Annual Report 2021

About a.s.r.Operating environmentSustainable value creationBusiness performanceGovernanceFinancial statementsAdditional information

Sustainable products and servicesProduct Approval & Review ProcessIT and the digital strategyPrevention of payment problemsComplaints management

Organisational success and employee engagementEmployee Mood MonitorHR policy and strategyWorking conditionsRemunerationBusiness targets and personal targetsEmployee Share Purchase Plan

Socially responsible taxpayerHuman rightsIntegrityEthical reflectionPrivacyPolitical engagementCarbon footprint own operations

ASR Nederland N.V.Non-life segmentLife segmentAsset Management segmentDistribution and Services segmentHolding and Other segment (including eliminations)

Consolidated balance sheetConsolidated income statementConsolidated statement of comprehensive incomeConsolidated statement of changes in equityConsolidated statement of cash flows

Changes in presentationChanges in EU endorsed published IFRS standards and interpretations effective in 2021New standards, interpretations of existing standards or amendments to standards, not yet effective in 2021Key accounting policiesOther accounting policies

Group structureSegmented balance sheetSegmented income statement and operating resultNon-life ratiosAcquisitions

Intangible assetsProperty, plant and equipmentInvestment propertyAssociates and joint venturesInvestmentsInvestments on behalf of policyholdersInvestments related to investment contractsLoans and receivablesDerivativesDeferred taxesOther assetsCash and cash equivalentsEquitySubordinated liabilitiesInsurance liabilitiesLiabilities arising from investment contractsEmployee benefitsProvisionsBorrowingsDue to customersDue to banksOther liabilities

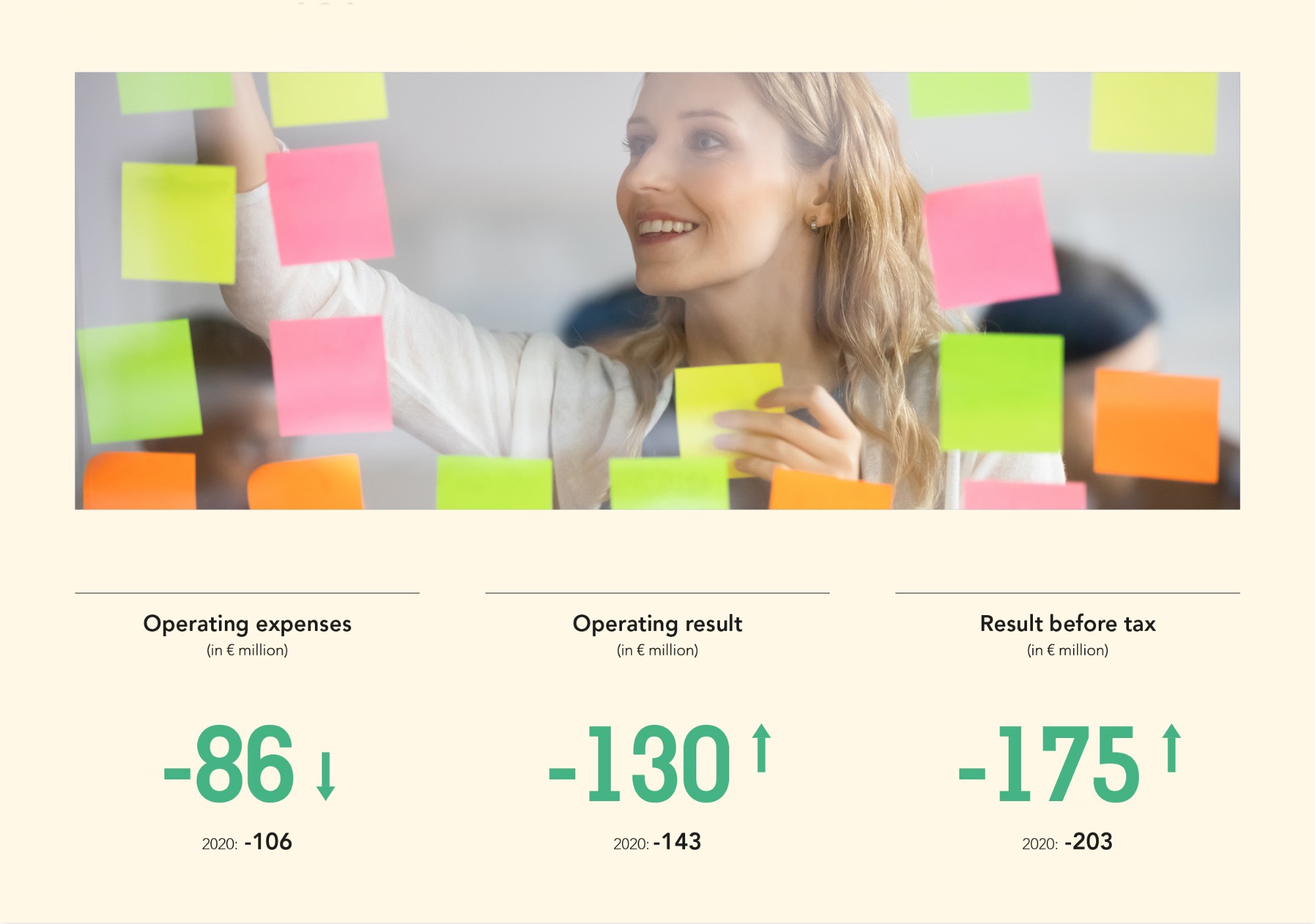

Gross insurance premiumsInvestment incomeRealised gains and lossesFair value gains and lossesFee and commission incomeOther incomeNet insurance claims and benefitsOperating expensesImpairmentsInterest expenseOther expensesIncome tax (expense) / gain

Fair value of assets and liabilitiesOffsetting of financial assets and liabilitiesFair value of financial assets categorised into two groups based on business model and SPPI test resultsRelated party transactionsKey management personnel remunerationEmployee Share Purchase PlanContingent liabilities and assetsEvents after the balance sheet dateList of principal group companies and associatesProfit appropriation

Risk management system including the Own Risk and Solvency Assessment Risk Management SystemInsurance riskMarket riskCounterparty default riskLiquidity riskOperational riskStrategic and operational risk management

Financial indicatorsCustomer-related indicatorsHuman Resources indicatorsResponsible investor indicatorsInvestor community indicatorsEnvironmental indicatorsSustainability ratings