a.s.r. attaches great value to maintaining a strong relationship with the investment community in the broadest sense and adheres to high standards relating to transparent communication and fair disclosure. The aim of a.s.r.’s investor relations is to provide all relevant information which can help investors make well-informed investment decisions. a.s.r. makes every possible effort to ensure that the information it discloses is accurate, complete and timely.

a.s.r. provides relevant insight into its activities through various financial and non-financial disclosures. To that end, it regularly updates the markets on its financial performance, the progress it is making on the execution of its strategy and any other relevant developments through press releases, webcasts, conference calls and other forms of communication. a.s.r. publishes its financial and non-financial results twice a year in the form of half-year and full-year results.

In 2021, a.s.r.’s management continued to actively engage with its existing investor base and potential new investors. Due to COVID-19, almost all meetings, roadshows and conferences were converted into conference calls or video meetings. In December 2021 a.s.r. held an Investor Update (IU) in which it provided an update of its strategy and announced its medium-term financial and non-financial targets for the 2022-2024 period.

For more information about a.s.r.’s policy on fair disclosure and bilateral dialogue, see www.asrnl.com.

a.s.r. shares

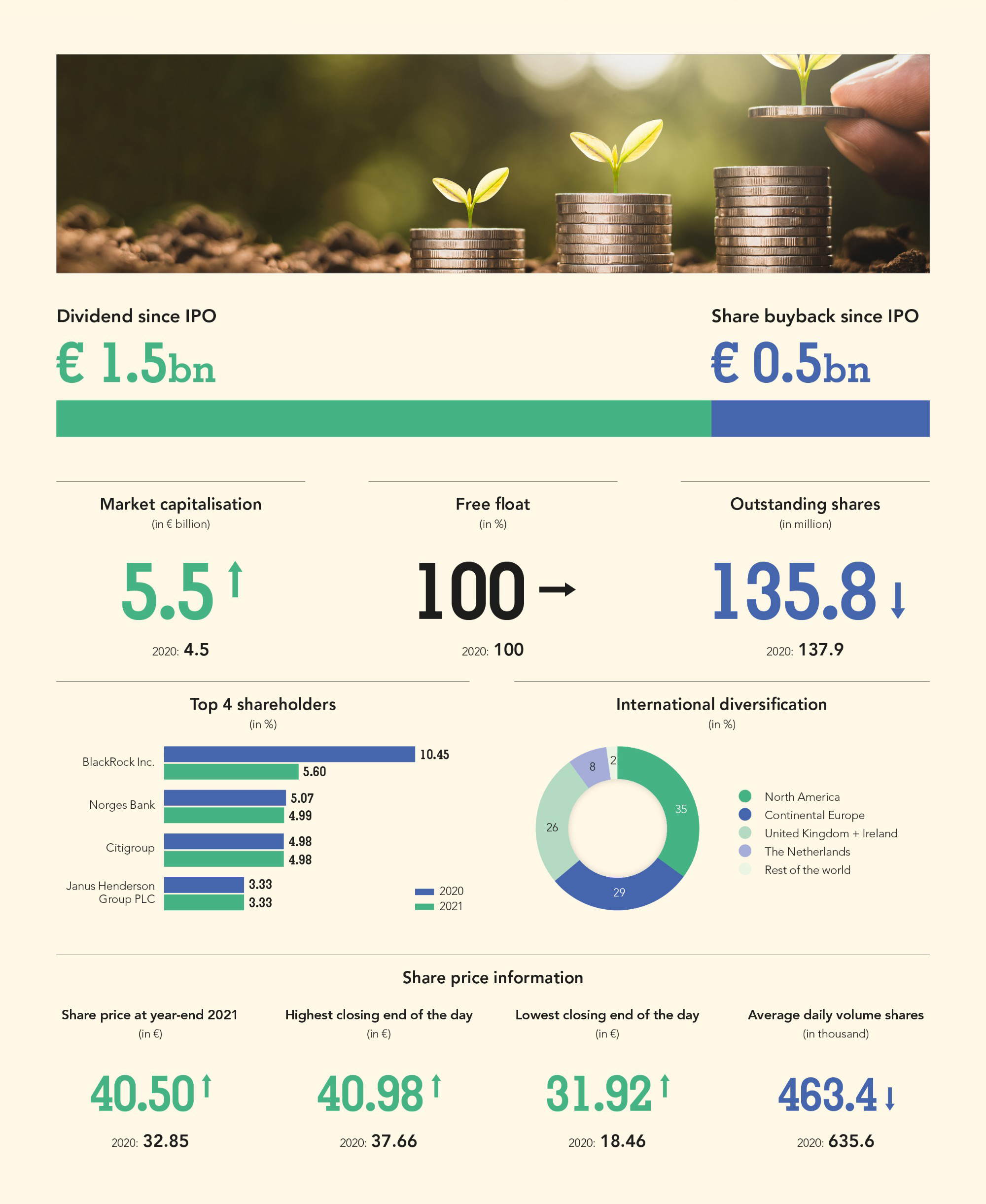

a.s.r.’s shares have been listed on Euronext Amsterdam since 10 June 2016 (symbol: ASRNL, ISIN: NL0011872643). a.s.r. was included in the AEX Index until 20 December 2021 and thereafter became part of the AMX Index. The free float, as defined by Euronext Amsterdam, was 100% as at 31 December 2021. Each share has one vote.

On 20 February 2021, a.s.r. announced a SBB programme for € 75 million, which was completed on 4 May 2021. A total of 2,035,868 shares were repurchased as part of this programme in 2021. As at 31 December 2021, there were 135,793,392 shares outstanding. During 2021 the number of outstanding shares decreased mainly due to the SBB programme.

Shares| In numbers | Year-end 2021 | Year-end 2020 |

|---|

| Authorised capital | 325,000,000 | 350,000,000 |

| Issued share capital | 138,057,204 | 141,000,000 |

| Own shares held by a.s.r. | 2,263,812 | 3,071,697 |

| Outstanding shares | 135,793,392 | 137,928,303 |

Dividend

a.s.r.’s dividend policy applicable for 2021 is based on a pay-out ratio of 45-55% of net operating result distributable to shareholders (i.e. net of tax and hybrid costs), while taking into account the aim to offer a stable regular dividend per share. Effectively as from 2022, a.s.r. will adopt a new dividend policy intended to offer shareholders a progressive dividend going forward.

a.s.r.’s dividend policy includes an interim dividend, which is set at 40% of the total dividend for the previous year. The interim dividend falls within the dividend policy and is conditional on achieving adequate results and solvency. a.s.r. holds cash at the holding company to cover operating holding costs and hybrid expenses for the next 12 months (rolling forward), and cash to pay the final and interim dividend.

Dividend per share| In € | 2021 | 2020 |

|---|

| Interim dividend | 0.82 | 0.76 |

| Final dividend | 1.60 | 1.28 |

| Total dividend | 2.42 | 2.04 |

Based on its financial performance in 2021, a.s.r. proposes to pay a total dividend of € 2.42 per share, which is paid as an interim dividend of € 0.82 per share (in September 2021) and a final dividend of € 1.60 per share (to be paid in June 2022). The total dividend of € 2.42 per share represents an increase of 19% compared with the total dividend over 2020 (€ 2.04 per share). The dividend reflects a.s.r.’s continued strong operational and financial performance throughout 2021, including the extraordinary favourable impact from the COVID-19 developments. Following approval by the Annual General Meeting (AGM) on 25 May 2022, the final dividend will be payable from 1 June 2022. The a.s.r. shares will trade ex-dividend on 27 May 2022.

Since the Initial Public Offering (IPO) on 10 June 2016, a total cash amount of € 2.0 billion has been returned to shareholders (including the proposed final dividend over 2021). This includes € 255 million of share buybacks in 2017 during the sell-down process by NL financial investments (NLFI), the SBB programmes of € 75 million in 2020 and in 2021 and the announced € 75 million SBB programme in 2022.

Shareholders

a.s.r. shares are held by an international and diversified shareholder base. By the end of 2021, based on public filings and company information, institutional investors in North America and the United Kingdom (UK) and Ireland, will represent the majority of a.s.r. shareholders, who own approximately 54% of the outstanding shares. The remainder is held mainly by investors based in the Netherlands, Germany, France, Norway and the rest of Europe. A limited number of the shares are held by retail investors in the Netherlands.

Major shareholders

Dutch law requires shareholders to report their holdings in Dutch-listed companies to the AFM if they exceed 3% of total outstanding share capital (and certain higher thresholds). As per 31 December 2021, BlackRock held a shareholding a.s.r. of more than 5% and Norges Bank, Citigroup, Janus Henderson Group, Ninety One, Dimensional Fund Advisors, BNP Paribas Asset Management, Amundi Asset Management, Samlyn Capital, Acadian Asset Management and Fidelity Management & Research held a shareholding in a.s.r. of more than 3%.

Shares and share price performance

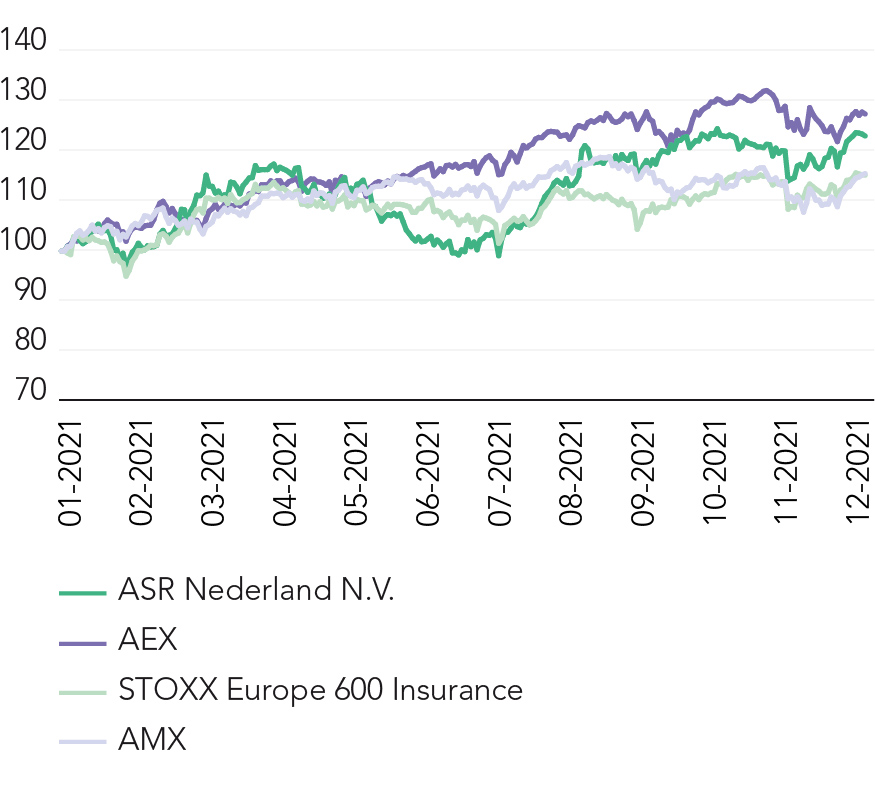

At the end of 2021 the share price stood at € 40.50 (2020: € 32.85). Total shareholder return amounted to 30.4% in 2021 (including a dividend reinvestment in a.s.r. shares) and amounted to 175% since the IPO in 2016. The Euronext AEX Index, Euronext AMX Index and the STOXX Europe 600 Insurance Index appreciated by respectively 30.5%, 18.5% and 21.1% in 2021.

Share price performance| In € | 2021 | 2020 |

|---|

| Starting price as at 1 January | 32.85 | 33.36 |

| Highest closing price | 40.98 | 37.66 |

| Lowest closing price | 31.92 | 18.46 |

| Closing price as at 31 December | 40.50 | 32.85 |

| Market cap as at 31 December (€ million) | 5,500 | 4,531 |

| Average daily volume shares (numbers) | 463,387 | 635,603 |

a.s.r. is included in the following indices:

AEX Index between 19 March 2018 until 20 December 2021 and thereafter part of the AMX Index.

DJSI World Index, since 23 November 2020 and in the DJSI Europe Index since 12 November 2021.

FTSE4Good Index Series, confirmed on 5 August 2020.

Ethibel Sustainability Index (ESI) Excellence Europe, confirmed on 8 May 2020.

Euronext Vigeo Eiris (Eurozone 120), confirmed on 29 May 2020.

Bloomberg Gender Equality Index, since 26 January 2022.

a.s.r. is also included in several MSCI indices and ISS indices.

Analysts

a.s.r. is actively covered by research analysts and bank / brokers. 18 equity analysts have a price target and recommendation on the share price of a.s.r. with an average price target of € 45.27 per year-end 2021 and 11 buy recommendations and five hold recommendations. Two analysts changed broker and are expected to initiate coverage on a.s.r. in 2022.

Bonds

a.s.r. has four debt instruments outstanding for a total nominal amount of € 2 billion, one Restricted Tier 1 (RT1) for € 500 million and three Tier 2 bonds for € 500 million each.

Bonds| | Nominal value | Coupon | First call date |

|---|

| Perpetual Tier 2 Capital Securities | € 500 million | 5.000% | 30 September 2024 |

| Fixed to fixed Tier 2 Capital Securities | € 500 million | 5.125% | 29 September 2025 |

| Perpetual Restricted Tier 1 Capital Securities | € 500 million | 4.625% | 19 October 2027 |

| Fixed to fixed Tier 2 Capital Securities | € 500 million | 3.375% | 2 May 2029 |

Credit ratings

a.s.r. is rated by Standard & Poor's (S&P). In 2021, a.s.r. had several conference calls with the rating agency to discuss developments both at a.s.r. itself and in the Dutch insurance market. This resulted in a comprehensive S&P analysis report on a.s.r. on 14 September 2021, which confirmed the ratings and outlook. The single A rating of the insurance entities has applied since 29 September 2008, and the stable outlook since 23 August 2012.

More information on a.s.r.’s bonds and ratings can be found on www.asrnl.com.

Credit ratings| Standard & Poor's | Type | Rating | Outlook | Since |

|---|

| ASR Nederland N.V. | CCR | BBB+ | Stable | 15 May 2014 |

| ASR Levensverzekering N.V. | CCR | A | Stable | 23 August 2012 |

| ASR Levensverzekering N.V. | IFSR | A | Stable | 23 August 2012 |

| ASR Schadeverzekering N.V. | CCR | A | Stable | 23 August 2012 |

| ASR Schadeverzekering N.V. | IFSR | A | Stable | 23 August 2012 |

| | | | | |

| Perpetual Tier 2 Capital Securities (5.000%) | | BBB- | | 16 September 2014 |

| Fixed to fixed Tier 2 Capital Securities (5.125%) | | BBB- | | 29 September 2015 |

| Fixed to fixed Tier 2 Capital Securities (3.375%) | | BBB- | | 1 May 2019 |

| Perpetual Restricted Tier 1 Capital Securities (4.625%) | | BB+ | | 18 July 2019 |

ESG ratings

a.s.r. is rated by several ESG research agencies. These agencies provide a.s.r. with external recognition for its realisation of its group targets including non-financial targets. These agencies also benchmark a.s.r. to its peers. Sustainalytics, S&P Global (Dow Jones Sustainability Index) and Moody’s ESG (Vigeo Eiris) in 2021 improved their rating on a.s.r., which led to a continued strong position in these benchmarks. The ratings of MSCI and the Carbon Disclosure Project (CDP) also improved to A and B respectively. The rating at FTSE4Good decreased with 0.2 points, while the rating of ISS Oekom remained the same.

ESG ratings| | Score low | Score high | 2021 | 2020 |

|---|

| Dow Jones Sustainability Index | 0 | 100 | 86 / #8 | 82 / #10 |

| MSCI | CCC | AAA | A | BBB |

| Sustainalytics ESG Risk Rating | 100 | - | 10.0 / #1 | 14.7 / #5 |

| Carbon Disclosure Project | D- | A | B | C |

| Vigeo Eiris | 0 | 100 | 61 / #5 | 60 / #6 |

| ISS Oekom | D- | A+ | C (prime) | C (prime) |

| FTSE4Good | 0 | 5 | 4.1 | 4.3 |

More information on a.s.r.’s ESG ratings can be found on www.asrnl.com.

Sustainable asset management

a.s.r. invests approximately € 75 billion. A large proportion of that is intended to enable a.s.r. to meet future obligations to clients. Of which € 28 billion is invested for third parties. Investing an estimated € 20 million, the Netherlands Red Cross is one such party.

When the Red Cross had to choose an asset manager in 2021, a.s.r. was quickly chosen. Wilco van Wijck, manager Finance & Control of the Red Cross explains why: ‘a.s.r.’s vision on the Sustainable Development Goals and issues such as child labour is in line with our principles. The fact that our money is invested sustainably and does not lose its value in the future, is more important to us than the pursuit of high returns.’.

A short clip on the choice made by the Red Cross can be found at www.asrvermogensbeheer.nl.