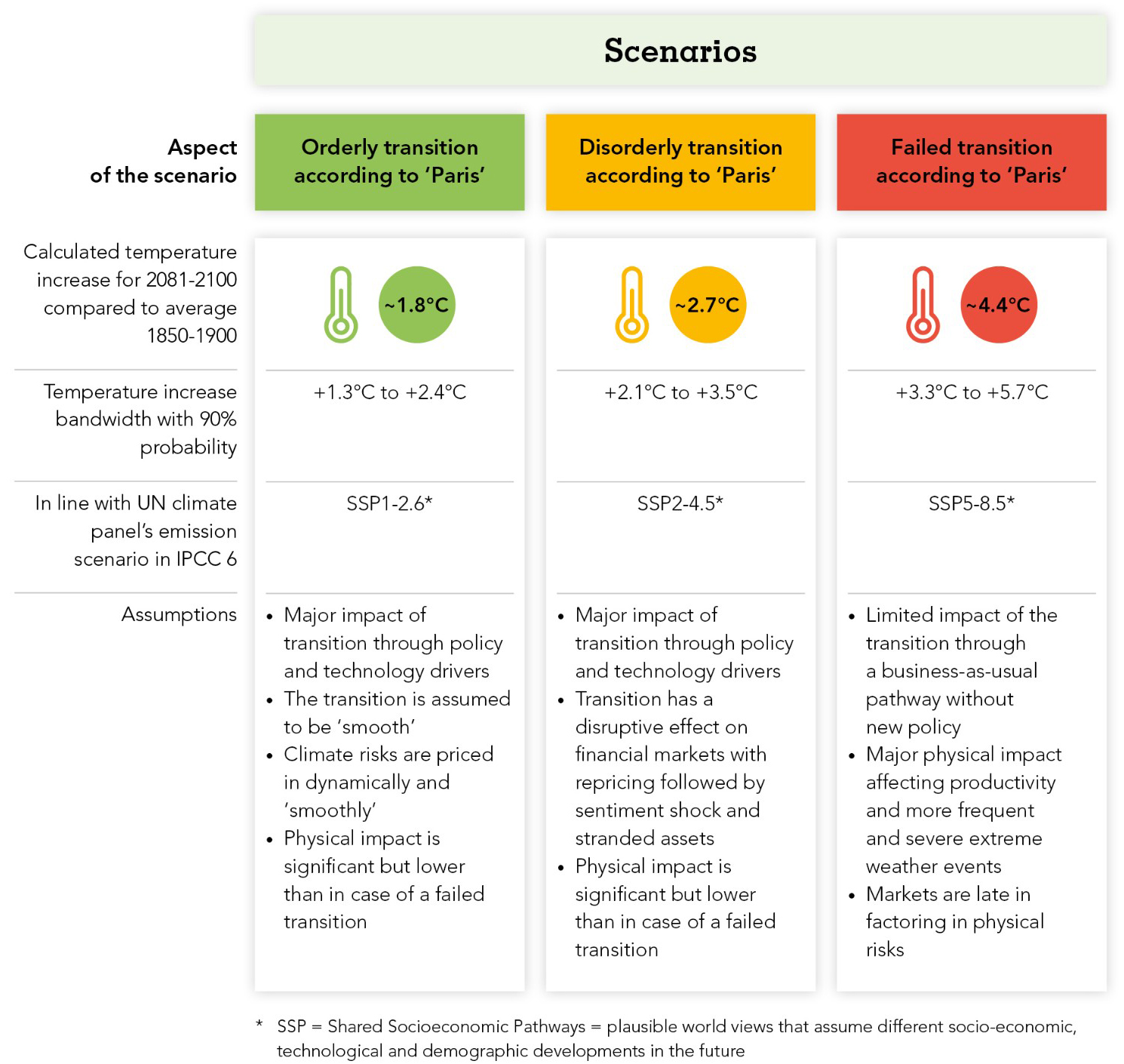

In the top-down approach a.s.r. has since several years made use of scenario-driven insights into the resilience of the business, mainly focused on the impact of climate change on assets. This is done by three climate scenarios with a 30-year horizon based on the SAA 2021 model:

The Climate Risk Monitor was developed to manage climate risks within the urban property portfolio. This is an analysis tool for decision-making in acquisitions, disinvestments and portfolio maintenance. The Climate Risk Monitor contains building-specific data combined with climate data from the Climate Effect Atlas. These datasets are then combined in the Geographic Information System (GIS) to generate cartographic layers that provide a quantitative insight into the level of risk per asset. By 2021, the climate dataset was embedded in the business processes.

A risk analysis was also carried out for the mortgage portfolio on the basis of the climate effect atlas in order to generate insight into the risk areas for flooding, for example. Because mortgages at a.s.r. can run for up to 40 years, it is important to have insight into the long-term risks for this portfolio.

Overall, climate risks are incorporated into a.s.r.’s risk appetite and part of the regular risk management processes such as the annual group-wide Strategic Risk Analysis (SRA) process. Material climate risks including storms and floods, identified in the SRA process, are incorporated into the scenario analysis of the ORSA and quantified by the business actuary teams. The ORSA is a source for calculating premiums, setting up the necessary reserves and identifying the level of necessary reinsurance arrangements.

Metrics and targets

a.s.r. believes it can make a positive impact through a sustainable investment policy and by developing insurance products and services that support the energy transition and help customers adapt to climate risks. In addition, a.s.r. continuously works to reduce its own (indirect) negative impact. The following targets have been set for this:

Climate metrics and targets| KPIs | Target | 2021 progress |

|---|

| Reduction of carbon footprint of the investment portfolio’s in-house own funds | 65% by 2030 | 56% |

| Impact investments | € 4.5 billion in 2024 | € 2.5 billion |

| Reduction of carbon emissions in the insurance portfolio | Climate neutral by 2050 | Methodology is work in progress |

| Damages to vehicles and fire damage to property insured by P&C are repaired sustainably | 85% vehicles by 2025

50% property by 2025 | The first data was available in the fourth quarter. It is not possible yet to report 2021 percentages. |

| Make P&C’s insurance products, as far as they are influenced by climate risks and opportunities, more resilient and enhance these products with (more) sustainable covers | 100% by 2025 | 48% |