The remuneration of current and former EB members is in accordance with the remuneration policy. Neither a.s.r. nor any undertaking belonging to the group provides any loans, advances or guarantees on behalf of a member of the EB.

Annual remuneration for members of the Executive BoardAmounts for 2021

in € thousand | Fixed remuneration | Variable remuneration | | | | |

|---|

| Executive Board member | Base salary | Fees | Fringe benefits | One-year variable | Multi-year variable | Extraordinary items | Pension expense | Total remuneration | Fixed portion of the total remuneration |

|---|

| Jos Baeten, CEO | 861 | - | 13 | - | - | - | 233 | 1,108 | 100% |

| Ewout Hollegien, CFO | 51 | - | 2 | - | - | - | 3 | 57 | 100% |

| Ingrid de Swart, COO / CTO | 713 | - | 16 | - | - | - | 141 | 869 | 100% |

| | | | | | | | | | |

| Former member | | | | | | | | | |

| Annemiek van Melick | 653 | - | 14 | - | - | - | 95 | 762 | 100% |

| Total | 2,279 | - | 44 | - | - | - | 473 | 2,796 | 100% |

Annual remuneration for members of the Executive BoardAmounts for 2020

in € thousand | Fixed remuneration | Variable remuneration | | | | |

|---|

| Executive Board member | Base salary | Fees | Fringe benefits | One-year variable | Multi-year variable | Extraordinary items | Pension expense | Total remuneration | Fixed portion of the total remuneration |

|---|

| Jos Baeten, CEO | 811 | - | 13 | - | - | 151 | 445 | 1,420 | 89% |

| Annemiek van Melick, CFO | 666 | - | 15 | - | - | - | 106 | 787 | 100% |

| Ingrid de Swart, COO / CTO | 666 | - | 16 | - | - | - | 148 | 830 | 100% |

| | | | | | | | | | |

| Former member | | | | | | | | | |

| Karin Bergstein | - | - | - | - | - | 10 | - | 10 | - |

| Michel Verwoest | - | - | - | - | - | 10 | - | 10 | - |

| Chris Figee, CFO | 53 | - | 6 | - | - | 10 | 11 | 80 | 87% |

| Total | 2,196 | - | 49 | - | - | 182 | 709 | 3,137 | 94% |

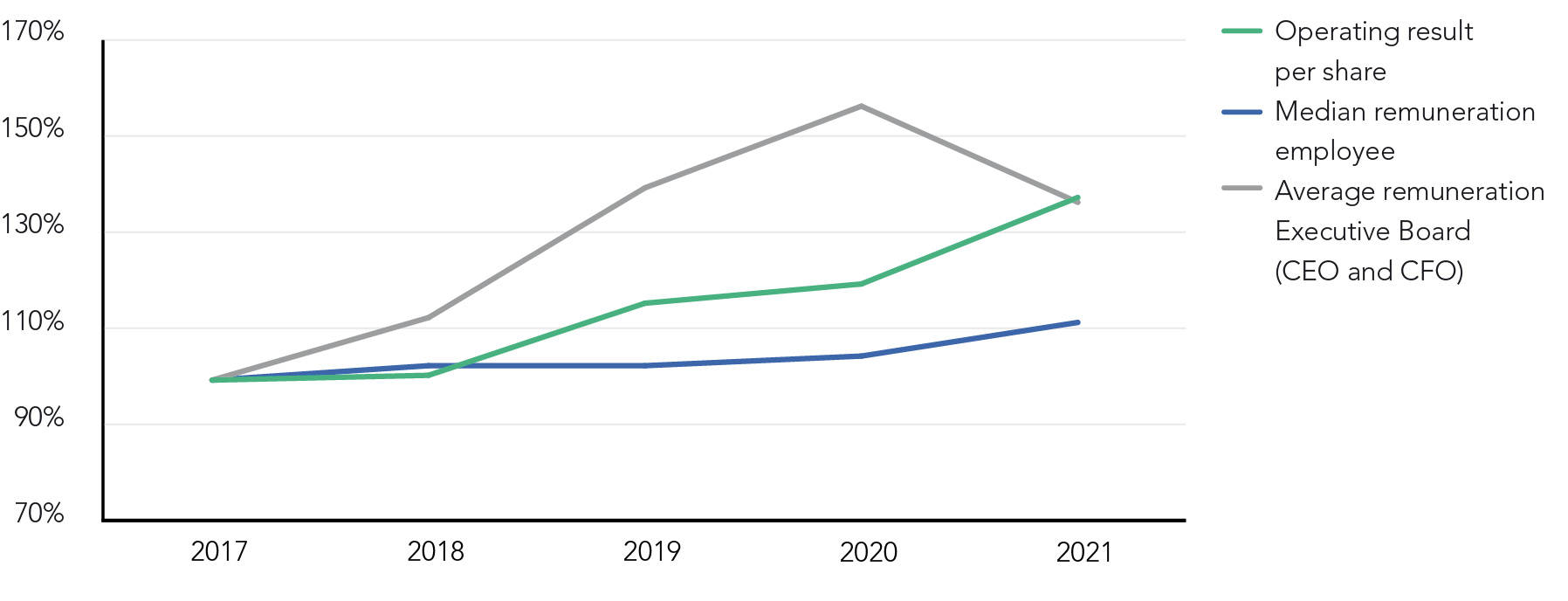

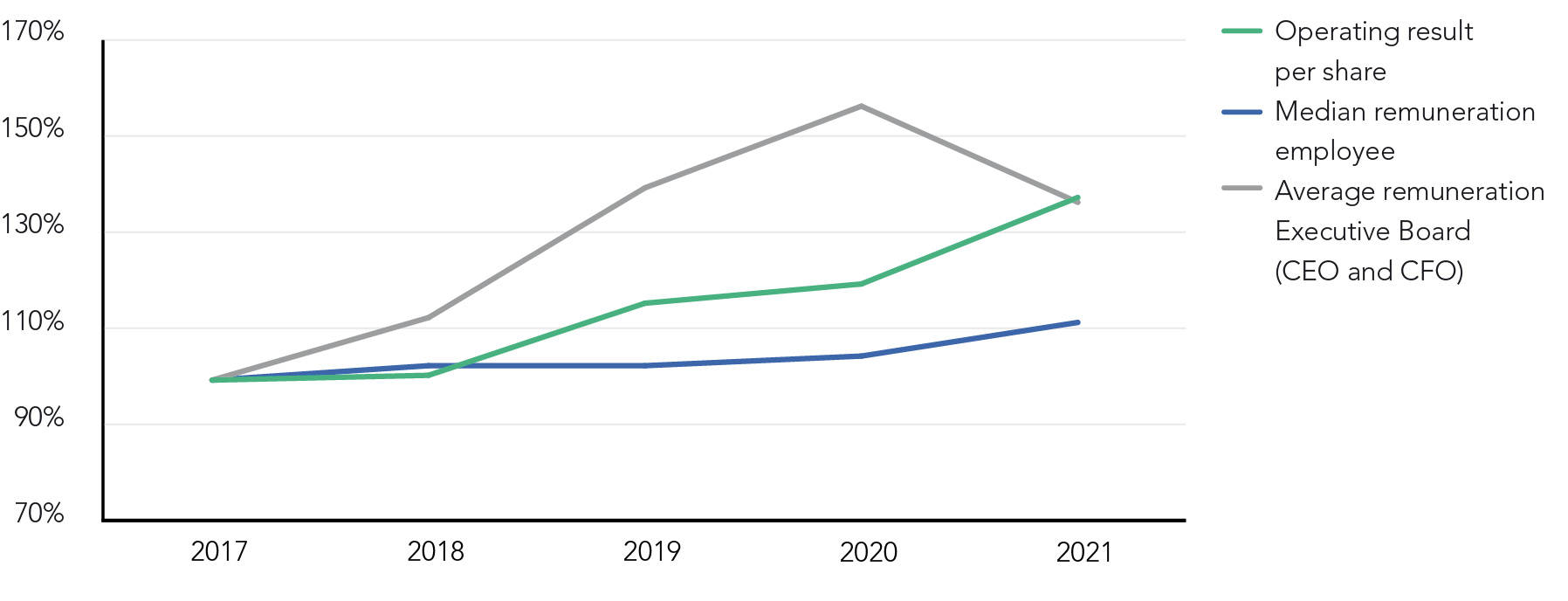

Comparative chart over the remuneration and company performance over the last five reported financial years

A comparative chart is included above concerning the remuneration and company performance over the last five reported financial years. Company performance is expressed in terms of operating result per share. The median remuneration of employees (who are not EB members) is also shown, and this is also used for the aforementioned pay ratio. Finally, the average EB remuneration (CEO and CFO) is presented.

The full remuneration policy can be found at www.asrnl.com.

Pensions

The calculation of annual pension expenses is based on the total pension rights granted during a term of service at a.s.r. pension costs include:

Pensions based on a maximum pensionable salary cap (€ 112,189, fiscal maximum).

Compensation for the maximum pensionable salary cap (to be used for pensions at the employee’s discretion).

Pension benefits related to historically awarded pension rights.

VPL (early retirement and life cycle; ‘VUT, Prepensioen en Levensloop’).

All components of the remuneration of the EB are included in the base used for calculating the pension benefits. EB members have the same pension scheme as a.s.r. employees.

Remuneration in 2022

Based on the benchmark and the mitigation principle, the salary of the CEO is currently at a level of between € 682,000 and € 1,026,845. A salary scale of € 530,000 to € 796,200 applies for the CFO. For the COO, a scale of € 505,000 to € 760,392 applies. The maximum for the salary scale of the CEO is currently set at approximately 10% below the median for the reference group. The maximum for the salary scale of the CFO and COO are currently set at about 5% below the median for the reference group. The benchmark is set every two years. The positioning, the scale maximum and the resulting bandwidth of the scale are then assessed and may be adjusted in relation to the resulting median.

The reference group 2021, which consists of 20 companies, is shown hereafter.

Reference group| Organisation | Index |

|---|

| Aalberts | AMX |

| Arcadis | AMX |

| BAM Groep | AScX |

| Boskalis | AMX |

| Fugro | AMX |

| GrandVision | AMX |

| KPN | AEX |

| PostNL | AMX |

| SBM Offshore | AMX |

| Sligro | AScX |

| Signify | AEX |

| TomTom | AScX |

| Vopak | AMX |

| ABN AMRO | AMX |

| Achmea | Not listed |

| Aegon | AEX |

| NN Group | AEX |

| Triodos Bank | Not listed |

| Van Lanschot Kempen | AScX |

| Volksbank | Not listed |

Those employees who have not yet reached the end of their salary scale are paid a yearly guaranteed increase of 3% until they reach the maximum of their salary scale. EB members who have not reached the maximum of their salary scale can be paid a yearly increase of between 0% and 6% (not guaranteed) until they reach the maximum of their scale. Although market conditions have changed due to COVID-19, the results of a.s.r. are undiminished good. The financial results for 2021 are excellent and in addition, all externally published medium-term targets for the period 2019-2021 have been achieved. With exception of the target on employee contribution through the a.s.r. foundation, but this is due to COVID-19 related lockdowns and contact restrictions. As far as the shareholders are concerned, the interim dividend for 2021 has been paid regularly and a solid total dividend for 2021 will also be paid. In the view of the SB there are also (currently) no negative consequences for other stakeholders of a.s.r., such as customers or employees. A very thorough process was completed last year in the context of the updated strategy and careful preparation for the targets 2022-2024, which were presented during a successful Investor Update on 7 December 2021. On the advice of the Remuneration Committee, it was therefore decided to grant a salary increase of 6% to all members of the EB as of 1 January 2022 (with the exception of Ewout Hollegien due to his appointment as of 1 December 2021).

Also under the current (2021-2022) CLA, a.s.r. employees are given an indexation of their salary of 2.25% (as per 1 March 2021 and as per 1 March 2022). This increase due to the CLA would also apply to the EB. For 2022, this means that all members of the EB will receive an increase of 2.25% as per 1 March 2022.

Participation in a.s.r. shares

In addition to the remuneration policy, EB members have committed themselves to taking a percentage of their remuneration in the form of a.s.r. shares. Each member has signed an individual agreement committing to purchase these shares. As of 2020, the EB members have committed themselves to a shareholding of 75% for the CEO and 50% for the other members, of their latest gross salary. The share interest will be achieved within a maximum of seven years. The shares must be held for a minimum of five years (blocking period). This percentage may be considered low in relation to other companies, but the fact that EB members use their own financial resources to purchase these shares must be taken into account. The shares do not form part of a variable remuneration or a remuneration in shares. The SB has concluded agreements with the EB members that the intended target (a shareholding of 75% for the CEO and 50% for the other members of the EB, of their latest gross salary) will be achieved by 2026 at the latest.

As of 1 March 2022, the current EB members will hold the following shares:

Jos Baeten 7,655 (42.6% of latest gross salary)

Ewout Hollegien 472 (5.7% of latest gross salary)

Ingrid de Swart 3,078 (31.0% of latest gross salary)