a.s.r. is a public limited company which is listed on the Euronext Amsterdam Exchange and governed by Dutch corporate law. It has a two-tier board governance structure consisting of an EB and a SB. The EB is responsible for the realisation of the company's corporate targets, the strategy with its associated risks and the delivery of the results. The SB is responsible for advising the EB, supervising its policies and for the general state of affairs relating to a.s.r. and its group entities. The SB also acts as employer of the EB. Next to the EB, there is also a Business Executive Committee (BEC). The task of the BEC is to support the EB in implementing and realising a.s.r.'s targets and executing the (business) strategy with the associated risk profile. More information on the governance structure can be found in chapter 5.1.2.

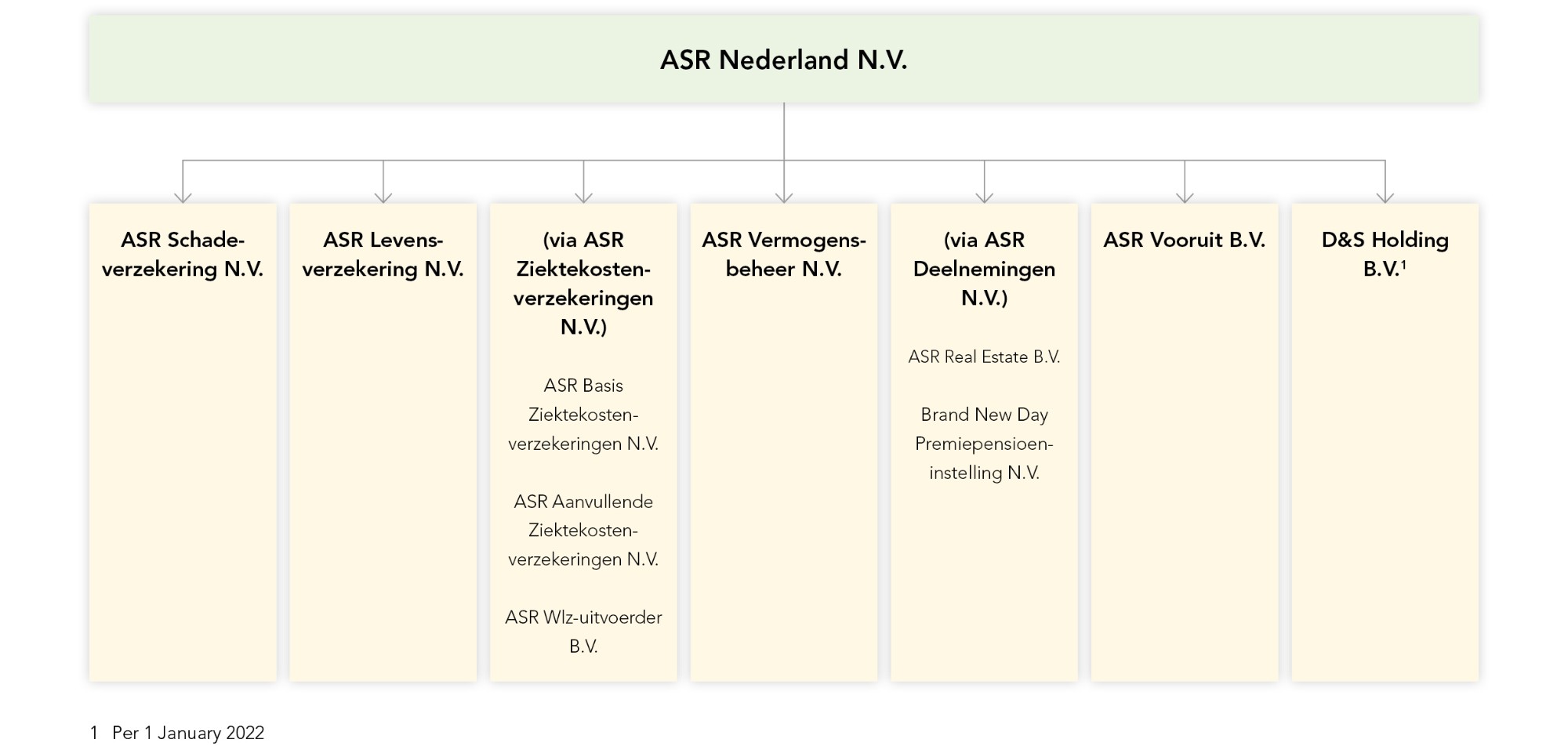

Legal structure

ASR Nederland N.V. is the Group’s holding company. The supervised entities (OTSOs) within the Group are ASR Schadeverzekering N.V., ASR Levensverzekering N.V., ASR Basis Ziektekostenverzekeringen N.V. and ASR Aanvullende Ziektekostenverzekeringen N.V.

A union exists between ASR Nederland N.V., ASR Levensverzekering N.V. and ASR Schadeverzekering N.V. through cross-membership of the EB and the SB. ASR Basis Ziektekostenverzekeringen N.V. and ASR Aanvullende Ziektekostenverzekeringen N.V. have their own EBs. The SBs of these entities consist of a combination of members of the EB and members of the SB of ASR Nederland N.V.

ASR Vermogensbeheer N.V. and ASR Real Estate B.V. are two Alternative Investment Fund Managers Directive (AIFMD) licensed AIFMs. These entities have their own EBs.

The acquisition of Brand New Day Premiepensioeninstelling N.V. (Brand New Day IORP) was completed on 1 April 2021. This entity has its own EB and SB.

ASR Vooruit B.V. operates as an investment firm and insurance advisor since 15 October 2021. The EB of this company consists of one member of the EB of ASR Nederland N.V. and two other members. D&S Holding B.V. operates as a holding company for the entities within the segment Distribution & Services.

General Meeting of Shareholders and consultation with shareholders

In line with a.s.r.’s articles of association, at least one Annual General Meeting (AGM) is held per annum, no later than 30 June. The main purpose of the AGM is to decide on matters as specified in a.s.r.’s articles of association and under Dutch law, such as the adoption of the financial statements. The articles of association also outline the procedures for convening and holding general meetings and the decision-making process. The draft minutes of the AGM must be published on www.asrnl.com no later than three months following the AGM. Shareholders are given three months to respond to the draft minutes. The minutes of the AGM are subsequently adopted and signed by the chair of the SB and the company secretary.

Total issued share

capital represented

at AGM

(in %, with voting rights)

72

Total issued share

capital represented

at AGM

(in %, with voting rights)

72

Due to developments surrounding COVID-19, a.s.r. took additional safety measures in relation to the AGM in accordance with the guidelines set out by ASR Nederland N.V., the central government and the RIVM (Dutch National Institute for Public Health and the Environment). In 2021, the AGM on 19 May was held entirely virtually without the physical presence of shareholders. A total of 72.15% of the total issued share capital with voting rights was represented by an electronic proxy with voting instructions. The agenda of the AGM included for advisory vote the 2020 remuneration report and the proposals to adopt the financial statements, the dividend payments for the financial year 2020, the proposal to grant a discharge to each (former) member of the EB and SB from liability in respect of the exercise of their duties in the 2020 financial year, the proposals to extend the authorisation of the EB to issue ordinary shares and / or to grant rights to subscribe for ordinary shares, to restrict or exclude the statutory pre-emptive right and to acquire the company’s own shares and the proposals to cancel shares held by a.s.r. and to amend the articles of association for the cancellation of the shares held by a.s.r. All agenda items were approved by the AGM. The resignation of Kick van der Pol as member and chair of the SB and the succession of Joop Wijn as chair of the SB were also discussed. The next AGM will be held on Wednesday 25 May 2022.

An Extraordinary General Meeting (EGM) was held on 30 November 2021. The agenda included the proposal by the SB to appoint Ewout Hollegien as a member of the EB and as CFO of a.s.r. There were no voting items on this agenda.

Contacts with shareholders are conducted entirely in line with the policy on fair disclosure and on the basis of bilateral dialogue with shareholders. The policy on fair disclosure and the bilateral dialogue with shareholders is published on www.asrnl.com. The Group’s Disclosure Committee supervises compliance with laws and regulations in relation to the disclosure of price-sensitive information.

Anti-takeover measures

Stichting Continuïteit ASR Nederland (the Foundation) was established on 26 May 2016 under Dutch law in connection with a.s.r.’s listing on Euronext Amsterdam. The Foundation has an independent board consisting of three members. The role of the Foundation is to promote and protect the interests of a.s.r., its business and stakeholders, and to work against possible influences that could threaten the continuity, independence, strategy and / or identity of a.s.r. or its associated business to the extent that they could conflict with the aforementioned interests. If the interests of a.s.r., its business, stakeholders or continuity were to be undermined, the Foundation would be entitled - provided certain conditions under the call option agreement were to be met - to exercise a call option right on preference shares such that the number of preference shares acquired under the call option would never exceed the total number of shares forming the issued capital of a.s.r. at the time the call option was exercised, minus the number of preference shares already held by the Foundation (if any) at the time and minus one.