a.s.r. manages its business primarily using operational key performance indicators (KPIs). The operating result is the KPI covering the overall profitability of the business. Furthermore, a.s.r. uses other operational measures such as the COR, the life operating expenses as well as the availability and creation of capital, based on the Solvency II standard formula, as key figures in business decision making (see chapter 6.9).

The operating result is managed and presented at the consolidated a.s.r. and at a segment level (see chapter 6.4.3) and is also the key profitability indicator at business line level. The operating result is an inclusive measure covering all result components that can be influenced by the regular business. As such the operating result is the single bottom line performance indicator covering the performance of the business.

As a.s.r. applies shadow accounting and realised gains and loss accounting under IFRS 4, to ensure that insurance liabilities are adequate and to ensure that capital gains or losses on assets backing the insurance liabilities are allocated to the insurance liabilities, the operating result only differentiates from the IFRS result on items which are not directly related to its business. The capital gains on assets backing the insurance liabilities are allocated to the technical provisions and are released into the (operating) result over time. The operating result therefore reflects all investment related components that can be influenced by the business, as included in the IFRS result, but does not include any impairments on financial instruments, nor capital gains and fair value changes on the assets not backing the insurance liabilities (mostly equity and real estate investments).

It is current market practice for insurers to use an operating result to measure the underlying business performance, however the various current operating result definitions in the market seem to diverge. The a.s.r. operating result definition has limited deviations from the IFRS result. Following the implementation of IFRS 17 the operating result definitions need to be revised which may provide the opportunity to enhance the comparability of the operating result definition in the market.

Definition of operating result

Operating result is calculated by adjusting result before tax for continuing operations reported in accordance with IFRS, as adjusted for the changes in accounting policies and for the following:

Investment related: investment income of an incidental nature (including capital gains and losses, impairments and fair value changes) on financial instruments for own account, net of applicable shadow accounting and net of additional provisions recognised for realised gains and losses on financial assets backing the insurance liabilities (‘compensation of realised capital gains’) impact;

Incidental items:

Model- and methodological changes of a fundamental nature;

Results of non-core operations; and

Other non-recurring or one-off items, which are not directly related to the core business and / or ongoing business of the group, restructuring costs, regulatory costs not related to business activities, changes in the own pension arrangements and expenses related to M&A activities and start-ups.

The RoE, which is based on the operating result, is defined as:

The operating result adjusted for hybrid expenses and the applicable tax divided by

The IFRS equity adjusted for unrealised capital gains reserve and equity components of non-core activities.

Historical comparison

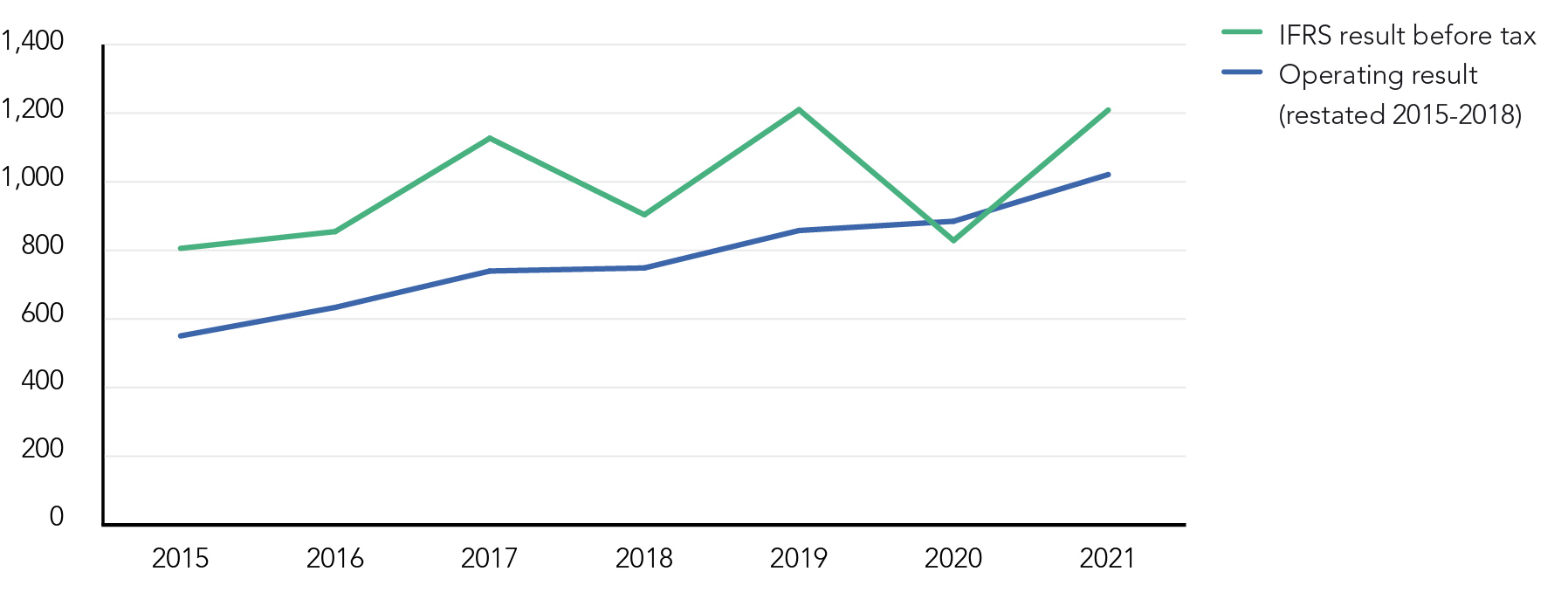

a.s.r. introduced the operating result in 2015 prior to the IPO. The operating result has since been the KPI for managing the profitability of the business. The seven-year comparison of the IFRS result and the operating result shows that the IFRS result for the year is more prone to volatility. In every year except 2020 the IFRS result has exceeded the operating result. Only in 2020, the operating result was higher than the IFRS result.

In 2021, indirect investment income increased (€ 107 million), partly driven by COVID-19 which had a more negative impact in 2020. Impairments on investments decreased by € 34 million, mainly related to decreasing equity prices on the stock markets due to COVID-19 in the first half of 2020, see chapter 6.5.5 and 6.6.9. Impairments are back on the pre-COVID-19 level of 2019.

In addition, the impact of incidentals was less negative in 2021 compared to 2020, see below. As a result, the IFRS result of 2021 is in line with the IFRS result of 2019, pre-COVID-19.

The development of the operating results shows a steady increase as the business has grown.

Reconciliation of IFRS result for the year to operating result

The reconciliation of the IFRS result for the year to the operating result is presented as follows:

IFRS result to operating result| | 2021 | 2020 |

|---|

| Result before tax | 1,209 | 829 |

| minus: investment related | 291 | 185 |

| minus: incidentals | -104 | -241 |

| | | |

| Operating result | 1,021 | 885 |

Indirect investment income amounted to € 291 million, an increase of € 107 million compared to 2020. The increase is due to one-off transaction results on the step up acquisition of Brand New Day IORP and mortgages sold to external parties, lower impairments and positive revaluations on real estate equity funds.

Incidentals increased by € 137 million to € -104 million. This is mainly due to impairments on goodwill in 2020 which were partly COVID-19 related (€ 117 million). Furthermore, as a result of the agreed change of pension scheme, a past service cost of € -93 million pre-tax has been recognised in 2021 (2020: € -59 million), see chapter 6.5.17.1. In 2021, incidentals also comprise regulatory project implementation costs (IFRS 17 and IFRS 9), amortisation of intangibles identified in business combinations (VOBA, other intangible assets) and start-up costs for innovations.